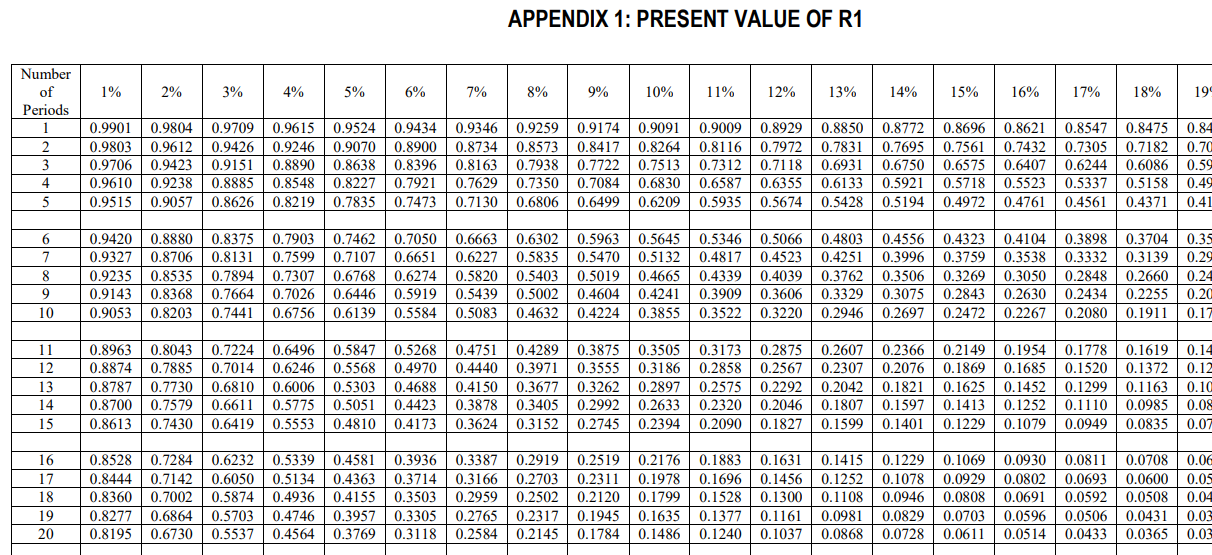

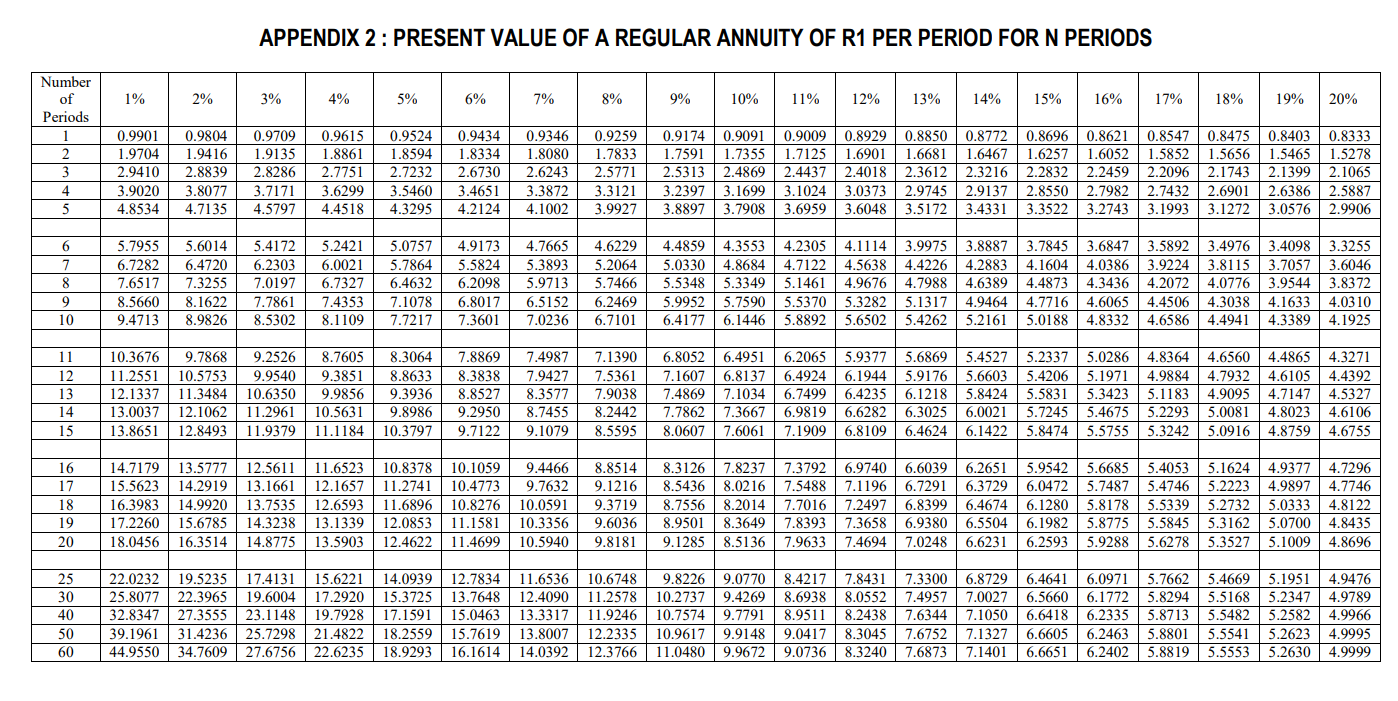

Question: APPENDIX 1: PRESENT VALUE OF R1 APPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS REQUIRED Use the

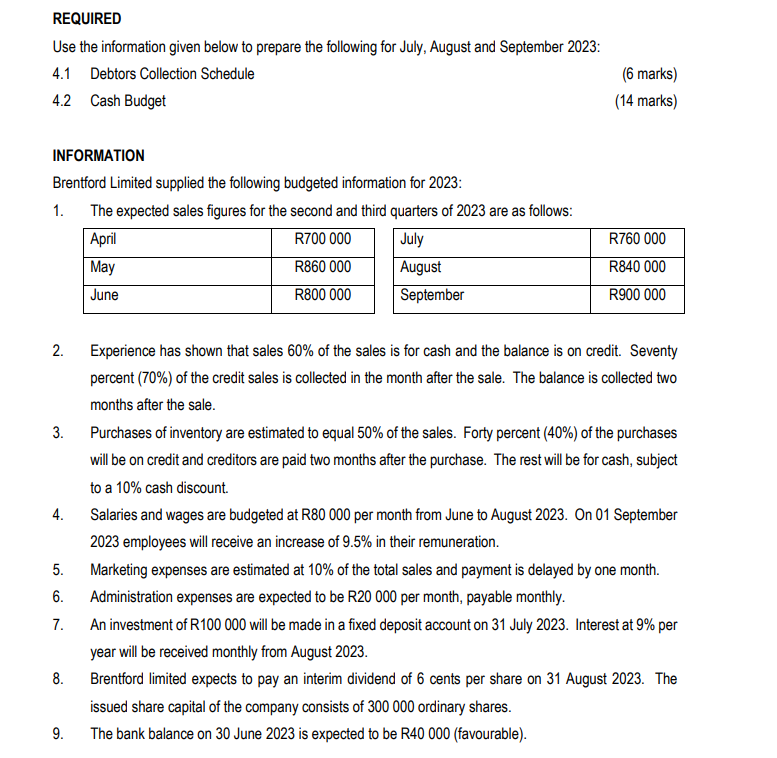

APPENDIX 1: PRESENT VALUE OF R1 APPENDIX 2 : PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS REQUIRED Use the information given below to prepare the following for July, August and September 2023: 4.1 Debtors Collection Schedule (6 marks) 4.2 Cash Budget (14 marks) INFORMATION Brentford Limited supplied the following budgeted information for 2023: 1. The expected sales figures for the second and third quarters of 2023 are as follows: 2. Experience has shown that sales \60 of the sales is for cash and the balance is on credit. Seventy percent \(70 of the credit sales is collected in the month after the sale. The balance is collected two months after the sale. 3. Purchases of inventory are estimated to equal \50 of the sales. Forty percent ( \40 of the purchases will be on credit and creditors are paid two months after the purchase. The rest will be for cash, subject to a \10 cash discount. 4. Salaries and wages are budgeted at R80 000 per month from June to August 2023. On 01 September 2023 employees will receive an increase of \9.5 in their remuneration. 5. Marketing expenses are estimated at \10 of the total sales and payment is delayed by one month. 6. Administration expenses are expected to be R20 000 per month, payable monthly. 7. An investment of R100 000 will be made in a fixed deposit account on 31 July 2023 . Interest at \9 per year will be received monthly from August 2023. 8. Brentford limited expects to pay an interim dividend of 6 cents per share on 31 August 2023. The issued share capital of the company consists of 300000 ordinary shares. 9. The bank balance on 30 June 2023 is expected to be R40 000 (favourable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts