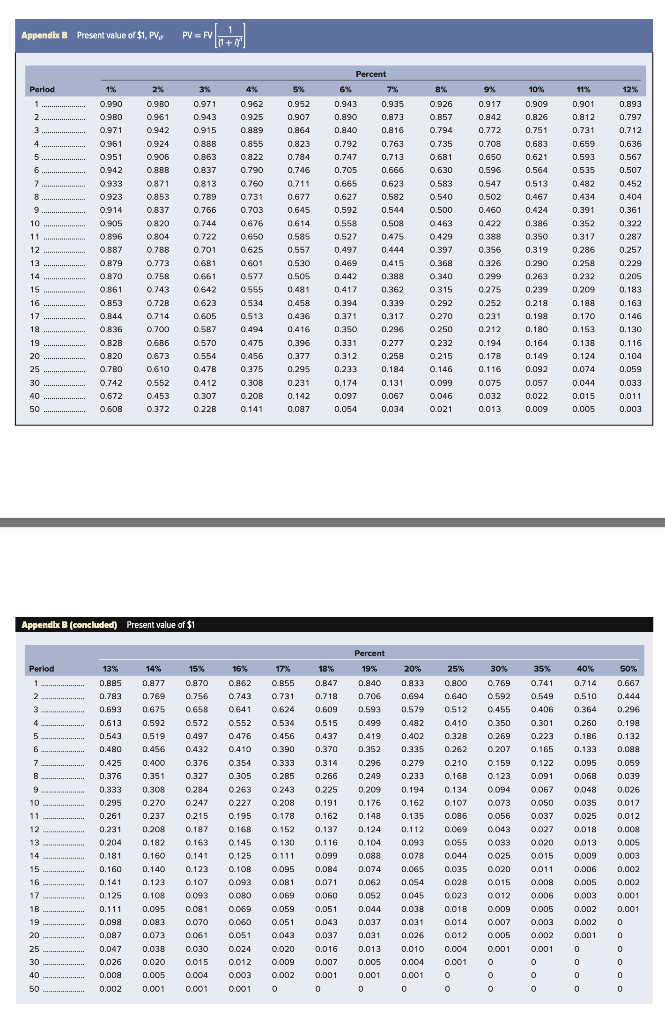

Question: Appendix B Present value of $1, PV, 1 PV = FV [11+ Percent Period 2% 3% 4% 5% 7% 8% 9% 10% 11% 12% 1

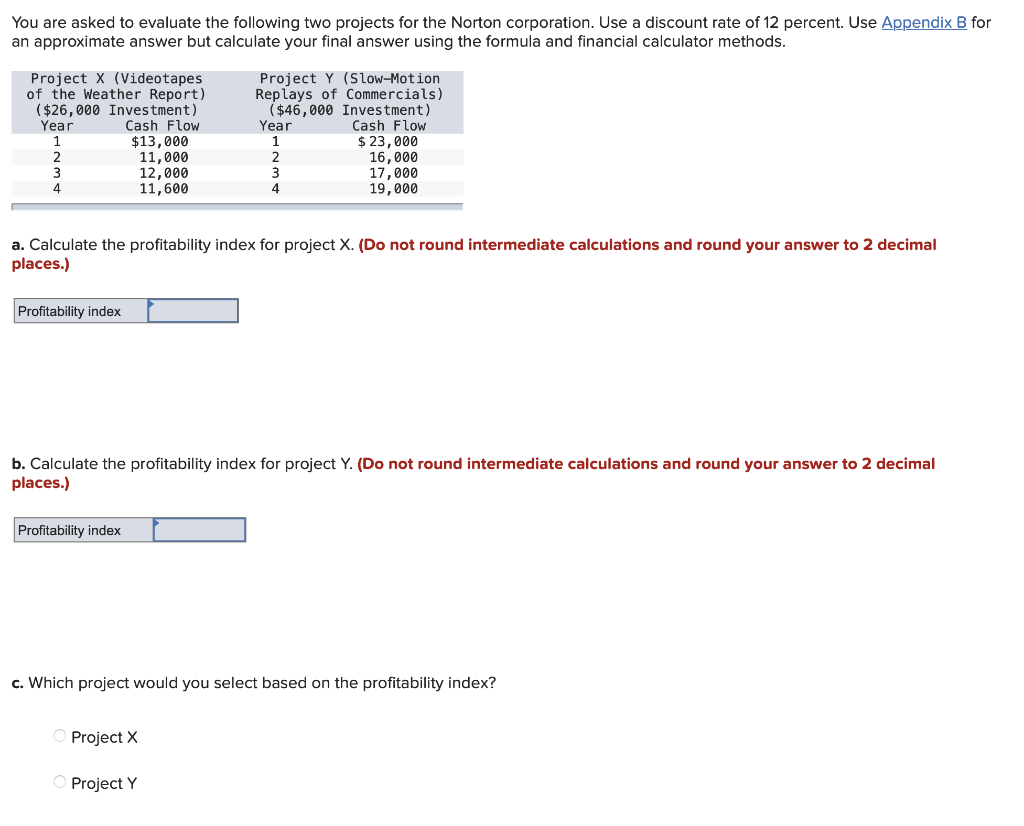

Appendix B Present value of $1, PV, 1 PV = FV [11+ Percent Period 2% 3% 4% 5% 7% 8% 9% 10% 11% 12% 1 0.990 0.900 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.900 0.961 0.943 0.925 0.907 0.890 0.873 0.B57 0.842 0.826 0.812 0.797 3 0.971 0.942 0.915 0.289 0.964 0.840 0.816 0.794 0.772 0.751 0.731 0.712 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 6 0.942 0.8BB 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7 0.933 0.871 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.813 0.789 8 0.923 0.853 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.614 0.558 0,508 0.463 0.422 0.386 0.352 0.322 11 0.896 0804 0.722 0.650 0.585 0.522 0,475 0.429 0.388 0.350 0.317 0.287 12 0.887 0.788 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.701 0.681 13 0.879 0.773 0.601 0.530 0.469 0,415 0.368 0.326 0.290 0.258 0.229 14 0.870 0.758 0.661 0.577 0.505 0,442 0.388 0.340 0.299 0.263 0.205 0.232 0.209 15 0.861 0.743 0.642 0.555 0481 0.417 0.362 0.315 0.275 0.239 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 19 0.B2B 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.20B 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.60B 0.372 0.22B 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 Appendbe B (concluded) Present value of $1 Percent Period 13% % 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.885 0.877 0.870 0.962 0.855 0.B47 0.840 0.833 0.800 0.769 0.741 0.714 0.667 2 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.640 0.592 0.549 0.510 0.444 3 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.512 0.455 0.406 0.364 0.296 0.613 0.592 0.572 0.552 0.534 0.515 0.499 0.482 0.410 0.350 0.301 0.260 0.198 5 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.328 0.269 0.222 0.186 0.132 6 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.262 0.207 0.165 0.133 0.098 7 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.210 0.159 0.122 0.095 0.059 B 0.376 0.351 0.327 0.305 0.265 0.266 0.249 0.233 0.16B 0.123 0.091 0.068 0.039 0.333 0.308 0.284 0263 0.243 0.225 0.209 0.194 0.134 0.094 0.067 0.048 0.026 10 0.295 0.270 0.247 0227 0 208 0.191 0.176 0.162 0.107 0.073 0.050 0.035 0.012 11 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.086 0.056 0.037 0.025 0.012 12 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.069 0.043 0.027 0.018 0.008 13 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.055 0.033 0.020 0.013 0.005 14 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.044 0.025 0.015 0.009 0.003 15 0.160 0.140 0.123 0.10B 0.095 0.084 0.074 0.065 0.035 0.020 0.011 0.006 0.002 16 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.028 0.015 0.008 0.005 0.002 17 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.023 0.012 0.006 0.003 0.001 1B 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.018 0.009 0.005 0.002 0.001 19 0.098 0.083 0.060 0.05 0.043 0.037 0.031 0.014 0.007 0.003 0.002 0 0.070 0.06 20 0.087 0.073 0.051 0.043 0.037 0.031 0.026 0.012 0.005 0.002 0.001 0 25 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.004 0.001 0.001 0 0 30 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.001 o 0 0 40 0.000 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0 0 o 0 0 50 0.002 0.001 0.001 0.001 0 0 0 0 O O o 0 0 You are asked to evaluate the following two projects for the Norton corporation. Use a discount rate of 12 percent. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Project X (Videotapes of the Weather Report) ($26,000 Investment) Year Cash Flow $13,000 11,000 12,000 4 11,600 Project Y (Slow-Motion Replays of Commercials) ($46,000 Investment) Year Cash Flow 1 $ 23,000 2 16,000 3 17,000 4 19,000 a. Calculate the profitability index for project X. (Do not round intermediate calculations and round your answer to 2 decimal places.) Profitability index your answer to decimal b. Calculate the profitability index for project Y. (Do not round intermediate calculations places.) Profitability index c. Which project would you select based on the profitability index? Project X Project Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts