Question: AP 4 - 3 ( Individual Tax Payable Seven Cases ) The following seven independent cases make varying assumptions with respect to Roger Blaine and

AP Individual Tax PayableSeven Cases

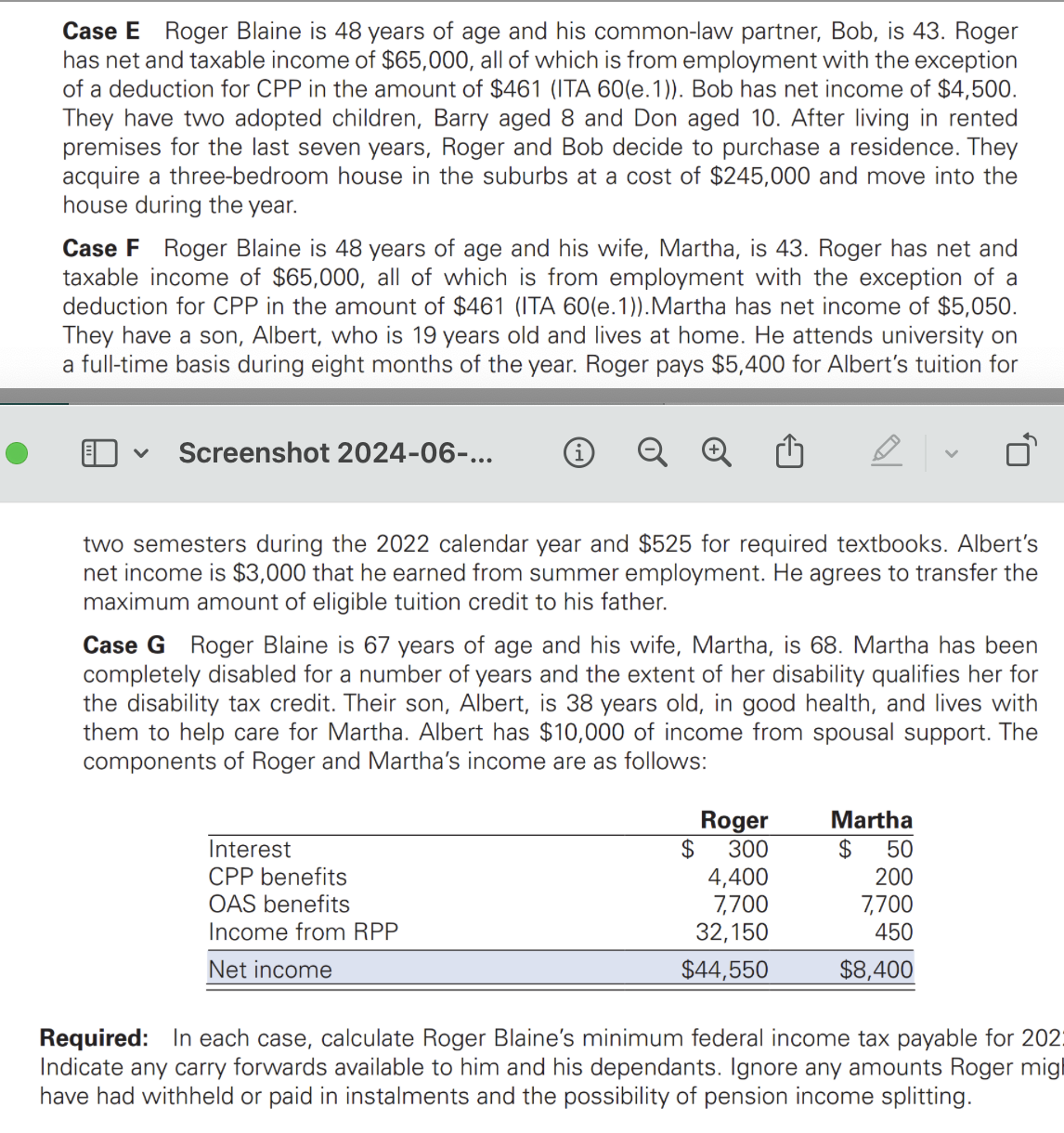

The following seven independent cases make varying assumptions with respect to Roger Blaine

and his income tax status. In all cases where Roger earned employment income, his employer

withheld the maximum EI premium and CPP contribution PLEASE put all cases into its own chart two semesters during the calendar year and $ for required textbooks. Albert's

net income is $ that he earned from summer employment. He agrees to transfer the

maximum amount of eligible tuition credit to his father.

Case G Roger Blaine is years of age and his wife, Martha, is Martha has been

completely disabled for a number of years and the extent of her disability qualifies her for

the disability tax credit. Their son, Albert, is years old, in good health, and lives with

them to help care for Martha. Albert has $ of income from spousal support. The

components of Roger and Martha's income are as follows:

Required: In each case, calculate Roger Blaine's minimum federal income tax payable for

Indicate any carry forwards available to him and his dependants. Ignore any amounts Roger mig

have had withheld or paid in instalments and the possibility of pension income splitting.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock