Question: APPENDIX 10A: APPLYING THE GASB CODIFIGATIOH. AN EXTENDED EXAMPLE Recognition of Tea Revenues, Using Fund Accounting The following example illustrates the recognition of sales and

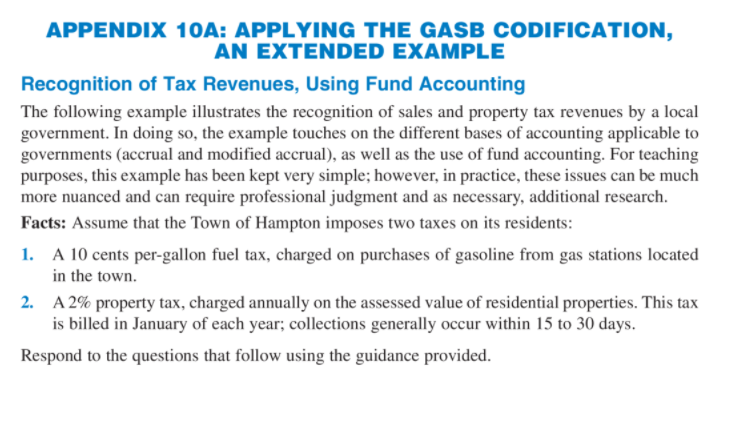

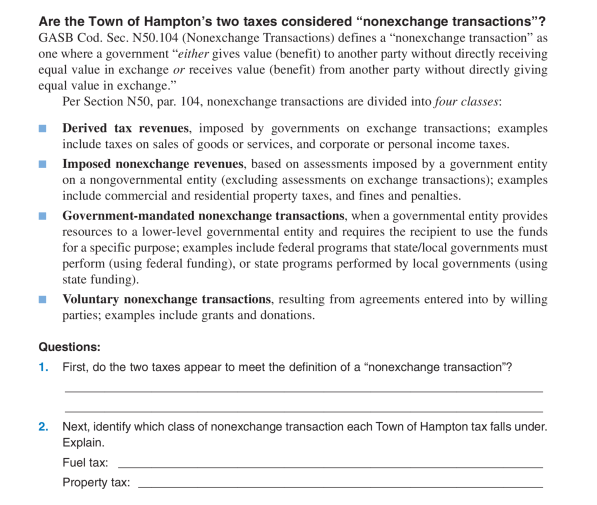

APPENDIX 10A: APPLYING THE GASB CODIFIGATIOH. AN EXTENDED EXAMPLE Recognition of Tea Revenues, Using Fund Accounting The following example illustrates the recognition of sales and property tax revenues by a local govemment. In doing so. the example touches on the different bases of accounting applicable to governments {accrual and modied accrual }. as well as the use of fund accounting. For teaching purposes. this example has been kept very simple: however. in practice. these issues can be much more nuanced and can require professional judgment and as necessary. additional reaearch. Facts: Assume that the Town of Hampton imposes two taxes on its residents: 1. A 10 Cents per-gallon fuel tax. charged on purchases of gasoline from gas stations located in the town. 2. A 2% property tax. charged annually on the assessed value of reaidential properties. This tax is billed in January of each year; collections generally occur within [5 to 30 days. Respond to the questions that follovt'r using the guidance provided. Are the Town of Hampton's two taxes considered "nonexchange transactions"? GASB Cod. Sec. N50.104 (Nonexchange Transactions) defines a "nonexchange transaction" as one where a government "either gives value (benefit) to another party without directly receiving equal value in exchange or receives value (benefit) from another party without directly giving equal value in exchange." Per Section N50, par. 104, nonexchange transactions are divided into four classes: Derived tax revenues, imposed by governments on exchange transactions; examples include taxes on sales of goods or services, and corporate or personal income taxes. Imposed nonexchange revenues, based on assessments imposed by a government entity on a nongovernmental entity (excluding assessments on exchange transactions); examples include commercial and residential property taxes, and fines and penalties. Government-mandated nonexchange transactions, when a governmental entity provides resources to a lower-level governmental entity and requires the recipient to use the funds for a specific purpose; examples include federal programs that state/local governments must perform (using federal funding), or state programs performed by local governments (using state funding). Voluntary nonexchange transactions, resulting from agreements entered into by willing parties; examples include grants and donations. Questions: 1. First, do the two taxes appear to meet the definition of a "nonexchange transaction"? 2. Next, identify which class of nonexchange transaction each Town of Hampton tax falls under. Explain. Fuel tax: Property tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts