Question: Appendix A Use Home Depot's financial information in Appendix A. Required: a. Compute the ROI and EVA for the two most recent years reported. Use

Appendix A

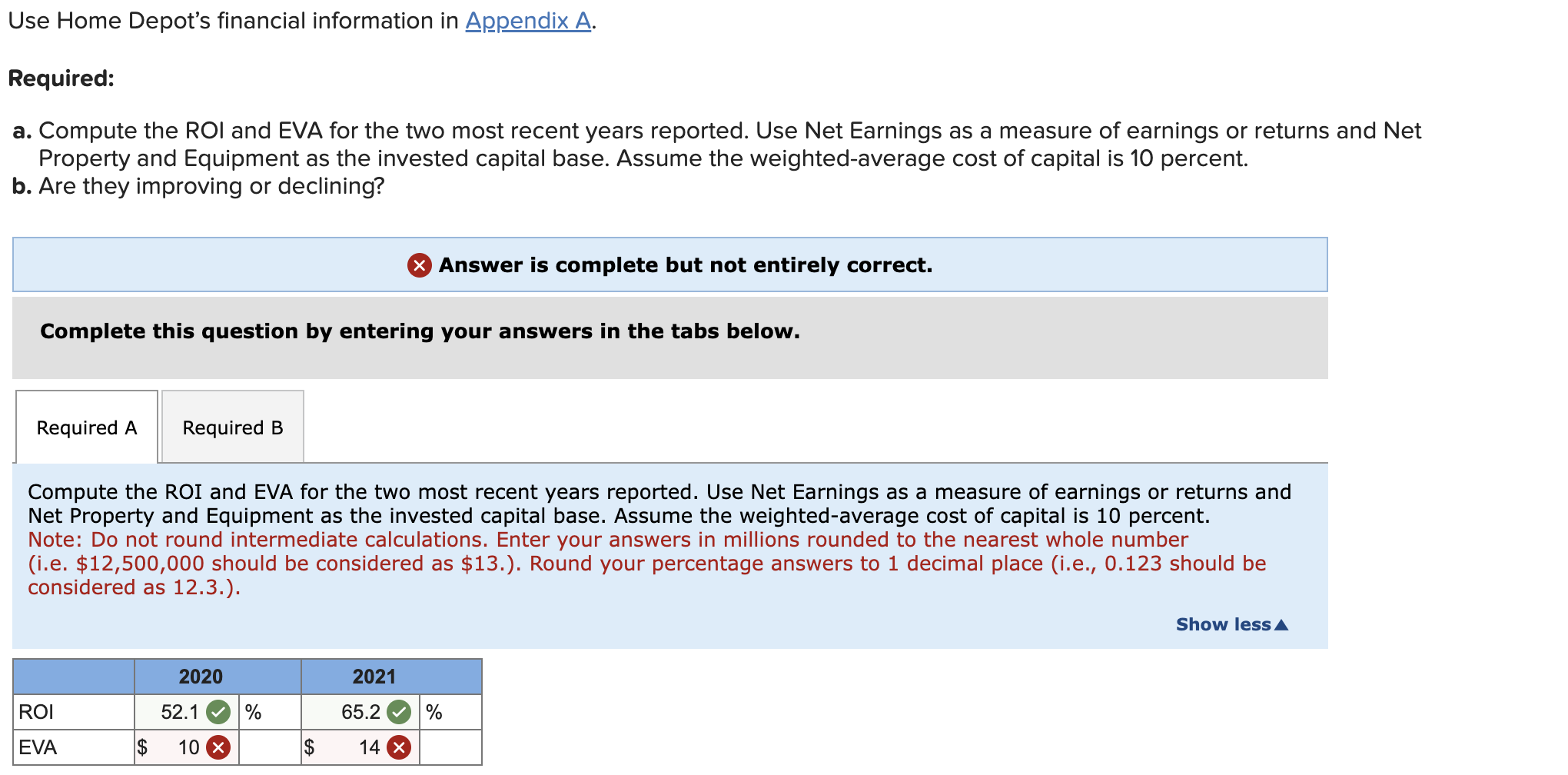

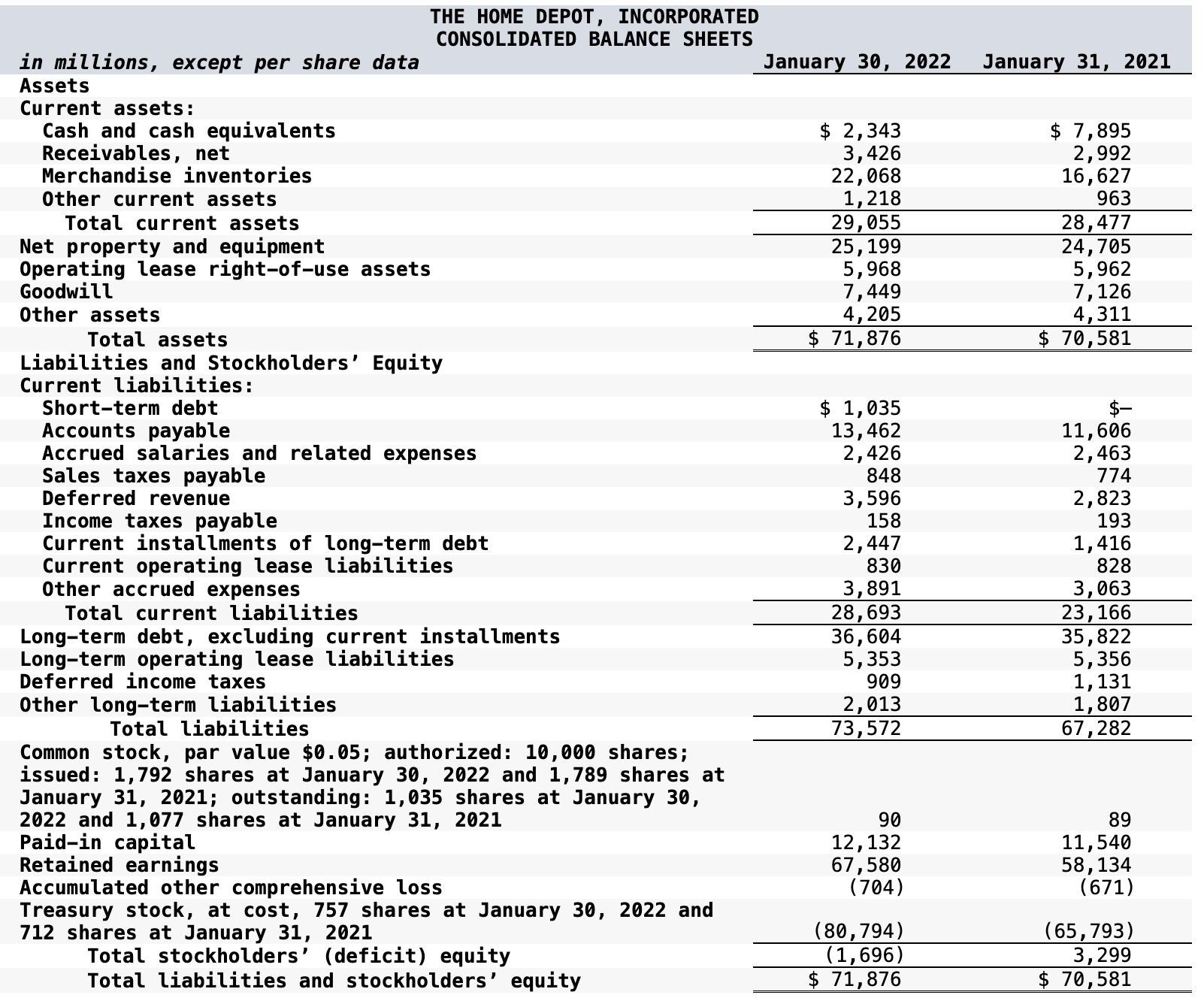

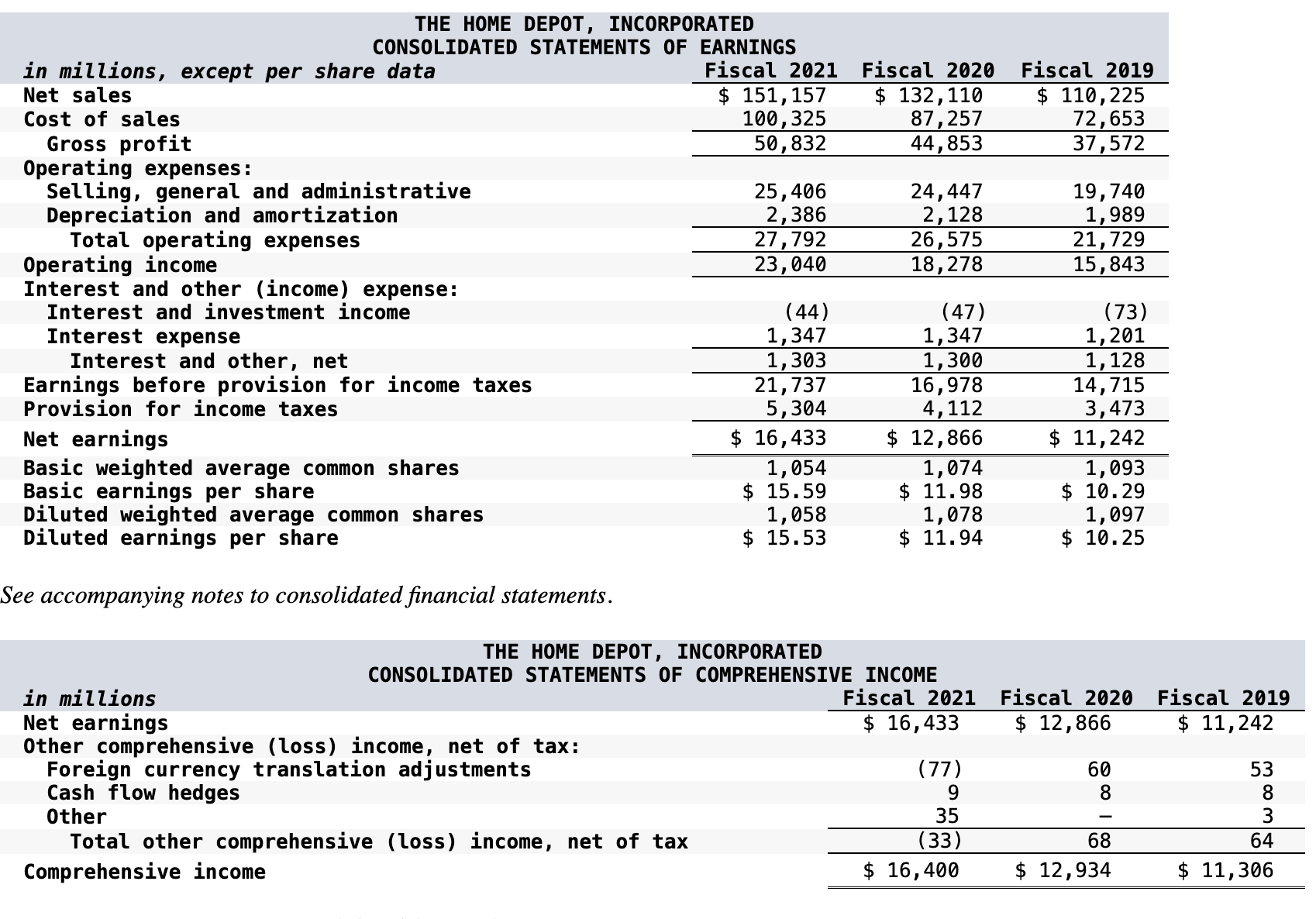

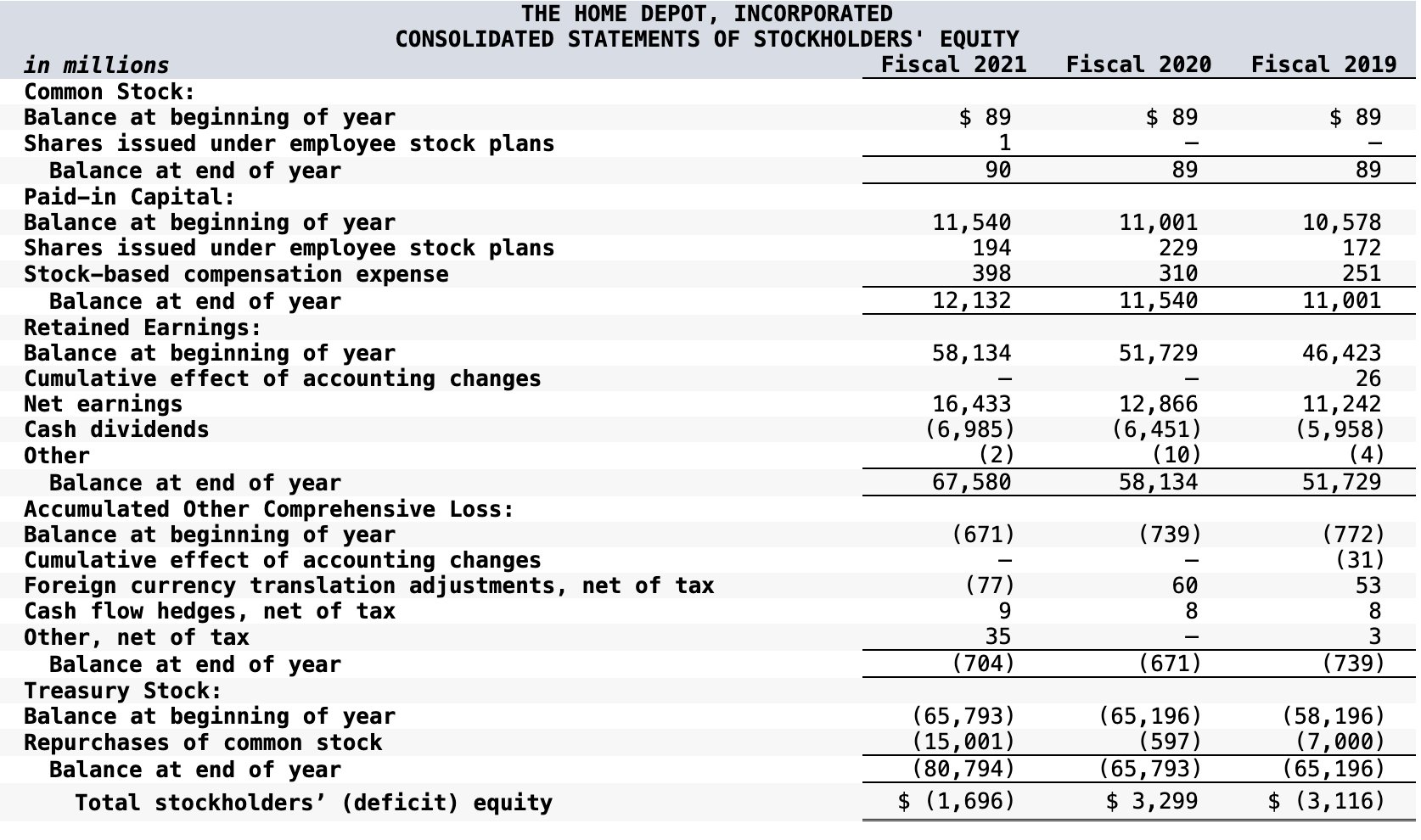

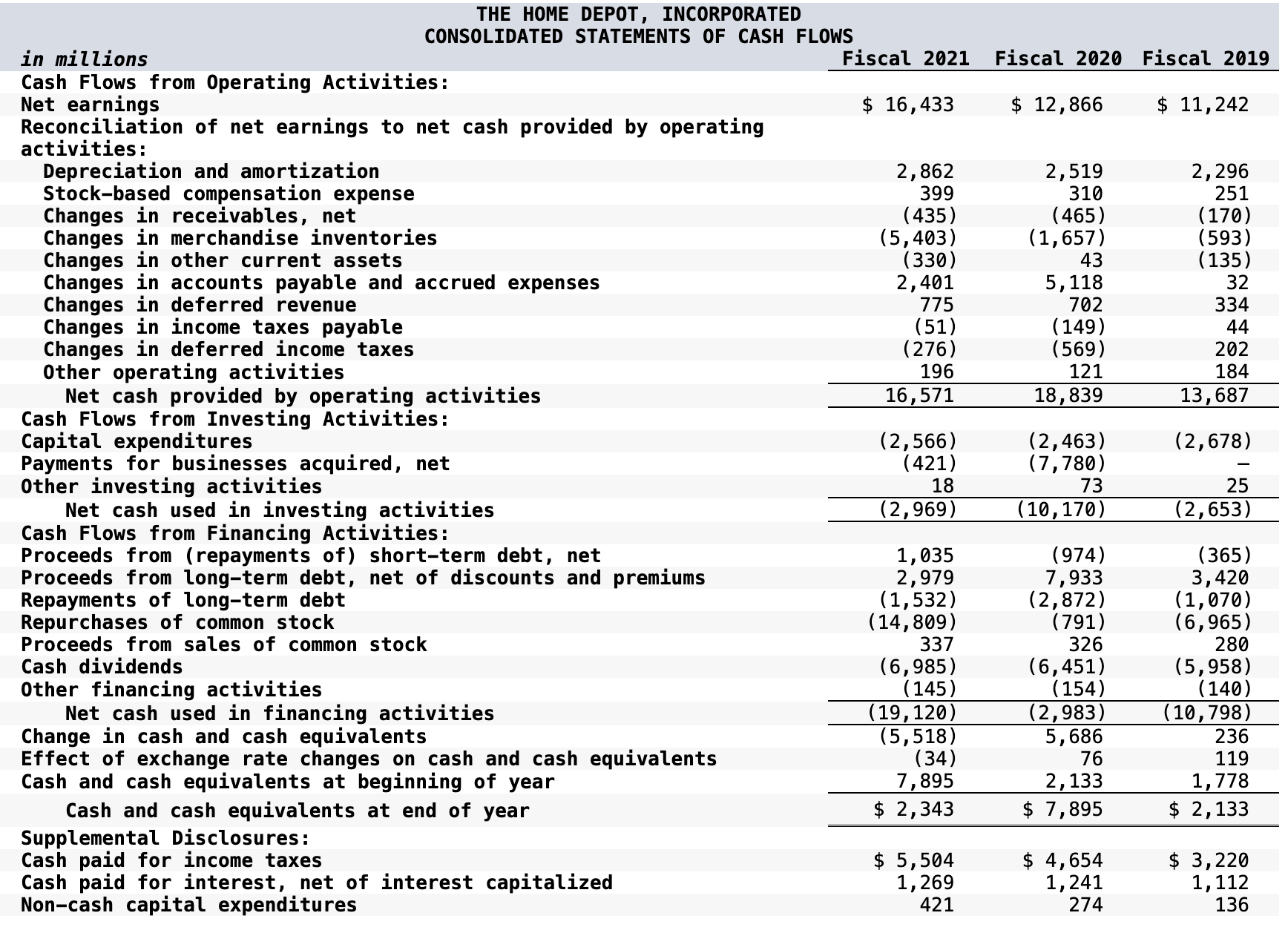

Use Home Depot's financial information in Appendix A. Required: a. Compute the ROI and EVA for the two most recent years reported. Use Net Earnings as a measure of earnings or returns and Net Property and Equipment as the invested capital base. Assume the weighted-average cost of capital is 10 percent. b. Are they improving or declining? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute the ROI and EVA for the two most recent years reported. Use Net Earnings as a measure of earnings or returns and Net Property and Equipment as the invested capital base. Assume the weighted-average cost of capital is 10 percent. Note: Do not round intermediate calculations. Enter your answers in millions rounded to the nearest whole number (i.e. $12,500,000 should be considered as $13.). Round your percentage answers to 1 decimal place (i.e., 0.123 should be considered as 12.3.). THE HOME DEPOT, INCORPORATED CONSOLIDATED BALANCE SHEETS in millions, except per share data Assets January 30, 2022 January 31, 2021 Current assets: Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease right-of-use assets Goodwill Other assets Total assets \begin{tabular}{rr} $2,343 & $7,895 \\ 3,426 & 2,992 \\ 22,068 & 16,627 \\ 1,218 & 963 \\ \hline 29,055 & 28,477 \\ \hline 25,199 & 24,705 \\ 5,968 & 5,962 \\ 7,449 & 7,126 \\ 4,205 & 4,311 \\ \hline$71,876 & $70,581 \\ \hline \hline \end{tabular} Liabilities and Stockholders' Equity Current liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Current operating lease liabilities Other accrued expenses Total current liabilities Long-term debt, excluding current installments Long-term operating lease liabilities Deferred income taxes other long-term liabilities Total liabilities Common stock, par value $0.05; authorized: 10,000 shares; issued: 1,792 shares at January 30,2022 and 1,789 shares at January 31,2021 ; outstanding: 1,035 shares at January 30 , 2022 and 1,077 shares at January 31, 2021 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 757 shares at January 30, 2022 and 712 shares at January 31, 2021 Total stockholders' (deficit) equity Total liabilities and stockholders' equity \begin{tabular}{rr} $1,035 & $ \\ 13,462 & 11,606 \\ 2,426 & 2,463 \\ 848 & 774 \\ 3,596 & 2,823 \\ 158 & 193 \\ 2,447 & 1,416 \\ 830 & 828 \\ 3,891 & 3,063 \\ \hline 28,693 & 23,166 \\ \hline 36,604 & 35,822 \\ 5,353 & 5,356 \\ 909 & 1,131 \\ 2,013 & 1,807 \\ \hline 73,572 & 67,282 \\ \hline & \\ 970 & \\ 12,132 & 89 \\ 67,580 & 11,540 \\ (704) & 58,134 \\ (80,794) & (671) \\ \hline(1,696) & (65,793) \\ \hline 71,876 & 3,299 \\ \hline \hline \end{tabular} See accompanying notes to consolidated financial statements. THE HOME DEPOT, INCORPORATED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\multicolumn{4}{|c|}{\begin{tabular}{l} in millions \\ Common Stock: \end{tabular}}} \\ \hline & & & \\ \hline Balance at beginning of year & $89 & $89 & $89 \\ \hline Shares issued under employee stock plans & 1 & - & - \\ \hline Balance at end of year & 90 & 89 & 89 \\ \hline \multicolumn{4}{|l|}{ Paid-in Capital: } \\ \hline Balance at beginning of year & 11,540 & 11,001 & 10,578 \\ \hline Shares issued under employee stock plans & 194 & 229 & 172 \\ \hline Stock-based compensation expense & 398 & 310 & 251 \\ \hline Balance at end of year & 12,132 & 11,540 & 11,001 \\ \hline \multicolumn{4}{|l|}{ Retained Earnings: } \\ \hline Balance at beginning of year & 58,134 & 51,729 & 46,423 \\ \hline Cumulative effect of accounting changes & - & - & 26 \\ \hline Net earnings & 16,433 & 12,866 & 11,242 \\ \hline \begin{tabular}{l} Cash dividends \\ Other \end{tabular} & \begin{aligned}\( (6,985) \\ (2)\end{aligned} \) & \begin{tabular}{r} (6,451) \\ (10) \end{tabular} & \begin{tabular}{r} (5,958) \\ (4) \end{tabular} \\ \hline Balance at end of year & 67,580 & 58,134 & 51,729 \\ \hline \multicolumn{4}{|l|}{ Accumulated Other Comprehensive Loss: } \\ \hline Balance at beginning of year & (671) & (739) & (772) \\ \hline Cumulative effect of accounting changes & - & - & (31) \\ \hline Foreign currency translation adjustments, net of tax & (77) & 60 & 53 \\ \hline Cash flow hedges, net of tax & 9 & 8 & 8 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Other, net of tax \\ Balance at end of year \end{tabular}} & 35 & - & 3 \\ \hline & (704) & (671) & (739) \\ \hline \multicolumn{4}{|l|}{ Treasury Stock: } \\ \hline \multicolumn{4}{|l|}{ Balance at beginning of year } \\ \hline \multirow{2}{*}{\multicolumn{4}{|c|}{\begin{tabular}{l} Repurchases of common stock \\ Balance at end of year \end{tabular}}} \\ \hline & (80,794) & (65,793) & (65,196) \\ \hline Total stockholders' (deficit) equity & $(1,696) & $3,299 & $(3,116) \\ \hline \end{tabular} THE HOME DEPOT, INCORPORATED CONSOLIDATED STATEMENTS OF CASH FLOWS \begin{tabular}{|c|c|c|c|} \hline \multirow{4}{*}{\begin{tabular}{l} in millions \\ Cash Flows from Operating Activities: \\ Net earnings \\ Reconciliation of net earnings to net cash provided by operating \\ activities: \end{tabular}} & Fiscal 2021 & Fiscal 2020 & Fiscal 2019 \\ \hline & & & \\ \hline & $16,433 & $12,866 & $11,242 \\ \hline & & & \\ \hline Depreciation and amortization & 2,862 & 2,519 & 2,296 \\ \hline Stock-based compensation expense & 399 & 310 & 251 \\ \hline Changes in receivables, net & (435) & (465) & (170) \\ \hline Changes in merchandise inventories & (5,403) & (1,657) & (593) \\ \hline Changes in other current assets & (330) & 43 & (135) \\ \hline Changes in accounts payable and accrued expenses & 2,401 & 5,118 & 32 \\ \hline Changes in deferred revenue & 775 & 702 & 334 \\ \hline Changes in income taxes payable & (51) & (149) & 44 \\ \hline Changes in deferred income taxes & (276) & (569) & 202 \\ \hline Other operating activities & 196 & 121 & 184 \\ \hline Net cash provided by operating activities & 16,571 & 18,839 & 13,687 \\ \hline Cash Flows from Investing Activities: & & & \\ \hline Capital expenditures & (2,566) & (2,463) & (2,678) \\ \hline Payments for businesses acquired, net & (421) & (7,780) & - \\ \hline other investing activities & 18 & 73 & 25 \\ \hline Net cash used in investing activities & (2,969) & (10,170) & (2,653) \\ \hline Cash Flows from Financing Activities: & & & \\ \hline Proceeds from (repayments of) short-term debt, net & 1,035 & (974) & (365) \\ \hline Proceeds from long-term debt, net of discounts and premiums & 2,979 & 7,933 & 3,420 \\ \hline Repayments of long-term debt & (1,532) & (2,872) & (1,070) \\ \hline Repurchases of common stock & (14,809) & (791) & (6,965) \\ \hline Proceeds from sales of common stock & 337 & 326 & 280 \\ \hline Cash dividends & (6,985) & (6,451) & (5,958) \\ \hline other financing activities & (145) & (154) & (140) \\ \hline Net cash used in financing activities & (19,120) & (2,983) & (10,798) \\ \hline Change in cash and cash equivalents & (5,518) & 5,686 & 236 \\ \hline Effect of exchange rate changes on cash & (34) & & 119 \\ \hline Cash and cash equivalents at beginnir & 7,895 & 2,133 & 1,778 \\ \hline Cash and cash equivalents at end of year & $2,343 & $7,895 & $2,133 \\ \hline mental & & & \\ \hline Cash paid for income taxes & $5,504 & $4,654 & $3,220 \\ \hline Cash paid for interest, net & 1,269 & 1,241 & 1,112 \\ \hline Non-cash capital expenditu & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts