Question: Apparently, I got part c-1 wrong but every time I check it I get the same answer. Can you help me and explain the steps

Apparently, I got part c-1 wrong but every time I check it I get the same answer. Can you help me and explain the steps so I don't miss points on this question? Thank you!

Apparently, I got part c-1 wrong but every time I check it I get the same answer. Can you help me and explain the steps so I don't miss points on this question? Thank you!

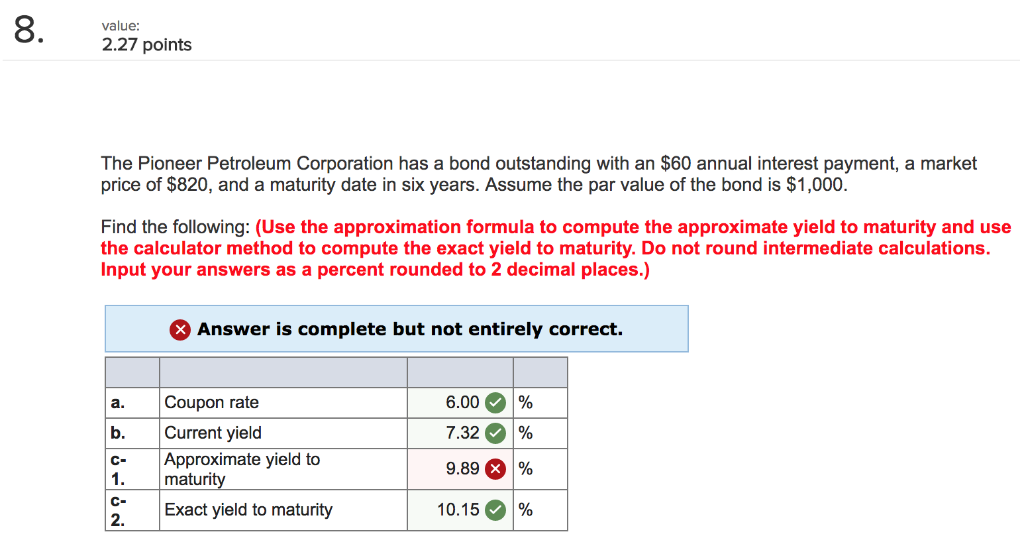

value 2.27 points The Pioneer Petroleum Corporation has a bond outstanding with an $60 annual interest payment, a market price of $820, and a maturity date in six years. Assume the par value of the bond is $1,000. Find the following: (Use the approximation formula to compute the approximate yield to maturity and use the calculator method to compute the exact yield to maturity. Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. a. Coupon rate b. Current yield c- Approximate yield to 1. maturity 6.00 % 7.32 % 9.89 % 10.15 % Exact yield to maturity 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts