Question: anyone who knows how to do this problem your help would be much appreciated this is all of the information given. what else are you

anyone who knows how to do this problem your help would be much appreciated

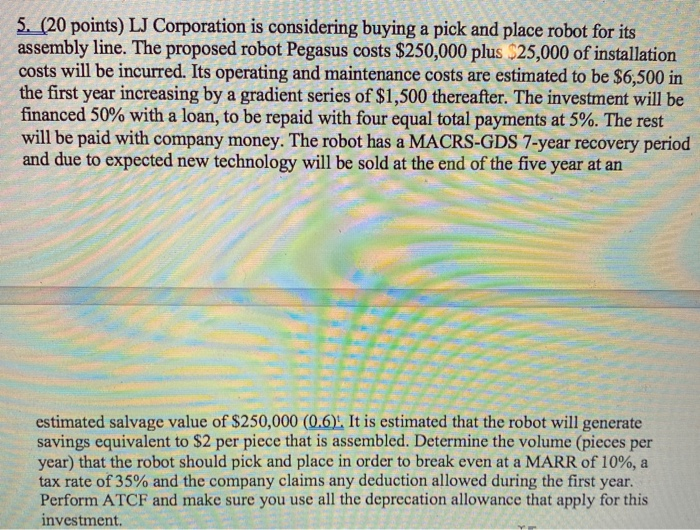

anyone who knows how to do this problem your help would be much appreciated 5. (20 points) LJ Corporation is considering buying a pick and place robot for its assembly line. The proposed robot Pegasus costs $250,000 plus $25,000 of installation costs will be incurred. Its operating and maintenance costs are estimated to be $6,500 in the first year increasing by a gradient series of $1,500 thereafter. The investment will be financed 50% with a loan, to be repaid with four equal total payments at 5%. The rest will be paid with company money. The robot has a MACRS-GDS 7-year recovery period and due to expected new technology will be sold at the end of the five year at an estimated salvage value of $250,000 (0.6. It is estimated that the robot will generate savings equivalent to $2 per piece that is assembled. Determine the volume (pieces per year) that the robot should pick and place in order to break even at a MARR of 10%, a tax rate of 35% and the company claims any deduction allowed during the first year. Perform ATCF and make sure you use all the deprecation allowance that apply for this investment. 5. (20 points) LJ Corporation is considering buying a pick and place robot for its assembly line. The proposed robot Pegasus costs $250,000 plus $25,000 of installation costs will be incurred. Its operating and maintenance costs are estimated to be $6,500 in the first year increasing by a gradient series of $1,500 thereafter. The investment will be financed 50% with a loan, to be repaid with four equal total payments at 5%. The rest will be paid with company money. The robot has a MACRS-GDS 7-year recovery period and due to expected new technology will be sold at the end of the five year at an estimated salvage value of $250,000 (0.6. It is estimated that the robot will generate savings equivalent to $2 per piece that is assembled. Determine the volume (pieces per year) that the robot should pick and place in order to break even at a MARR of 10%, a tax rate of 35% and the company claims any deduction allowed during the first year. Perform ATCF and make sure you use all the deprecation allowance that apply for this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts