Question: Anything will be helpful. Question 1 (0.2 points) Ten years ago, an account was opened with an investment of $5000. Its balance is now $7000.

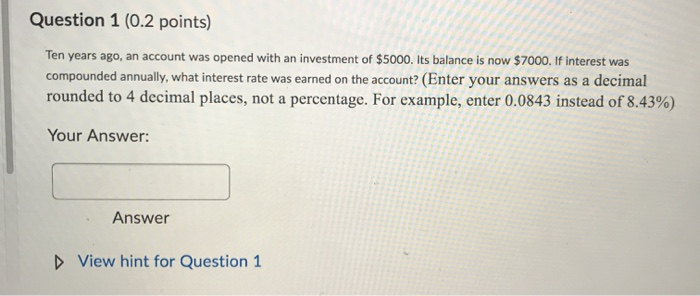

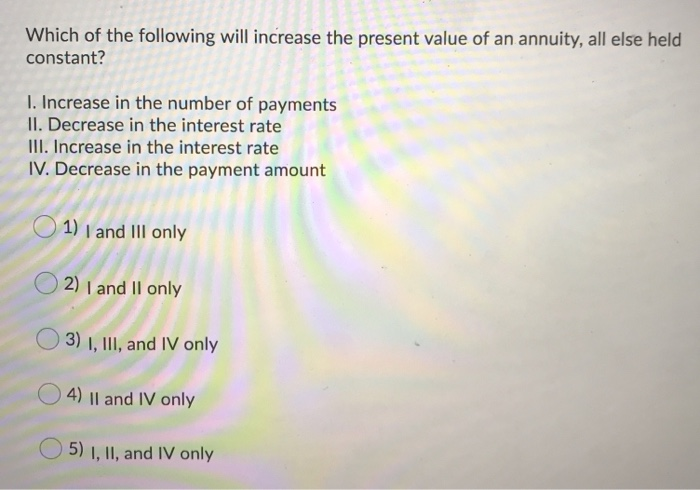

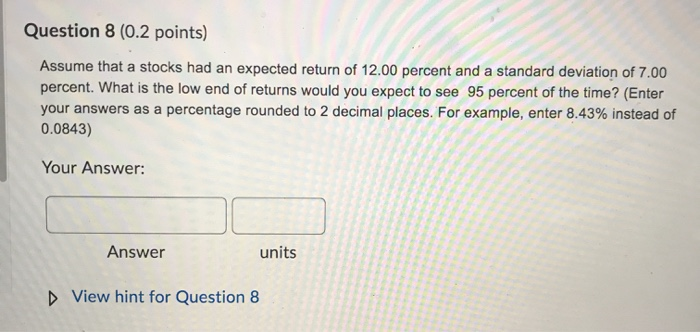

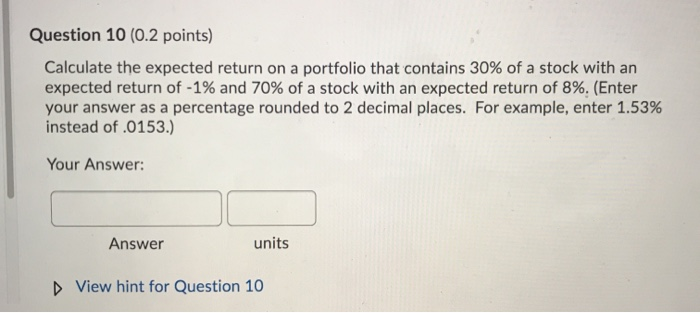

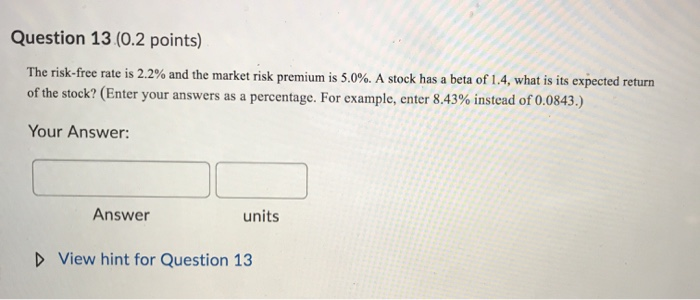

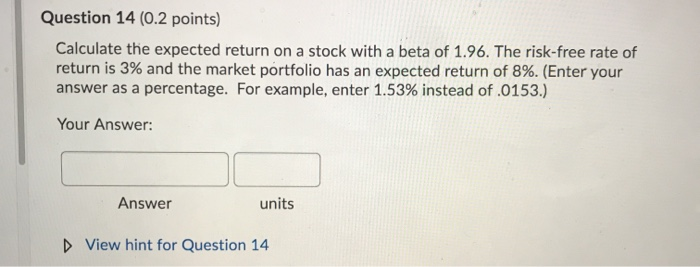

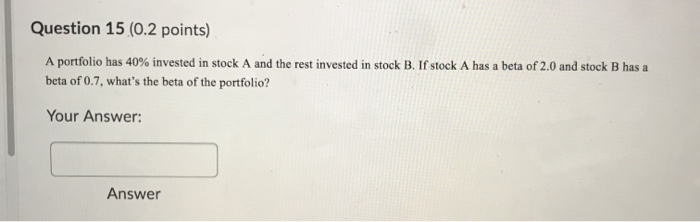

Question 1 (0.2 points) Ten years ago, an account was opened with an investment of $5000. Its balance is now $7000. If interest was compounded annually, what interest rate was earned on the account? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) Your Answer: Answer View hint for Question 1 Which of the following will increase the present value of an annuity, all else held constant? I. Increase in the number of payments II. Decrease in the interest rate III. Increase in the interest rate IV. Decrease in the payment amount 1) I and Ill only 2) I and Il only 3) I, III, and IV only 4) II and IV only 5) I, II, and IV only Question 8 (0.2 points) Assume that a stocks had an expected return of 12.00 percent and a standard deviation of 7.00 percent. What is the low end of returns would you expect to see 95 percent of the time? (Enter your answers as a percentage rounded to 2 decimal places. For example, enter 8.43% instead of 0.0843) Your Answer: Answer units View hint for Question 8 Question 10 (0.2 points) Calculate the expected return on a portfolio that contains 30% of a stock with an expected return of -1% and 70% of a stock with an expected return of 8%. (Enter your answer as a percentage rounded to 2 decimal places. For example, enter 1.53% instead of .0153.) Your Answer: Answer units View hint for Question 10 Question 13 (0.2 points) The risk-free rate is 2.2% and the market risk premium is 5.0%. A stock has a beta of 1.4, what is its expected return of the stock? (Enter your answers as a percentage. For example, enter 8.43% instead of 0.0843.) Your Answer: Answer units View hint for Question 13 Question 14 (0.2 points) Calculate the expected return on a stock with a beta of 1.96. The risk-free rate of return is 3% and the market portfolio has an expected return of 8%. (Enter your answer as a percentage. For example, enter 1.53% instead of .0153.) Your Answer: Answer units View hint for Question 14 Question 15 (0.2 points) A portfolio has 40% invested in stock A and the rest invested in stock B. If stock A has a beta of 2.0 and stock B has a beta of 0.7, what's the beta of the portfolio? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts