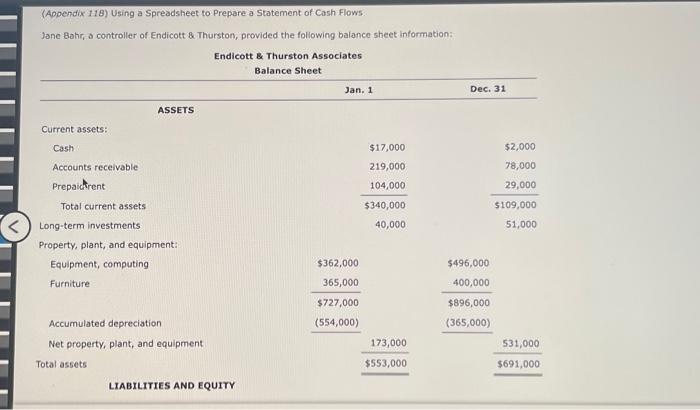

Question: (Appendix 118) Using a Spreadsheet to Prepare a Statement of Cash Flows Jane Bahr, a controller of Endicott & Thurston, provided the following balance sheet

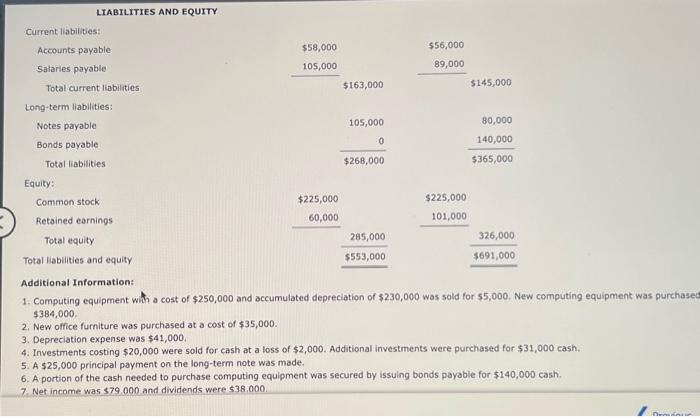

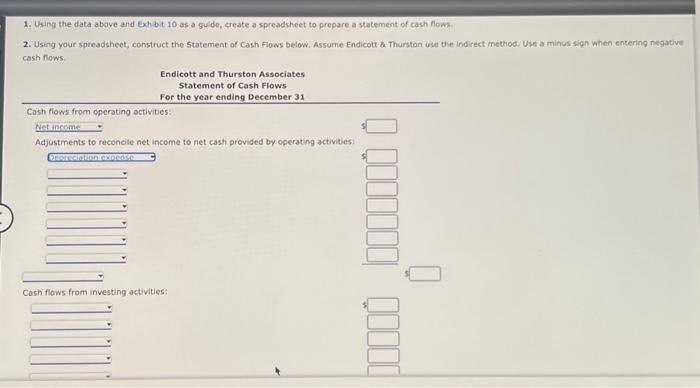

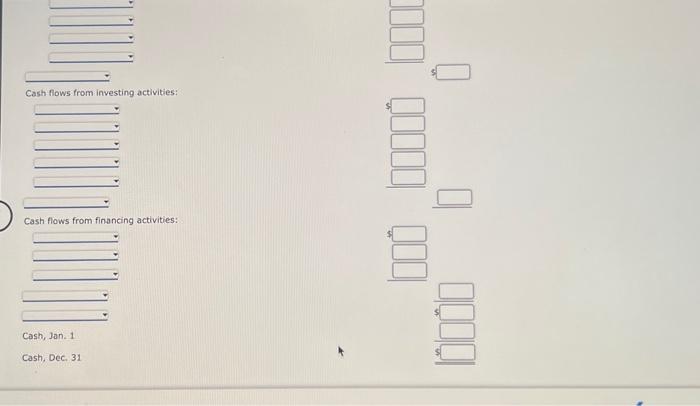

(Appendix 118) Using a Spreadsheet to Prepare a Statement of Cash Flows Jane Bahr, a controller of Endicott \& Thurston, provided the following balance sheet information: 1. Computing equipment whih a cost of $250,000 and accumulated depreciation of $230,000 was sold for $5,000. New computing equipment was purchased 5384,000 . 2. New office furniture was purchased at a cost of $35,000. 3. Depreciation expense was $41,000. 4. Investments costing $20,000 were sold for cash at a loss of $2,000. Additional investments were purchased for $31,000 cash. 5. A $25,000 principal payment on the long-term note was made. 6. A portion of the cash needed to purchase computing equipment was secured by issulng bonds payable for $140,000 cash. 7. Net income was $79,000 and dividends were 538.000 . 1. Using the data above and Exhbit 10 as a guide, create a spreadsheet to prepare a statement of cash flows. 2. Using your spreadsheet, construct the Statement of Cash flows below. Assume Endicott th. Thurston ose the indirect method. Use a minus sign when entering negative cash flows. Endicott and Thurston Associates Statement of Cash Flows For the vear endine December 31 Cash flows from investing activities: Cash flows from financing activities: Cash, Jan.1 Cash. Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts