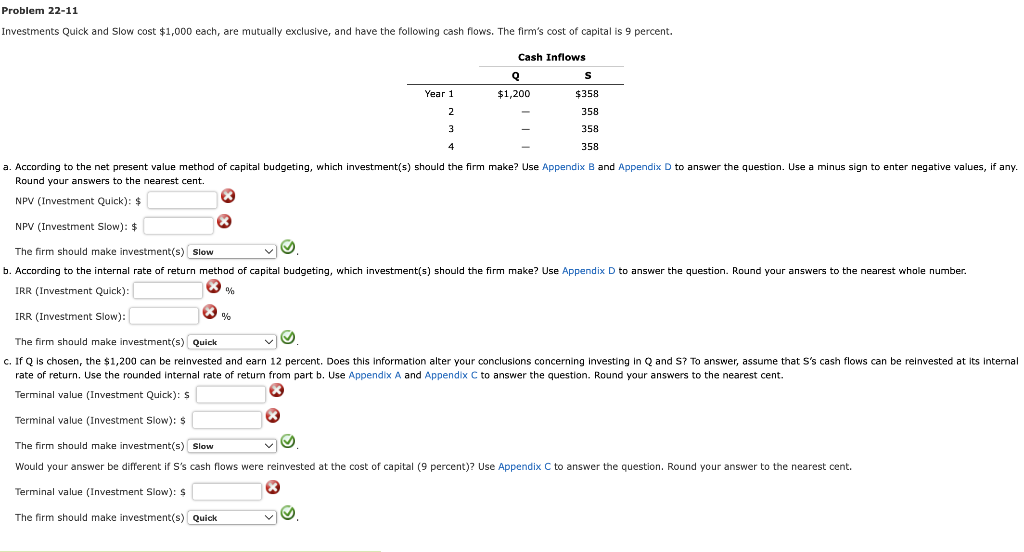

Question: Appendix A Appendix B Above Appendix C AppendixD Please answer fast Problem 22-11 investments Quick and Slow cost $1,000 each, are mutually exclusive, and have

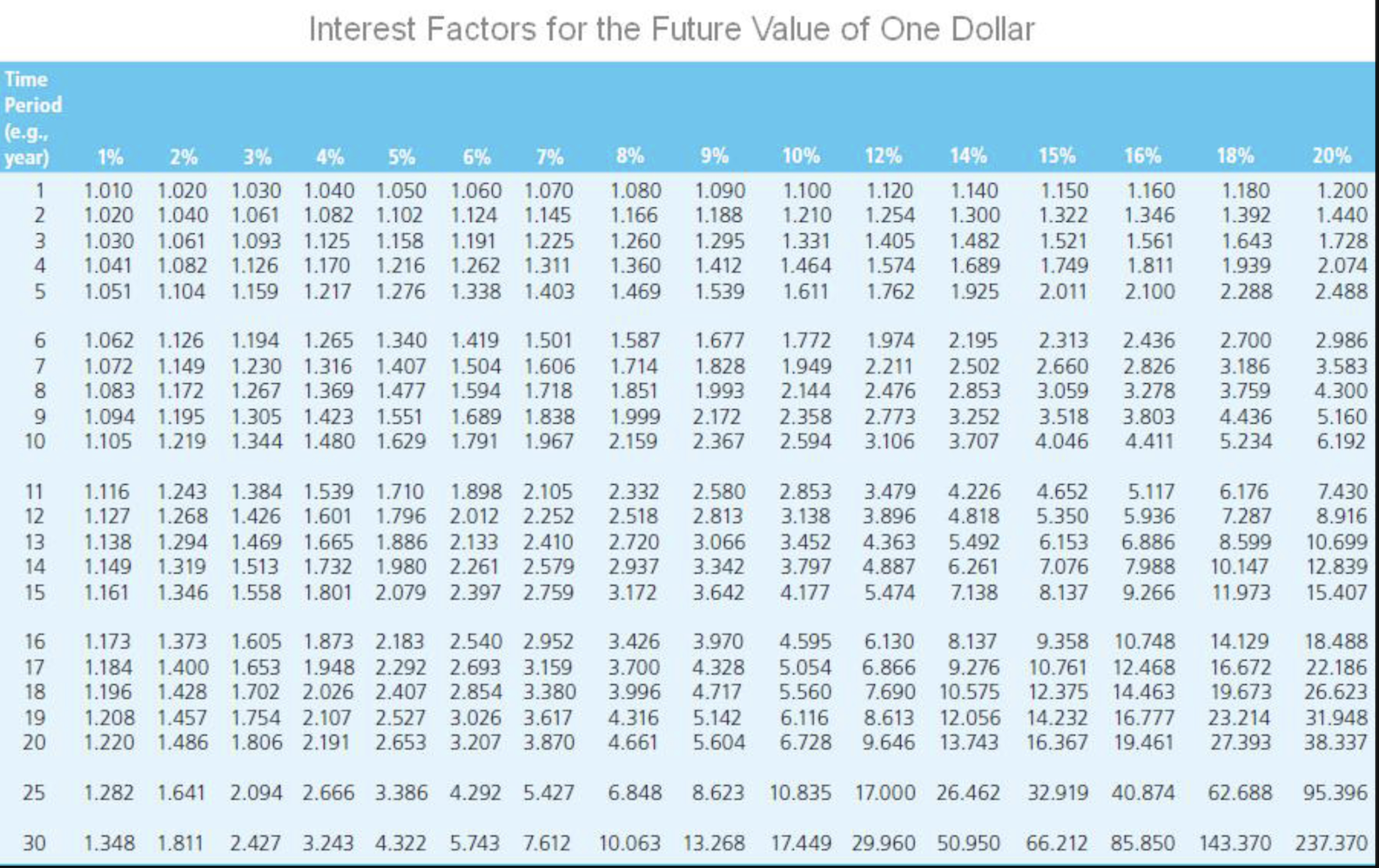

Appendix A

Appendix A

Appendix B Above

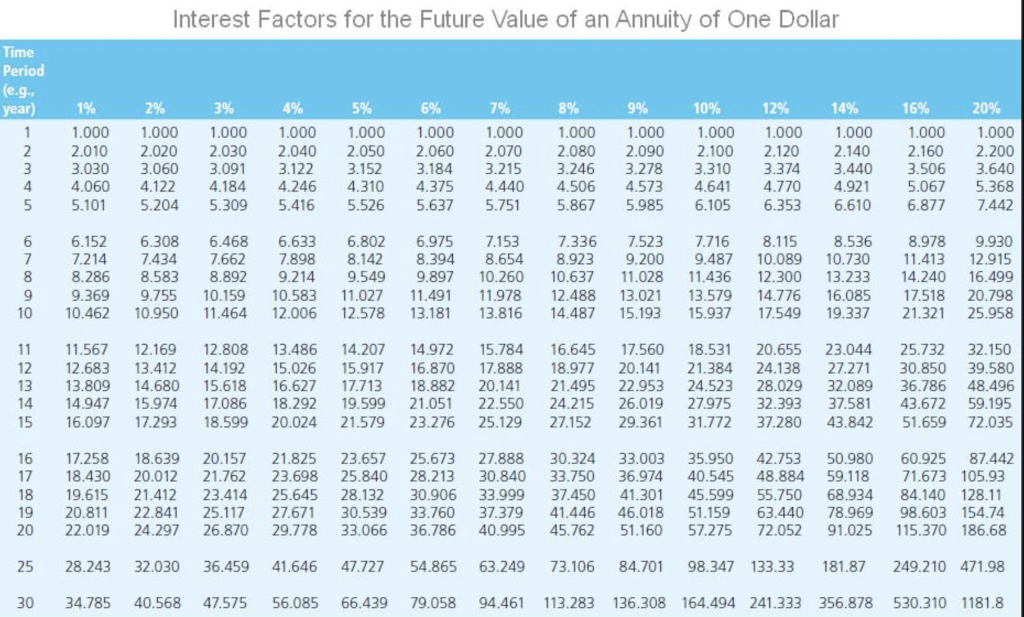

Appendix C

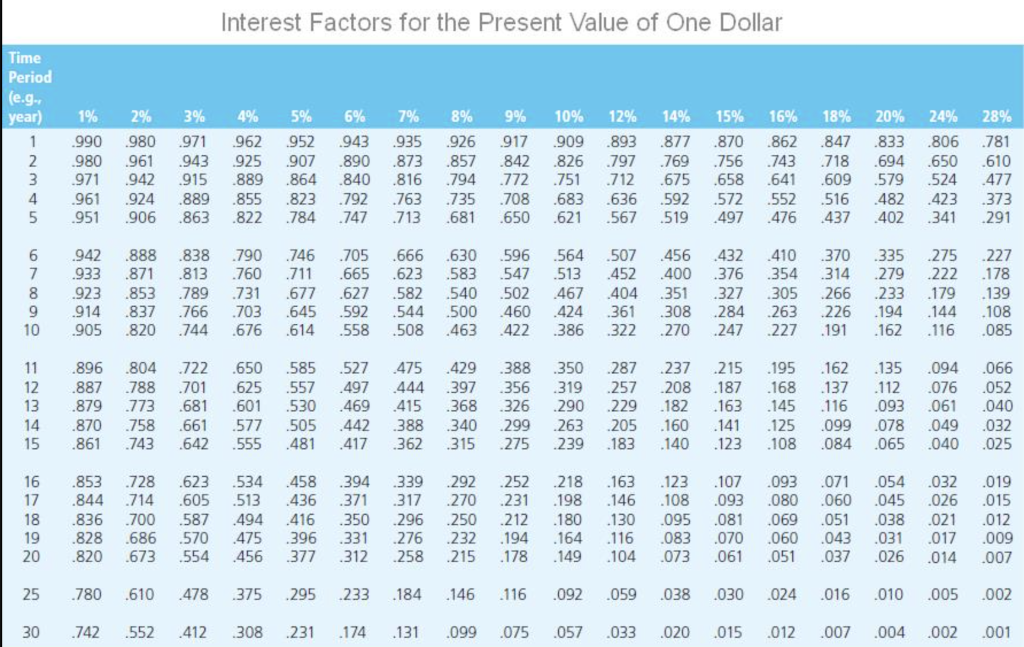

AppendixD

AppendixD

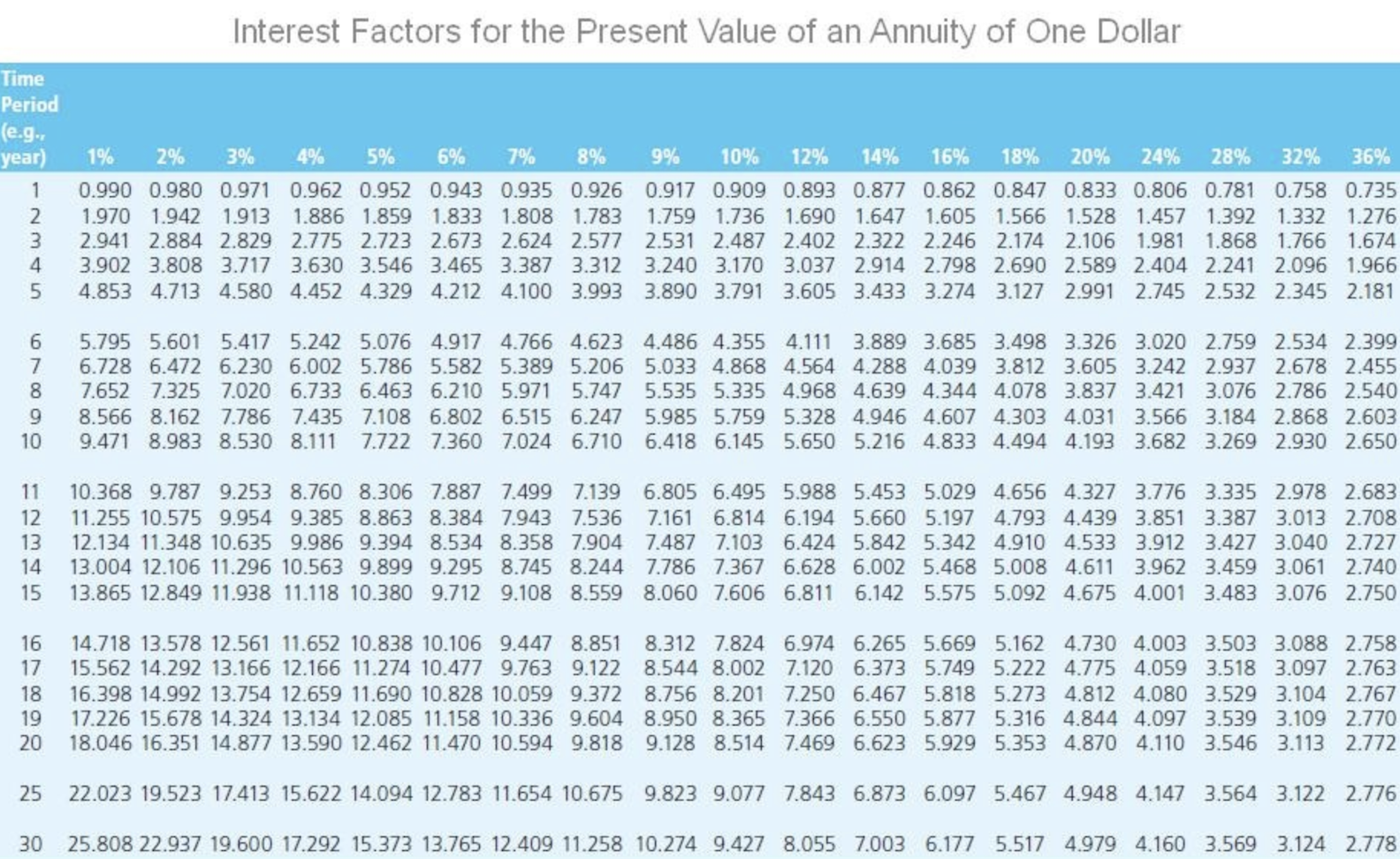

Problem 22-11 investments Quick and Slow cost $1,000 each, are mutually exclusive, and have the following cash flows. The firm's cost of capital is 9 percent. Round your answers to the nearest cent. NPV (Investment Quick): $ NPV (Investment Slow): $ The firm should make investment(s) IRR (Investment Quick): IRR (Investment Slow): The firm should make investment(s) rate of return. Use the rounded internal rate of retum from part b. Use Appendix A and Appendix C to answer the question. Round your answers to the nearest cent. Terminal value (Investment Quick): 5 Terminal value (Investment Slow): $ The firm should make investment(s) Would your answer be different if S's cash flows were reinvested at the cost of capital ( 9 percent)? Use Appendix C to answer the question. Round your answer to the nearest cent. Terminal value (Investment Slow): s The firm should make investment(s) Interect Factore for the Fitture Value of One Dollar Intarect Fontare far the Drecent l/alte af hno Mallor Interect Factors for the Fisture V/alue af an Annuitu af One Dollar Interest Factors for the Present Value of an Annuitv of One Dollar Problem 22-11 investments Quick and Slow cost $1,000 each, are mutually exclusive, and have the following cash flows. The firm's cost of capital is 9 percent. Round your answers to the nearest cent. NPV (Investment Quick): $ NPV (Investment Slow): $ The firm should make investment(s) IRR (Investment Quick): IRR (Investment Slow): The firm should make investment(s) rate of return. Use the rounded internal rate of retum from part b. Use Appendix A and Appendix C to answer the question. Round your answers to the nearest cent. Terminal value (Investment Quick): 5 Terminal value (Investment Slow): $ The firm should make investment(s) Would your answer be different if S's cash flows were reinvested at the cost of capital ( 9 percent)? Use Appendix C to answer the question. Round your answer to the nearest cent. Terminal value (Investment Slow): s The firm should make investment(s) Interect Factore for the Fitture Value of One Dollar Intarect Fontare far the Drecent l/alte af hno Mallor Interect Factors for the Fisture V/alue af an Annuitu af One Dollar Interest Factors for the Present Value of an Annuitv of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts