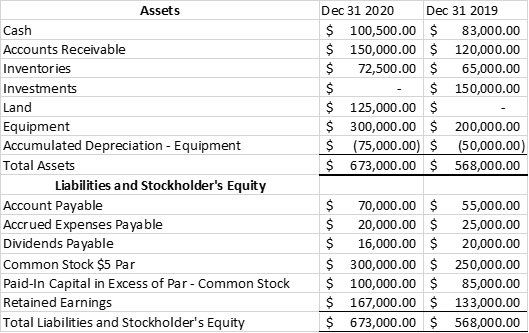

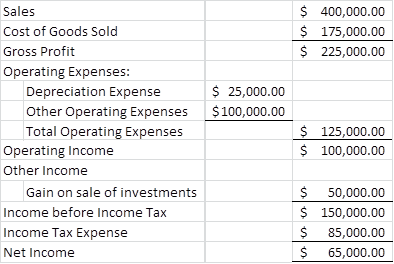

Question: Appendix A: Listed above is the comparative balance sheet and income statement for ABC Inc. on December 31, 2020. Additional data obtained from an examination

Appendix A: Listed above is the comparative balance sheet and income statement for ABC Inc. on December 31, 2020.

Additional data obtained from an examination of the accounts in the ledger is as follows:

A. There were no disposals of equipment during the year.

B. Equipment and land were acquired for cash.

C. Investments were sold for $200,000 cash.

D. The common stock was issued for cash.

E. There was a $65,000 credit to Retained Earnings for Net Income.

F. There was a $35,000 debit to Retained Earnings for cash dividends declared.

REQUIRED: Using the information shown above in Appendix A, prepare the operating activities section of the statement of cash flows using the direct method.

Assets Cash Accounts Receivable Inventories Investments Land Equipment Accumulated Depreciation - Equipment Total Assets Liabilities and Stockholder's Equity Account Payable Accrued Expenses Payable Dividends Payable Common Stock $5 Par Paid-In Capital in Excess of Par - Common Stock Retained Earnings Total Liabilities and Stockholder's Equity Dec 31 2020 Dec 31 2019 $ 100,500.00 $ 83,000.00 $ 150,000.00 $ 120,000.00 $ 72,500.00 $ 65,000.00 $ $ 150,000.00 $ 125,000.00 $ $ 300,000.00 $ 200,000.00 $ (75,000.00) $ (50,000.00) $ 673,000.00 $ 568,000.00 $ $ 70,000.00 $ 55,000.00 $ 20,000.00 $ 25,000.00 $ 16,000.00 $ 20,000.00 $ 300,000.00 $ 250,000.00 $ 100,000.00 $ 85,000.00 $ 167,000.00 $ 133,000.00 $ 673,000.00 $ 568,000.00 $ 400,000.00 $ 175,000.00 $ 225,000.00 $ 25,000.00 $100,000.00 Sales Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Other Operating Expenses Total Operating Expenses Operating Income Other Income Gain on sale of investments Income before Income Tax Income Tax Expense Net Income $ 125,000.00 $ 100,000.00 $ 50,000.00 $ 150,000.00 $ 85,000.00 $ 65,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts