Question: APOD Assignment 1 / 3 0 / 2 5 Your client is interested in purchasing for all cash, Garden Park Apartments, a 1 0 0

APOD Assignment

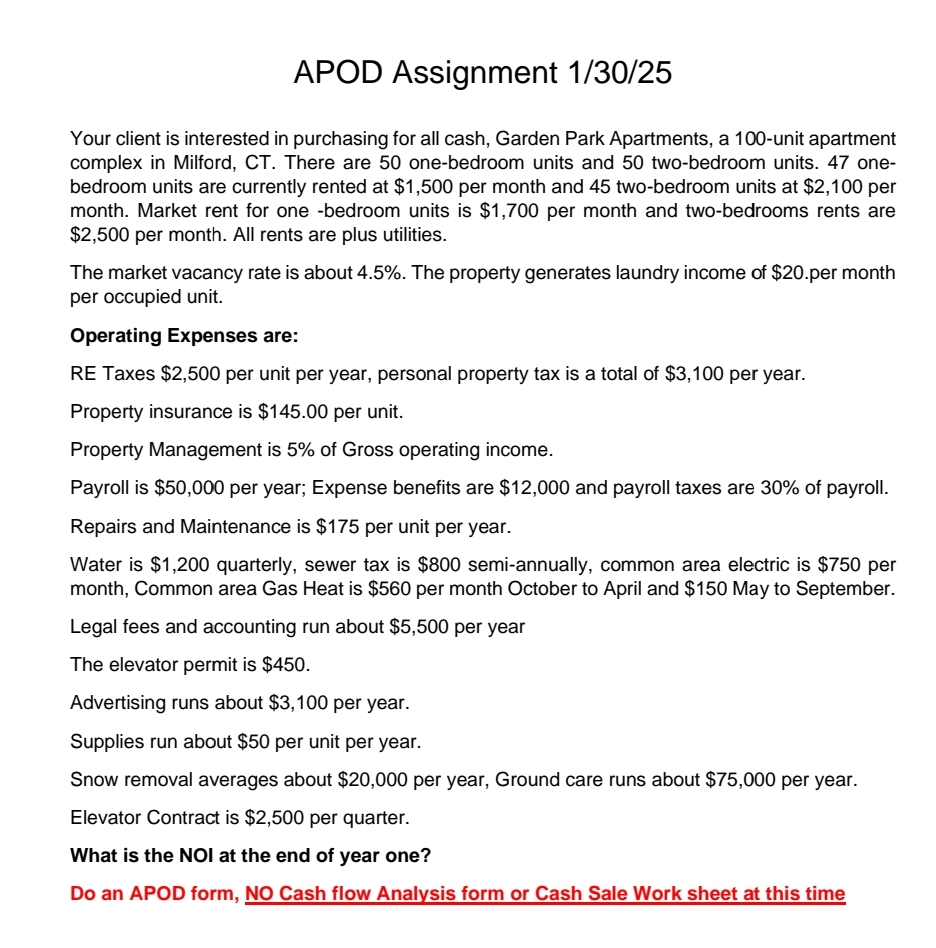

Your client is interested in purchasing for all cash, Garden Park Apartments, a unit apartment complex in Milford, CT There are onebedroom units and twobedroom units. onebedroom units are currently rented at $ per month and twobedroom units at $ per month. Market rent for one bedroom units is $ per month and twobedrooms rents are $ per month. All rents are plus utilities.

The market vacancy rate is about The property generates laundry income of $per month per occupied unit.

Operating Expenses are:

RE Taxes $ per unit per year, personal property tax is a total of $ per year.

Property insurance is $ per unit.

Property Management is of Gross operating income.

Payroll is $ per year; Expense benefits are $ and payroll taxes are of payroll.

Repairs and Maintenance is $ per unit per year.

Water is $ quarterly, sewer tax is $ semiannually, common area electric is $ per month, Common area Gas Heat is $ per month October to April and $ May to September.

Legal fees and accounting run about $ per year

The elevator permit is $

Advertising runs about $ per year.

Supplies run about $ per unit per year.

Snow removal averages about $ per year, Ground care runs about $ per year.

Elevator Contract is $ per quarter.

What is the NOI at the end of year one?

Do an APOD form, NO Cash flow Analysis form or Cash Sale Work sheet at this timehi

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock