Question: APPENDIX 1 1 A Comparison with MACRS ( Tax Depreciation ) Depreciation for financial reporting purposes is an attempt to distribute the cost of the

APPENDIX A Comparison with MACRS Tax Depreciation

Depreciation for financial reporting purposes is an attempt to distribute the cost of the asset, less any anticipated residual value, over the estimated useful life in a systematic and rational manner that attempts to match revenues with the use of the asset. Depreciation for income tax purposes is influenced by the revenue needs of government as well as the desire to influence economic behavior. For example accelerated depreciation schedules currently allowed are intended to provide incentive for companies to expand and modernize their facilities, thus stimulating economic growth.

The federal income tax code allows taxpayers to compute depreciation for their tax returns on assets acquired after using the modifi ed accelerated cost recovery system MACRS Key differences between the calculation of depreciation for financial reporting and the calculation using MACRS are

Estimated useful lives and residual values are not used in MACRS.

Firms can't choose among various accelerated methods under MACRS.

A halfyear convention is used in determining the MACRS depreciation amounts.

Under MACRS, each asset generally is placed within a recovery period category. The six categories for personal property are and years. For example, the year category includes automobiles, light trucks, and computers.

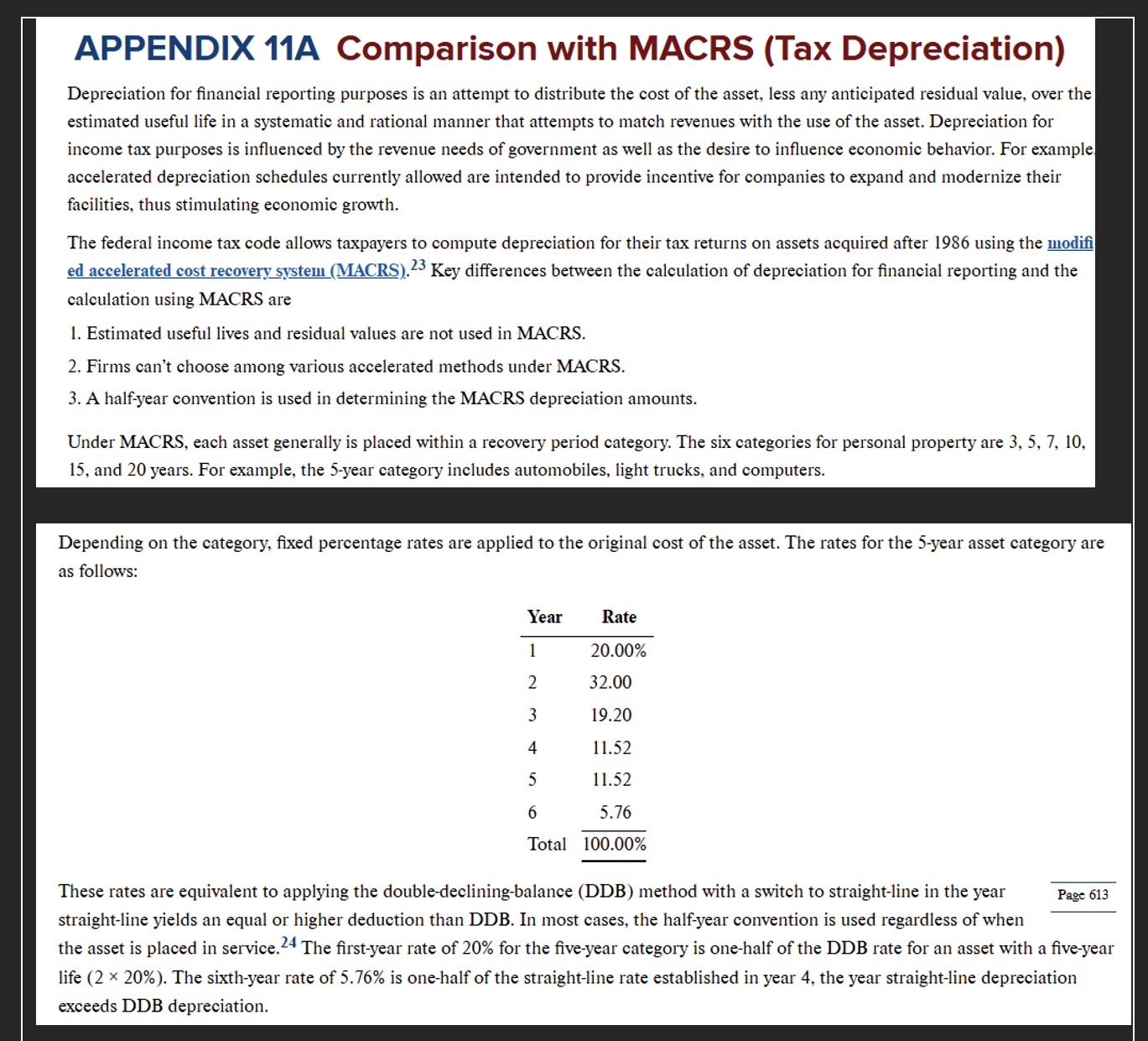

Depending on the category, fixed percentage rates are applied to the original cost of the asset. The rates for the year asset category are as follows:

These rates are equivalent to applying the doubledecliningbalance DDB method with a switch to straightline in the year straightline yields an equal or higher deduction than DDB In most cases, the halfyear convention is used regardless of when the asset is placed in service. The firstyear rate of for the fiveyear category is onehalf of the DDB rate for an asset with a fiveyear life times The sixthyear rate of is onehalf of the straightline rate established in year the year straightline depreciation exceeds DDB depreciation. be depreciated fully using MACRS.

The first two questions are financial accounting questions, not tax MACRS.

Prepare a table showing year straight line depreciation, assuming no residual value.

Prepare a similar table for double declining balance. It is ok if there is remaining book value. Optional: Prepare a table showing how MACRS is calculated for six years. #

begintabularllllll

hline Year & Depreciation Component & Depreciation Component & Total depreciation & Remaining book value & Comment

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline & & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock