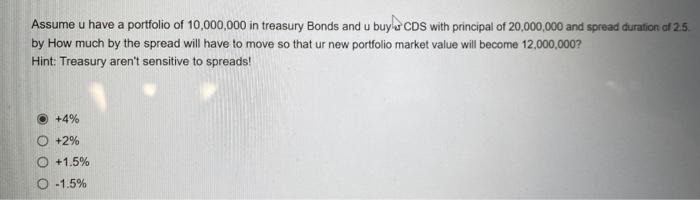

Question: anyone know how to solve this q Assume u have a portfolio of 10,000,000 in treasury Bonds and u buy- CDS with principal of 20,000,000

Assume u have a portfolio of 10,000,000 in treasury Bonds and u buy- CDS with principal of 20,000,000 and spread duration a 2.5. by How much by the spread will have to move so that ur new portfolio market value will become 12,000,000 ? Hint: Treasury aren't sensitive to spreads! +4% +2% +1.5% 1.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts