Question: Appendix 1 - MacVille Coffee Pty Ltd Scenario You are employed by MacVille Coffee Pty Ltd as Assistant Accountant. Your duties include creating and maintaining

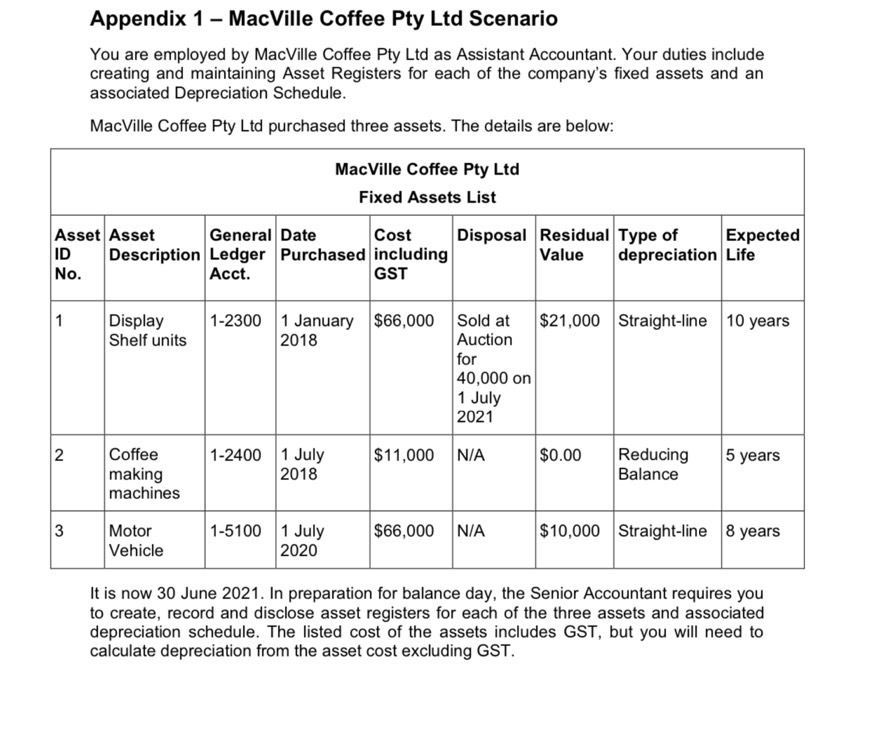

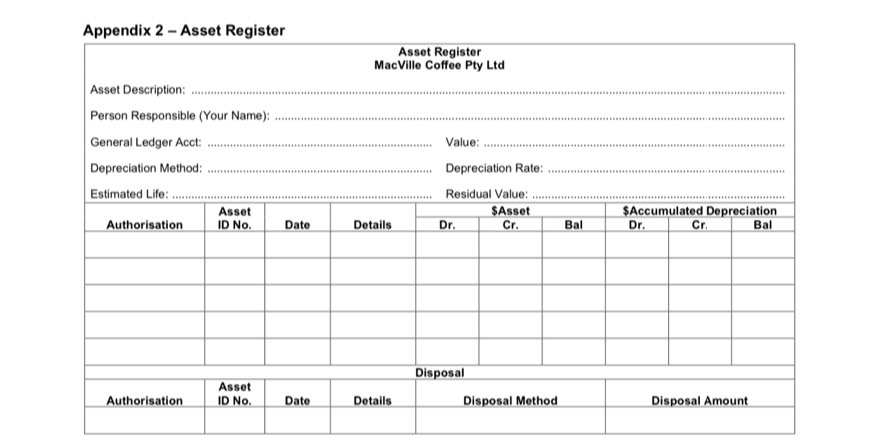

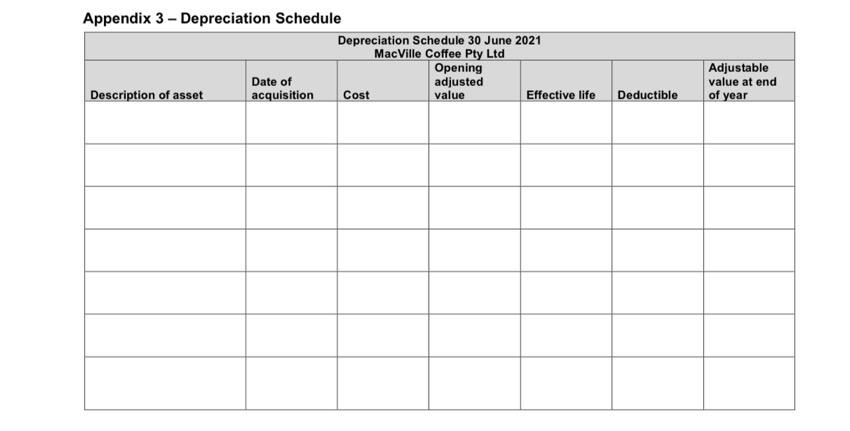

Appendix 1 - MacVille Coffee Pty Ltd Scenario You are employed by MacVille Coffee Pty Ltd as Assistant Accountant. Your duties include creating and maintaining Asset Registers for each of the company's fixed assets and an associated Depreciation Schedule. MacVille Coffee Pty Ltd purchased three assets. The details are below: MacVille Coffee Pty Ltd Fixed Assets List Asset Asset General Date Cost Disposal Residual Type of Expected ID Description Ledger Purchased including Value depreciation Life No Acct. GST 1 Display 1-2300 1 January $66,000 Sold at $21,000 Straight-line 10 years Shelf units 2018 Auction for 40,000 on 1 July 2021 2 Coffee 1-2400 1 July $11,000 N/A $0.00 Reducing 5 years making 2018 Balance machines 3 Motor 1-5100 1 July $66,000 N/A $10,000 Straight-line 8 years Vehicle 2020 It is now 30 June 2021. In preparation for balance day, the Senior Accountant requires you to create, record and disclose asset registers for each of the three assets and associated depreciation schedule. The listed cost of the assets includes GST, but you will need to calculate depreciation from the asset cost excluding GST.Appendix 2 - Asset Register Asset Register MacVille Coffee Pty Ltd Asset Description:..mmmmmmmmmmmm Person Responsible (Your Name): ........... General Ledger Acct: 414:410HUH Value: 64641 14SERIES Depreciation Method: Depreciation Rate: 14184 4 14 4 : Estimated Life: . Residual Value: Asset $Asset $Accumulated Depreciation ID No. Date Details Dr. Cr Bal Dr. Cr. Bal Authorisation Disposal Asset Authorisation ID No. Date Details Disposal Method Disposal AmountAppendix 3 - Depreciation Schedule Depreciation Schedule 30 June 2021 MacVille Coffee Pty Ltd Opening Adjustable Date of adjusted value at end Description of asset acquisition Cost value Effective life Deductible of year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts