Question: Apex Corp. is considering a project to construct a new Go-Kart racetrack. They estimate an initial cost of $1,400,000 to buy the land and build

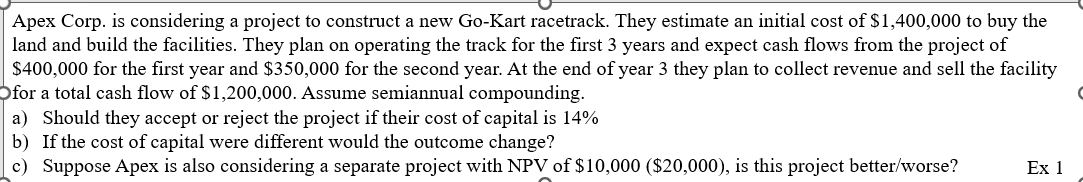

Apex Corp. is considering a project to construct a new Go-Kart racetrack. They estimate an initial cost of $1,400,000 to buy the land and build the facilities. They plan on operating the track for the first 3 years and expect cash flows from the project of $400,000 for the first year and $350,000 for the second year. At the end of year 3 they plan to collect revenue and sell the facility for a total cash flow of $1,200,000. Assume semiannual compounding. a) Should they accept or reject the project if their cost of capital is 14% b) If the cost of capital were different would the outcome change? c) Suppose Apex is also considering a separate project with NPV of $10,000($20,000), is this project better/worse? Ex 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts