Question: APPENDIX A AND B BELOW PROBLEM APPENDIX A APPENDIX B Use the present value table in Appendix A and Appendix B to compute the NPV

APPENDIX A AND B BELOW PROBLEM

APPENDIX A

APPENDIX B

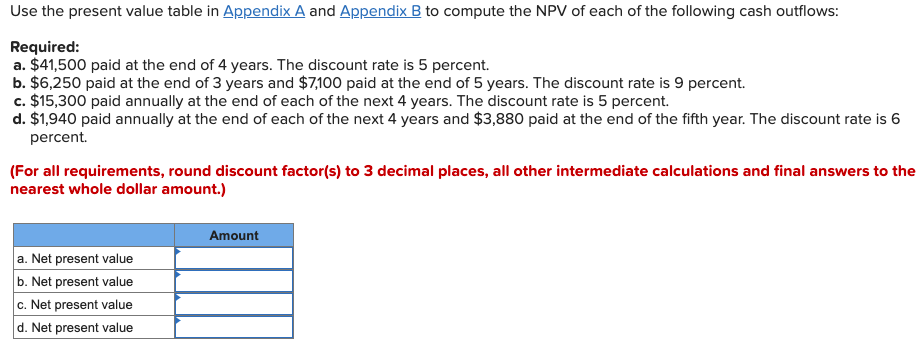

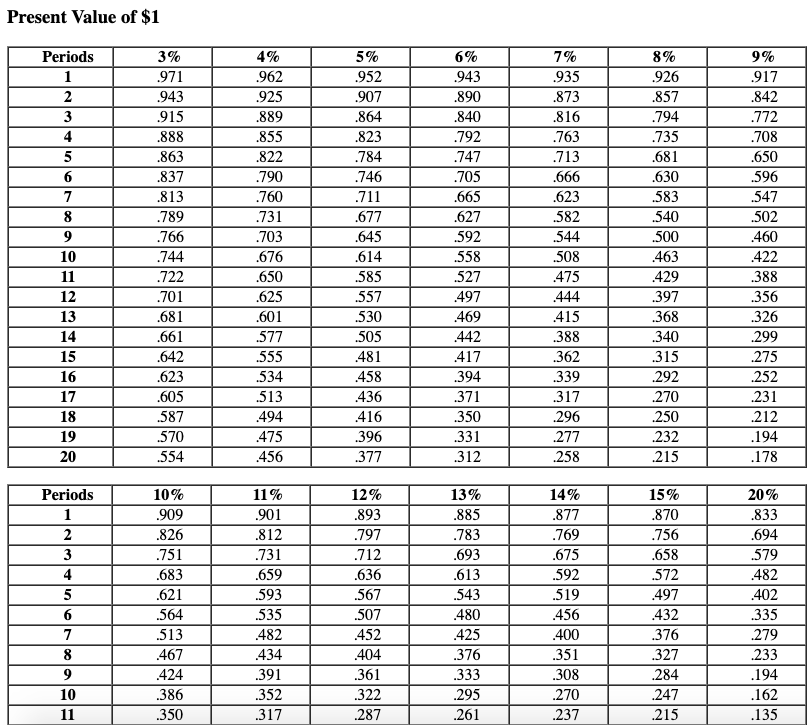

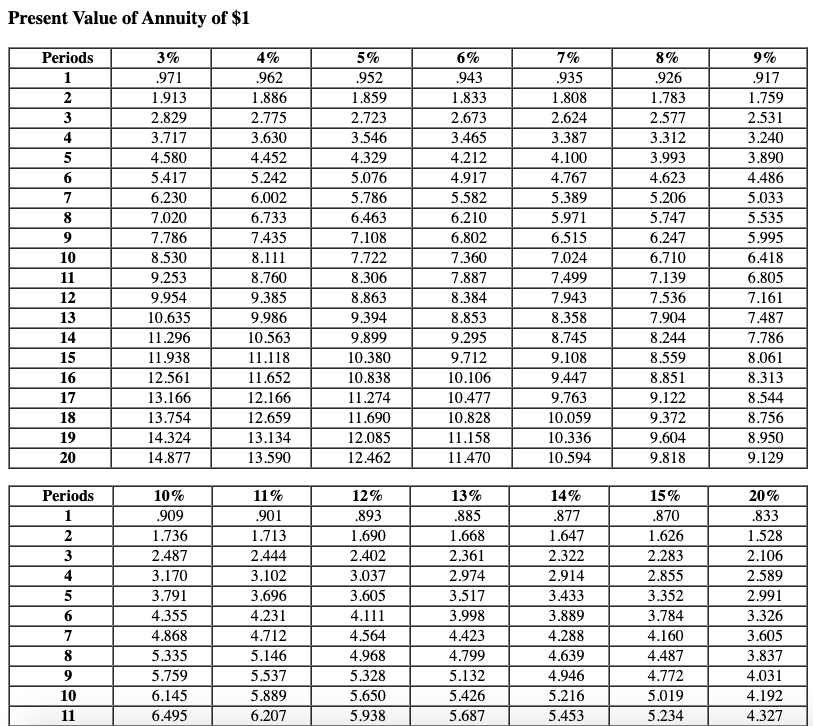

Use the present value table in Appendix A and Appendix B to compute the NPV of each of the following cash outflows: Required: a. $41,500 paid at the end of 4 years. The discount rate is 5 percent. b. $6,250 paid at the end of 3 years and $7,100 paid at the end of 5 years. The discount rate is 9 percent. c. $15,300 paid annually at the end of each of the next 4 years. The discount rate is 5 percent. d. $1,940 paid annually at the end of each of the next 4 years and $3,880 paid at the end of the fifth year. The discount rate is 6 percent. (For all requirements, round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount.) Amount a. Net present value b. Net present value c. Net present value d. Net present value Present Value of $1 Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Periods 1 2 3 4 5 6 7 8 9 10 11 3% .971 .943 .915 .888 .863 .837 .813 .789 .766 .744 .722 .701 .681 .661 .642 .623 .605 .587 .570 .554 10% .909 .826 .751 .683 .621 .564 513 .467 .424 .386 .350 4% .962 .925 .889 .855 .822 .790 .760 .731 .703 .676 .650 .625 .601 577 .555 .534 513 .494 .475 .456 11% .901 .812 .731 .659 .593 .535 .482 .434 .391 .352 .317 5% .952 .907 .864 .823 .784 .746 .711 .677 .645 .614 .585 .557 .530 .505 .481 458 .436 416 .396 .377 12% .893 .797 .712 .636 .567 .507 .452 .404 .361 .322 .287 6% .943 .890 .840 .792 .747 .705 .665 .627 .592 558 .527 .497 .469 .442 417 .394 .371 .350 .331 .312 13% .885 .783 .693 .613 .543 .480 .425 .376 .333 .295 .261 7% .935 .873 .816 .763 .713 .666 .623 582 544 .508 .475 .444 .415 .388 .362 .339 317 .296 277 .258 14% .877 .769 .675 .592 .519 .456 .400 .351 .308 .270 .237 8% .926 .857 .794 .735 .681 .630 583 .540 .500 .463 .429 .397 .368 .340 .315 .292 270 .250 .232 .215 15% .870 .756 .658 572 .497 .432 .376 .327 .284 .247 .215 9% .917 .842 .772 .708 .650 596 .547 .502 .460 .422 .388 .356 .326 .299 275 .252 .231 .212 .194 .178 20% .833 .694 .579 .482 .402 .335 279 .233 .194 .162 .135 Present Value of Annuity of $1 Periods 3% 1 .971 2 1.913 3 2.829 4 3.717 5 4.580 6 5.417 7 6.230 8 7.020 9 7.786 10 8.530 11 9.253 12 9.954 13 10.635 14 11.296 15 11.938 16 12.561 17 13.166 18 13.754 19 14.324 20 14.877 Periods 10% 1 .909 2 1.736 3 2.487 4 3.170 5 3.791 6 4.355 7 4.868 8 5.335 9 5.759 10 6.145 11 6.495 4% .962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 11% .901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 5% .952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 12% .893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6% .943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 13% .885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 7% .935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.594 14% .877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 8% .926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 15% .870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 9% .917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 20% .833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts