Question: AP Q Search this cours ueprint Problems and is also known as company-spedific risk. On the other hand, market risk is the risk that remains

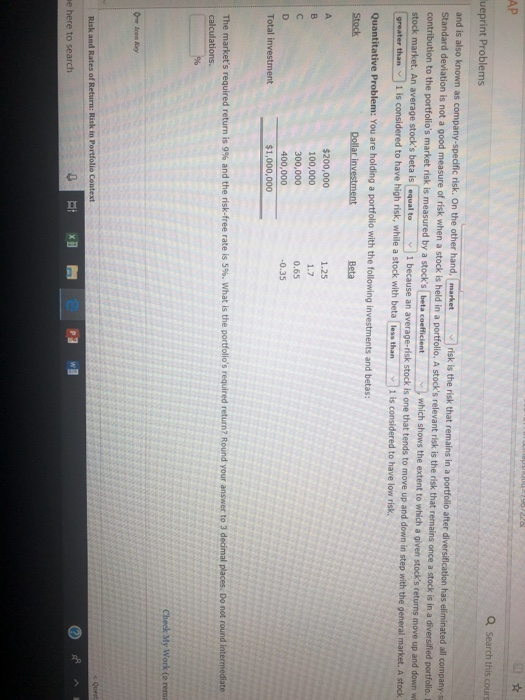

AP Q Search this cours ueprint Problems and is also known as company-spedific risk. On the other hand, market risk is the risk that remains in a Standard deviation is not a good measure of risk when a stock is held in a portfolio. A stock's relevant risk is the risk that remains once a stock is in a div contribution to the portfolio's market risk is measured by a stock's beta coefficient stock market. An average greater than1 is considered to have high risk, while a stock with beta less than portfollo after diversification has eliminatedall company s ersified portfollo. I stock's beta is equsl to1 because an averag urns move up and down wi ge-risk stock is one that tends to move up and down in step with the general market. A stock which shows the extent to which a iven stock's re Quantitative Problem: You are holding a portfolio with the following investments and betas: $200,000 100,000 300,000 400,000 $1,000,000 1.25 0.65 0.35 Total investment Check My Work (o rem leon Key Risk and Rates of Risk in Portfolio e here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts