Question: Appendix B, D & C are attached! Problem 13-10 You are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate

Appendix B, D & C are attached!

Appendix B, D & C are attached!

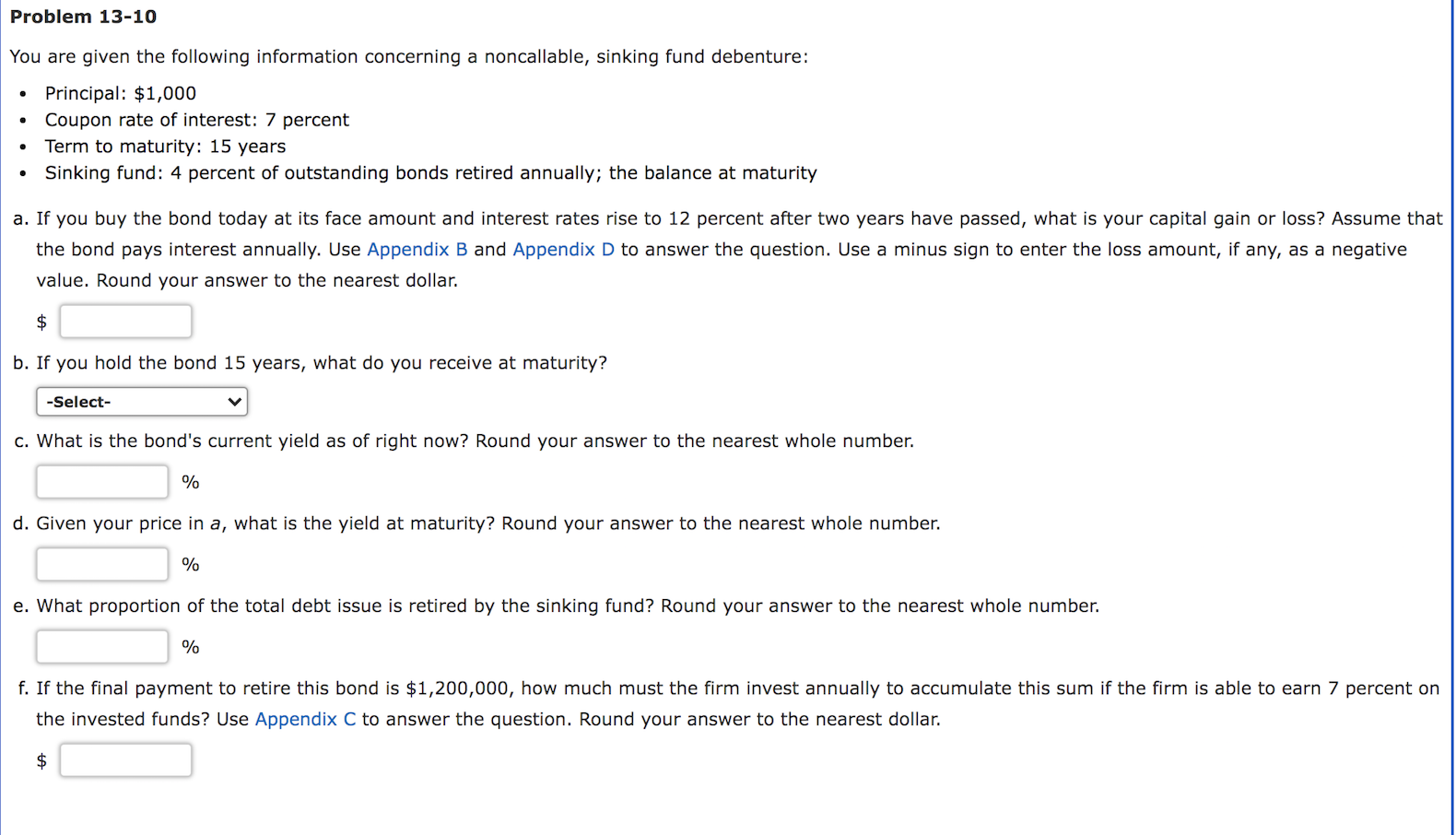

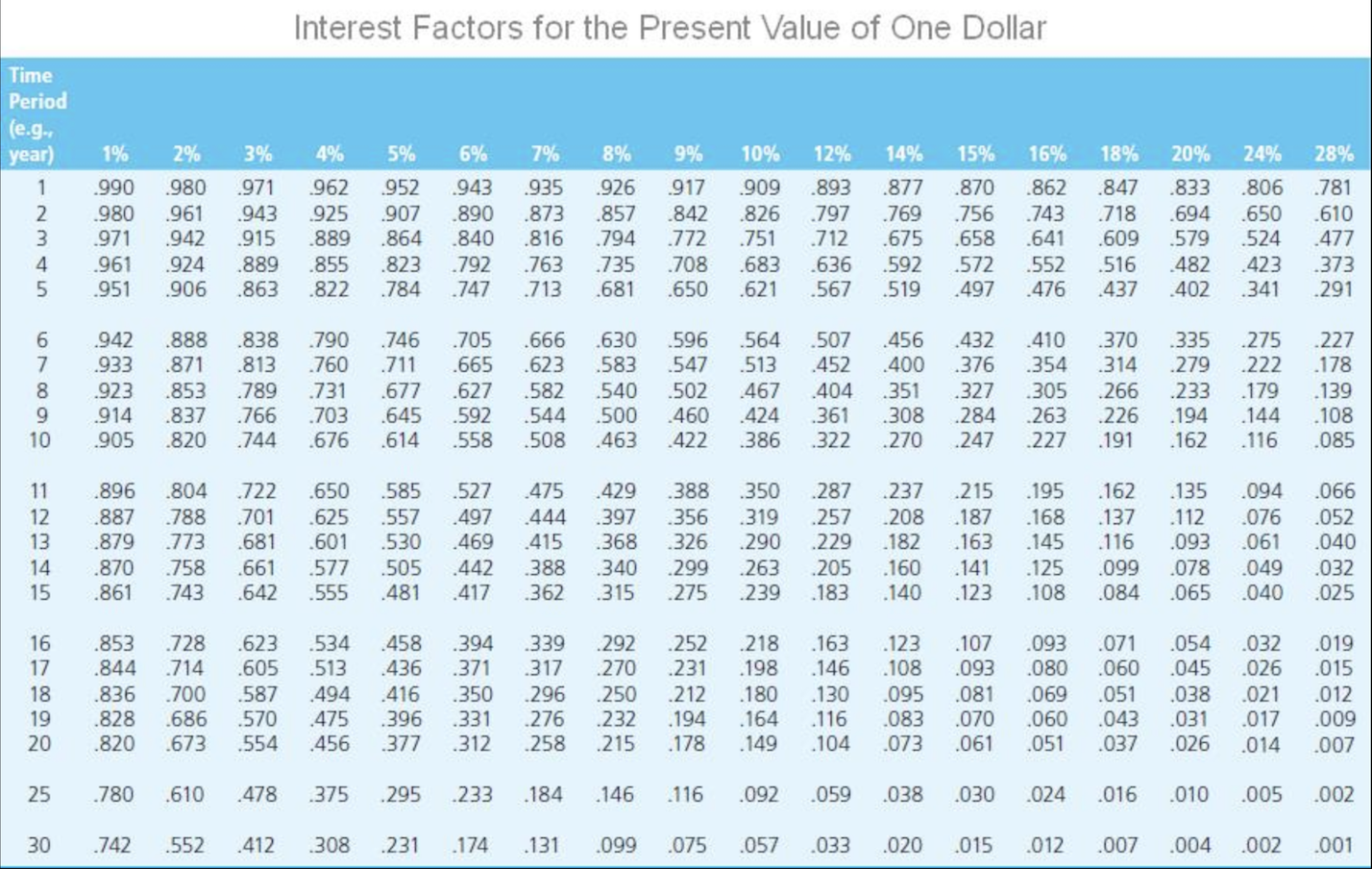

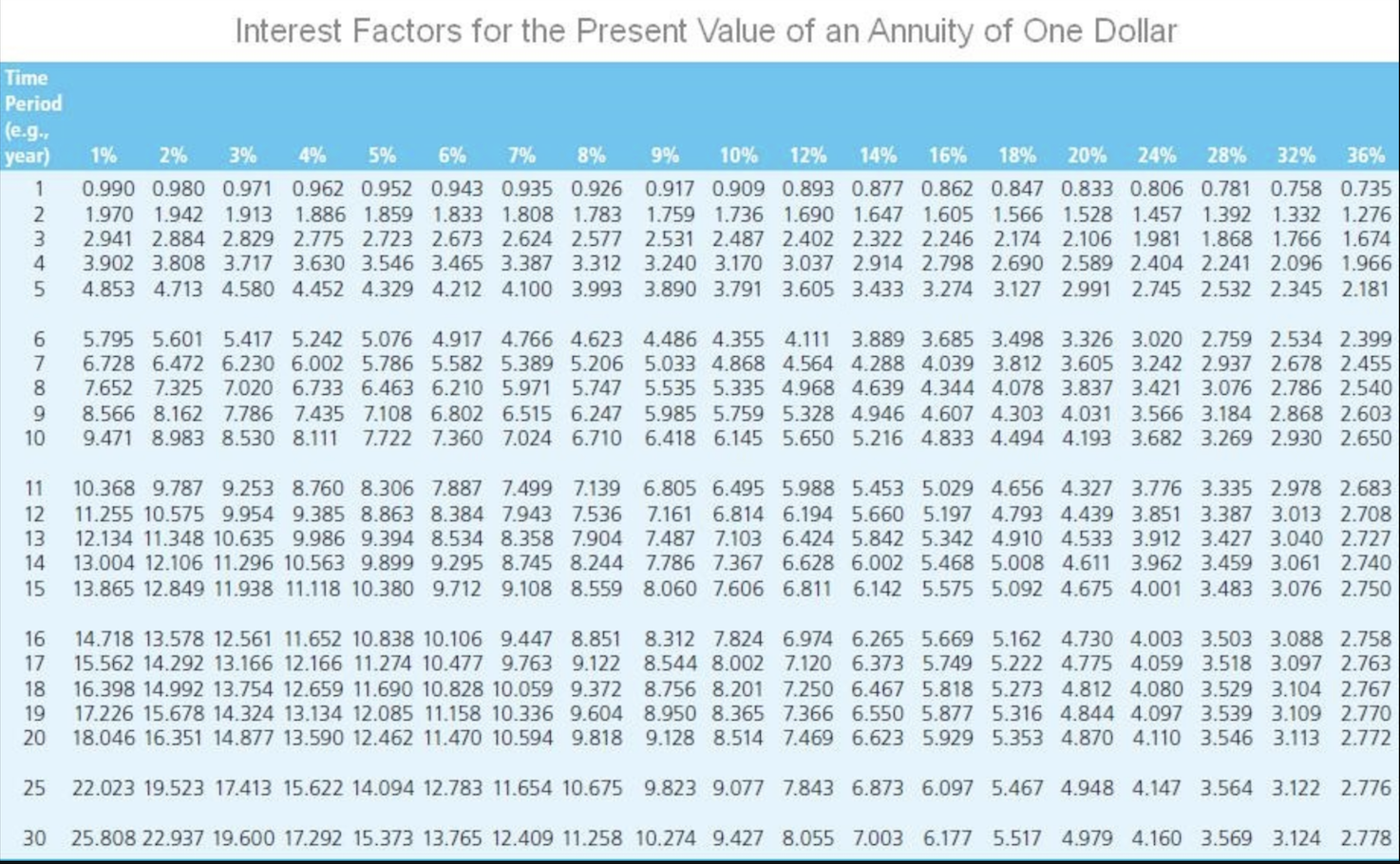

Problem 13-10 You are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 15 years Sinking fund: 4 percent of outstanding bonds retired annually; the balance at maturity . a. If you buy the bond today at its face amount and interest rates rise to 12 percent after two years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. $ b. If you hold the bond 15 years, what do you receive at maturity? -Select- c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. % d. Given your price in a, what is the yield at maturity? Round your answer to the nearest whole number. % e. What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number. % f. If the final payment to retire this bond is $1,200,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 7 percent on the invested funds? Use Appendix C to answer the question. Round your answer to the nearest dollar. $ Interest Factors for the Present Value of One Dollar Time Period (e.g. 1% 5% 6% 7% 8% 10% 12% 14% 24% year) 1 2 3 4 5 UAWN- 2% 980 1961 1942 .924 .906 990 980 971 1961 951 3% 4% .971 962 .943 .925 915 .889 .855 .863 822 952 .907 .864 .823 .784 .943 .890 .840 .792 .747 .806 .650 9% 917 .842 .772 .708 .650 .935 .873 .816 .763 .713 .926 .857 .794 .735 .681 .909 .826 .751 .683 .621 .889 15% .870 .756 .658 .572 497 .893 .797 .712 .636 .567 16% .862 .743 .641 .552 476 .877 .769 .675 .592 .519 18% .847 .718 .609 1516 437 20% .833 .694 579 482 402 28% .781 .610 .477 .373 .291 524 423 .341 6 7 8 9 10 000 942 .933 .923 .914 .905 .888 .871 .853 .837 .820 .838 .813 .789 .766 .744 .790 .760 .731 .703 .676 .746 .711 .677 .645 .614 .705 .665 .627 .592 .558 .666 .630 .623 583 1582 .540 .544 .500 .508 .463 1596 547 .502 460 422 .564 .513 467 424 .386 .507 .452 .404 361 .322 .456 .400 .351 .308 .270 432 .376 .327 .284 .247 410 .354 .305 .263 .227 .370 .314 .266 .226 .191 335 .279 .233 .194 .162 .275 .222 .179 .144 .116 .227 .178 .139 . 108 .085 .287 .257 11 12 13 14 15 .896 .887 .879 .870 .861 .804 .788 .773 .758 .743 .722 .701 .681 .661 .642 .650 .625 .601 577 .555 .585 .557 .530 .505 481 .527 .497 .469 .442 .417 475 444 415 .388 .362 429 .397 .368 .340 .315 388 1356 .326 .299 .275 .350 .319 .290 .263 .239 .229 .237 .208 .182 .160 .140 .215 .187 .163 .141 .123 .195 .168 .145 .125 .108 .162 .137 .116 .099 .084 .135 .112 .093 .078 .065 .094 .066 .076 052 .061 .040 .049 .032 .040.025 .205 .183 16 17 18 19 20 .853 .844 .836 .828 .820 .728 .714 .700 .686 .673 .623 .534 .605 513 494 .570 .475 .554 456 .587 .458 .436 416 .396 377 .394 .371 .350 .331 .312 .339 .317 .296 .276 .258 .292 .270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .163 .146 .130 .116 .104 .123 .107 .093 .108 .093 .080 .095 .081 .069 .083 .070.060 .073 .061.051 .071 .060 .051 .043 .037 .054 .045 .038 .031 .026 .032 .019 .026 015 .021 .012 .017 .009 .014 .007 25 .780 .610 .478 375 .295 .233 .184 .146 .116 .092 .059 .038 .030 .024 .016 .010 .005 .002 30 .742 .552 .412 308 .231 .174 .131 .099 .075 .057 033 .020 .015 .012 .007 .004 .002 .001 Interest Factors for the Present Value of an Annuity of One Dollar Time Period (e.g. year) 1 2 3 4 5 U AWN 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 ON 00 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778 Interest Factors for the Future Value of an Annuity of One Dollar Time Period (e.g. year) 3% 6% 14% 16% UNAWN 2 3 4. 5 1% 1.000 2.010 3.030 4.060 5.101 2% 1.000 2.020 3.060 4.122 5.204 1.000 2.030 3.091 4.184 5.309 4% 1.000 2.040 3.122 4.246 5.416 5% 1.000 2.050 3.152 4.310 5.526 1.000 2.060 3.184 4.375 5.637 7% 1.000 2.070 3.215 4.440 5.751 8% 1.000 2.080 3.246 4.506 5.867 9% 1.000 2.090 3.278 4.573 5.985 10% 1.000 2.100 3.310 4.641 6.105 12% 1.000 2.120 3.374 4.770 6.353 1.000 2.140 3.440 4.921 6.610 1.000 2.160 3.506 5.067 6.877 20% 1.000 2.200 3.640 5.368 7.442 8 9 10 0001 6.152 7.214 8.286 9.369 10.462 6.308 7.434 8.583 9.755 10.950 6.468 7.662 8.892 10.159 11.464 6.633 7.898 9.214 10.583 12.006 6.802 8.142 9.549 11.027 12.578 6.975 8.394 9.897 11.491 13.181 7.153 8.654 10.260 11.978 13.816 7.336 8.923 10.637 12.488 14.487 7.523 9.200 11.028 13.021 15.193 7.716 9.487 11.436 13.579 15.937 8.115 10.089 12.300 14.776 17.549 8.536 10.730 13.233 16.085 19.337 8.978 11.413 14.240 17.518 21.321 9.930 12.915 16.499 20.798 25.958 11 12 13 14 15 11.567 12.683 13.809 14.947 16.097 12.169 13.412 14.680 15.974 17.293 12.808 14.192 15.618 17.086 18.599 13.486 15.026 16.627 18.292 20.024 14.207 15.917 17.713 19.599 21.579 14.972 16.870 18.882 21.051 23.276 15.784 17.888 20.141 22.550 25.129 16.645 18.977 21.495 24.215 27.152 17.560 20.141 22.953 26.019 29.361 18.531 21.384 24.523 27.975 31.772 20.655 24.138 28.029 32.393 37.280 23.044 27.271 32.089 37.581 43.842 25.732 30.850 36.786 43.672 51.659 32.150 39.580 48.496 59.195 72.035 16 17 18 19 20 17.258 18.430 19.615 20.811 22.019 18.639 20.012 21.412 22.841 24.297 20.157 21.762 23.414 25.117 26.870 21.825 23.698 25.645 27.671 29.778 23.657 25.840 28.132 30.539 33.066 25.673 28.213 30.906 33.760 36.786 27.888 30.840 33.999 37.379 40.995 30.324 33.750 37.450 41.446 45.762 33.003 36.974 41.301 46.018 51.160 35.950 40.545 45.599 51.159 57.275 42.753 48.884 55.750 63.440 72.052 50.980 59.118 68.934 78.969 91.025 60.925 87.442 71.673 105.93 84.140 128.11 98.603 154.74 115.370 186.68 25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 133.33 181.87 249.210 471.98 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.283 136.308 164.494 241.333 356.878 530.310 1181.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts