Question: appendix b appendix d Ten years ago your grandfather purchased for you a 30-year $1.000 bond with a coupon rate of percent. You now wish

appendix b

appendix d

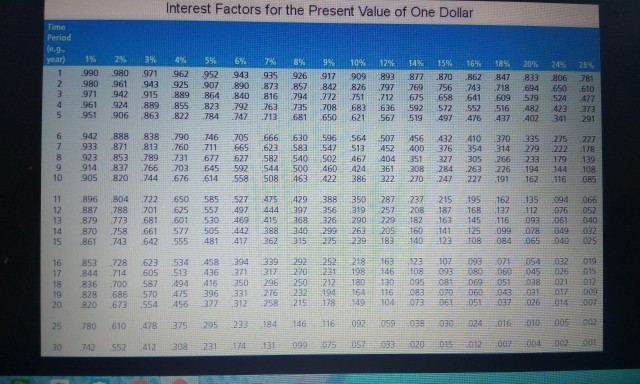

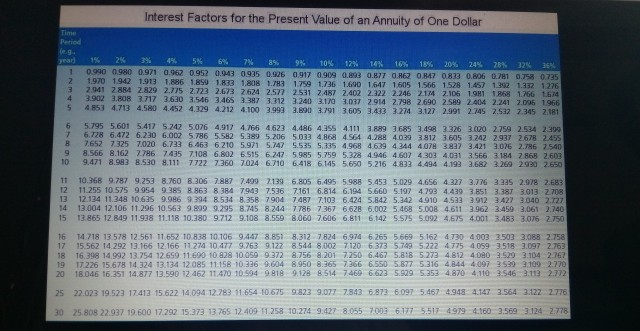

Ten years ago your grandfather purchased for you a 30-year $1.000 bond with a coupon rate of percent. You now wish to sell the bond and read that yields are percent. What price should you receive for the band Assume that the bond pays interest annually. Use Appendix Band Appendix D to answer the question. Round your answer to the nearest dollar. Interest Factors for the Present Value of One Dollar Period 10. 1% 1% 15% 168.16 :20 20180 91 92 91 99269 909 1893 SITED LATE ELET 19876191 95 911119 97 43 118 .4 L ED 1999RMB406T 51 49 594 192.15115 -708 bb Lab A233 99%9DE HEIRA) 13 ] 650 | 62 56? 54) 6 47 41 40 | LINE ?BABUTE EFF | 13: B181 TED T1165 21 ] 02:3 9 1 6 : 58: 54 09148 TEE | Fashing 60 10058194456lA8 519 463 22 EM 50 5641_1030 135 777 5 400 376354 | | - -12-17 467 0 713 -149 46] BR4 23 16941101 386-322-270-247 2, 19 16: 06 AD s]:2345 6789g ngBu % Bm % x % 11896 ) 2 ) 27549 12887-788|||||701-1625557% || 19 1380 31 ) | | 148707581661.577505 EBSTAR 2 1350 -287-237_215-195162513520943066 10 ) 1.1 TER 1177 7 290 18:16:15 16099 DE 1 F11998 198 2:10804 165 14 25 www 16853728623534458394339 6 :073 15 .. . - - - - 9. 236 ) 2 016 150 % 2 015 9 .25 E560 - 7016 - 1 6 2 220 51 55 56 37 3 75 :86-6767 780 616 478 35 2013 184 8 - 137 ) 2007 DOS 7.2 SS12308 231 31 099 33 970- 012 007 -12-01 Interest Factors for the Present Value of an Annuity of One Dollar Period year 1 Z 3 4 5 1 2 3 4 5 6 7 8% 9% 10% 12% 10% 10% 18% 20% 20% 20% 325 25 0 900 900 971 0.902 0952093 0935 096 0917 0909 0.93 08:27 OR OR OR ON 071 0.758 0725 1970 1942 1.913 1. 6 1RYO TR 1 R 1 3 1759 1.736 1.6901.647 1605 1566 1.528 1.457 1. 2 1.352 1276 2941 2 42.820 2775 2.723 2.673 2624 2577 25312467 24022222 2246 2114 2.10 10 168 1766 1674 3.902 3.BOR 3717 3630 3.546 3.465 37 712324031703077 2014 2.798 2.690 2589 2.404 2.241 7.095 1966 4 3 4 713 4.50 4.452 4.329 4.212 4100 3.993 ROD 379 3.605 3433 3.274 3127 2.991 2.145 2.512 2.345 2.181 6 7 8 9 10 5795 5.601 5.417 5242 5076 4017 4.766 4623 4.486 4.355 4.111 3 16 3.49 2 6 3020 2.759 2.534 2.390 6.728 5.472 620 602 576 552 5.305 206 5 3 4868 4564 4.2 4099 12 1653.242 2.937 2678 2455 7.652 7325 7020 6.73 6.663 6.210 5971 5.747 5535 5135 496 4629 4244 47 3827 3.421 9076 2.786 7540 8.566 8.162 7.786 7435 7108 6.802 6515 6.7475 .985 5.759 5.328 4246 4.602 4,302 4.0113,566 3 184 2 60 2603 9.471 8.9838530 111 7722 7360 7024 6.710 6418 6145 5.60 5.216 4832 4.404 4.19 3. 62 3.269 290 2.650 11 12 12 14 15 10.368 0.787 9.253 8.760 B 106 7.887 7.409 2139 6.805 6.495 5988 5.453 5.029 4.656 4.227 3.776 3.335 2.978 2.683 11.255 10.575 9 954 0 385 8863 34 7943 7536 7.161 6.814 6.194 5.660 5.1974.703 44193 St 3.387 3013 2708 12 124 11.348 10.635 906 0294 8 5348 358 7904 7.487 7.102 6.424 5.542 5.242 4910 4.5233912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.25 8.244 77857367 552 5.0025.4585 DOB 4.611 2962 3.459 2.061 2.740 13 865 12.849 11.938 11.118 10.780 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14 718 13 578 12 561 11 6 1 10.106 94478 851 8.312 7824 69746 265 566951627 4003503 30882758 17 15 562 14 292 13.166 12 166 11 274 10.477 9763 9.1228544 80027120637357952224175 40935183097 2753 18 16 398 14992 13.754 12 650 11600 10 8 1005993728.756 8201 7250 6467 5.818 5272 4812400 352 3104 2767 19 17225 15.578 1 12 120RS 11158103369604 89508765 7266655055775716 42409) 25231092770 2018.046 16 351 14877 13 500 12 462 1140 10 504981891285147460 6623 5.92957534870411035463113 2.772 25 30 22.003 19 523 17413 15 622 1409412.783 1654 10 675 0:323 9.077 7.803 673 6091 5067 0908 4.147 1564 2122 2.775 25 808 22.937 19.600 17.250 15.373 13.765 12.409 11258 10.278 9.427 8.055700361775.517 919 .160 350 3124 2778

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts