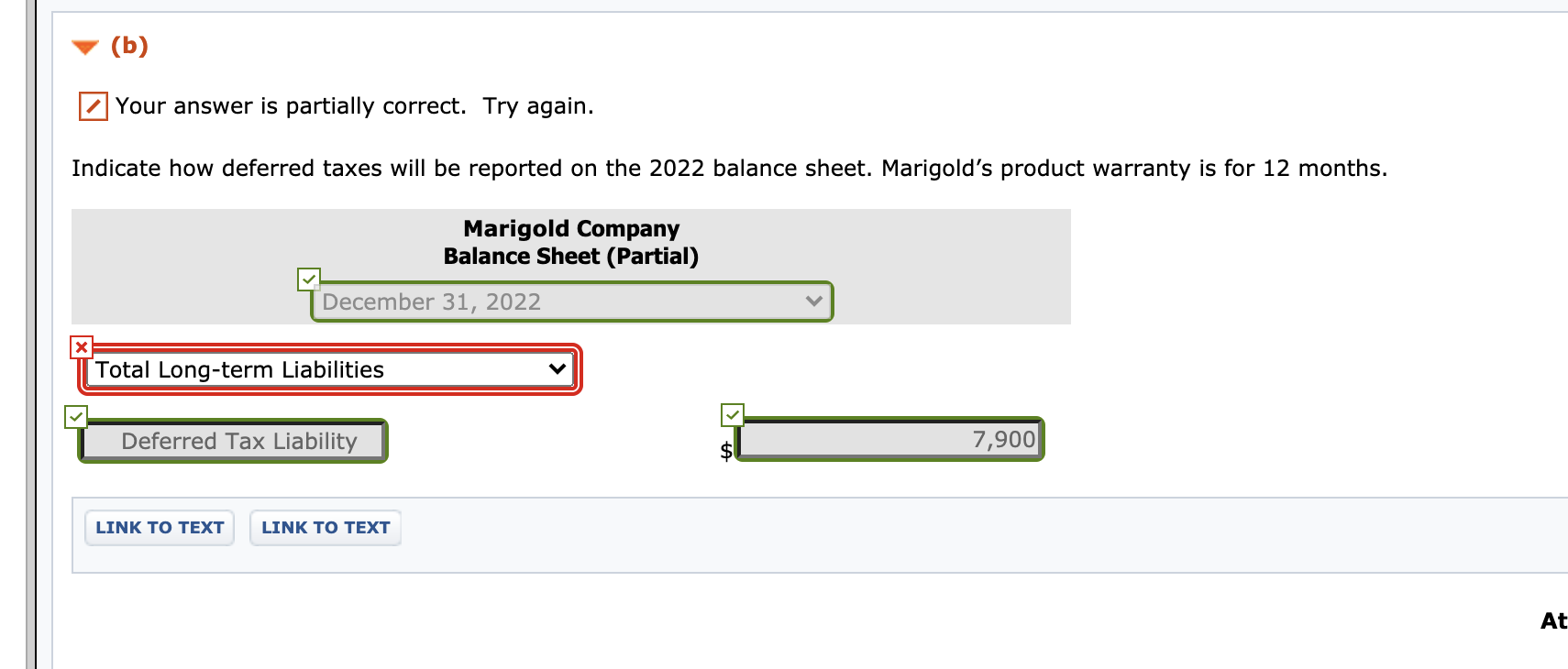

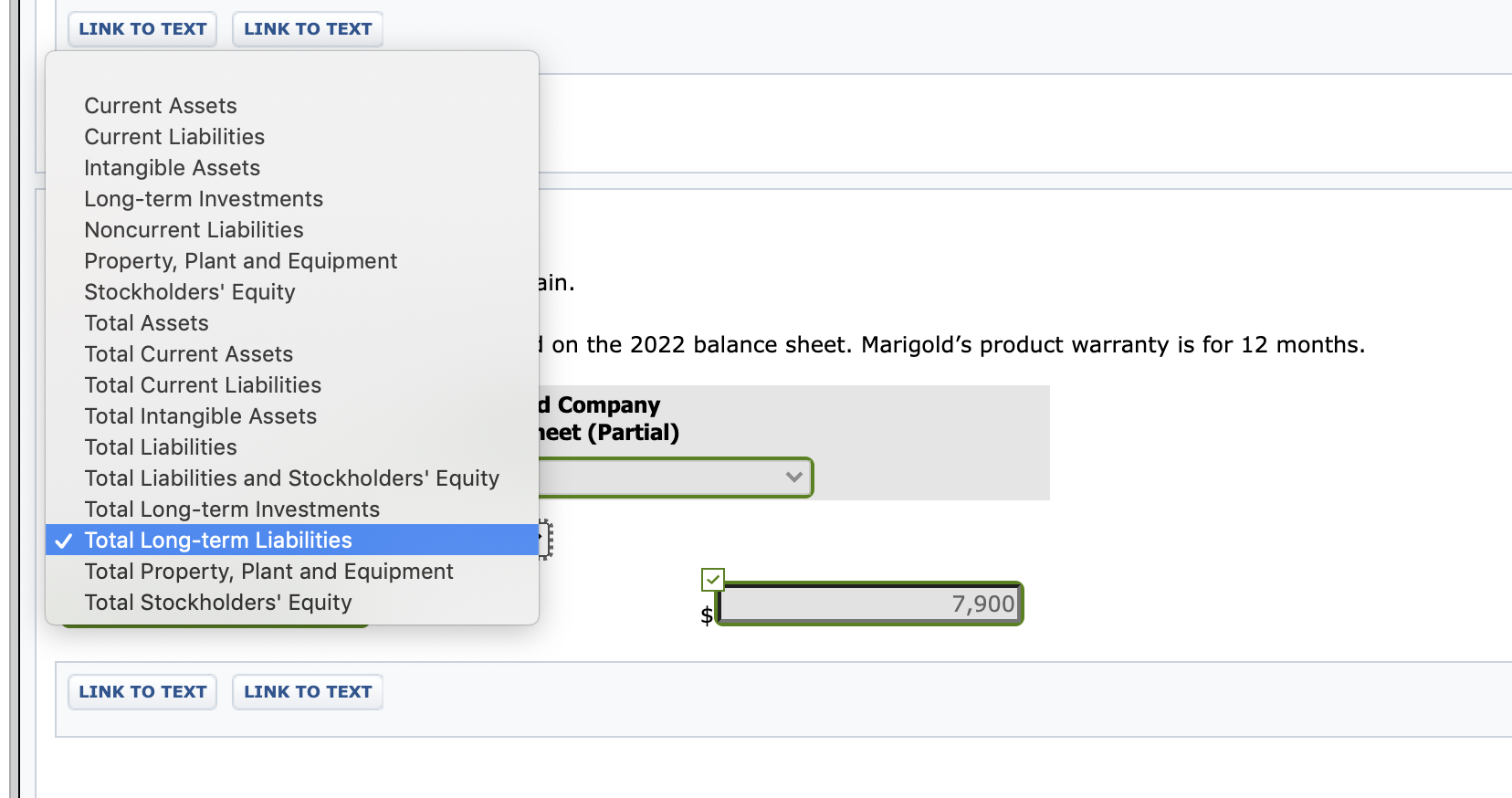

Question: Anyone know what the red boxed answer could be? I tried current asset and Total Long term liabilities and both were wrong ? :) (b)

Anyone know what the red boxed answer could be? I tried current asset and Total Long term liabilities and both were wrong ? :)

(b) Your answer is partially correct. Try again. Indicate how deferred taxes will be reported on the 2022 balance sheet. Marigold's product warranty is for 12 months. Marigold Company Balance Sheet (Partial) December 31, 2022 Total Long-term Liabilities Deferred Tax Liability 7,900 LINK TO TEXT LINK TO TEXT At LINK TO TEXT LINK TO TEXT ain. Current Assets Current Liabilities Intangible Assets Long-term Investments Noncurrent Liabilities Property, Plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long-term Investments Total Long-term Liabilities Total Property, Plant and Equipment Total Stockholders' Equity I on the 2022 balance sheet. Marigold's product warranty is for 12 months. d Company heet (Partial) 7,900 LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts