Question: Appendix D ndont's cals N Comprehensive Problem Two Gregory and Lulu Clifden's Tax Return Gregor R. and Lulu B. Clifden live with their family at

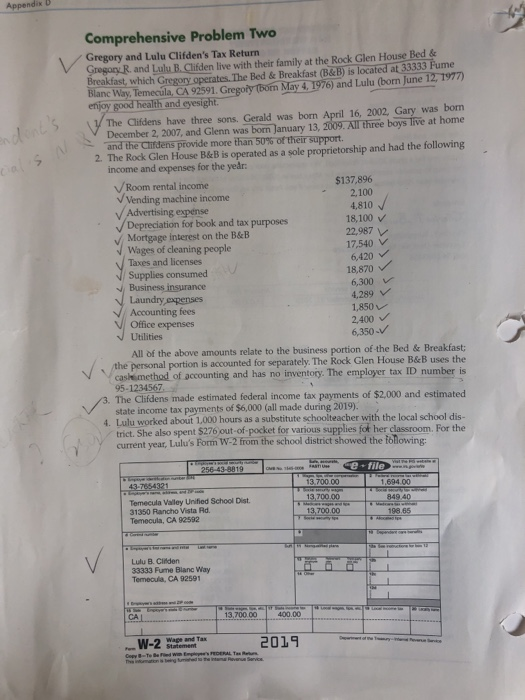

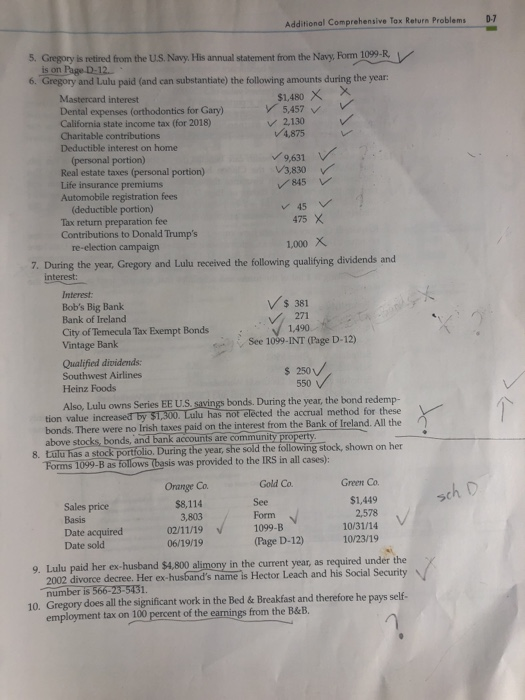

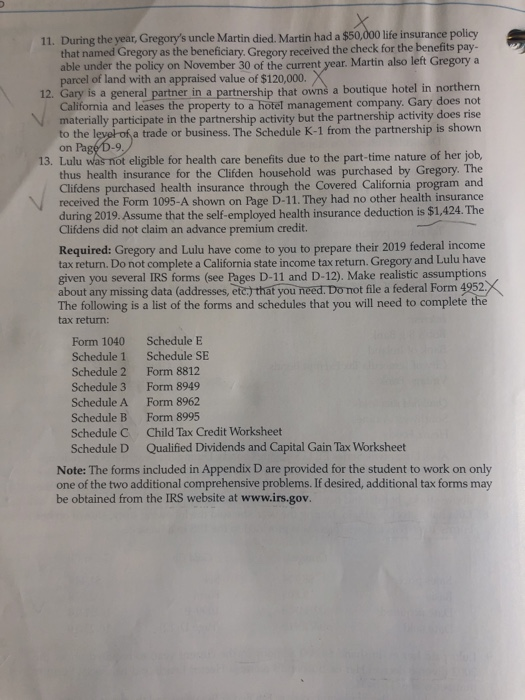

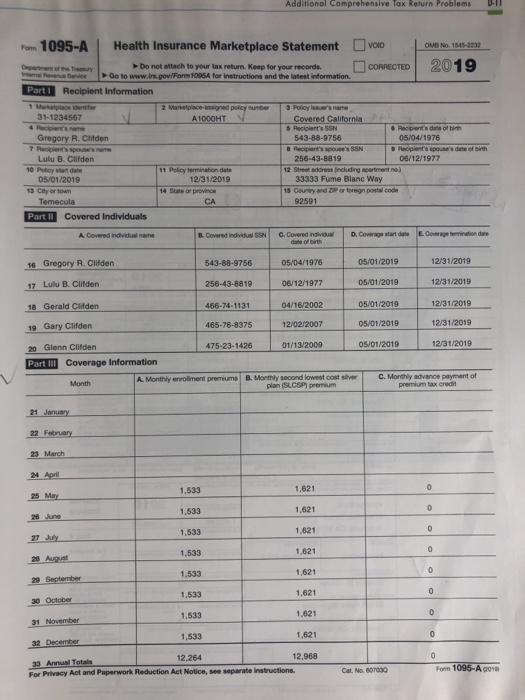

Appendix D ndont's cals N Comprehensive Problem Two Gregory and Lulu Clifden's Tax Return Gregor R. and Lulu B. Clifden live with their family at the Rock Glen House Bed & Breakfast, which Gregory operates. The Bed & Breakfast (B&B) is located at 33333 fume Blanc Way. Temecula, CA 92591. Gregory (born May 4, 1976) and Lulu (born June 12, 1977) enjoy good health and eyesight. The Clifdens have three sons. Gerald was born April 16, 2002, Gary was born December 2, 2007, and Glenn was born January 13, 2009. All three boys live at home and the Clifdens provide more than 50% of their support. 2. The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year: Room rental income $137,896 Vending machine income 2.100 Advertising expense 4,810 Depreciation for book and tax purposes 18,100 V Mortgage interest on the B&B 22.987 Wages of cleaning people 17,540 Taxes and licenses 6,420 Supplies consumed 18.870 Business insurance 6,300 V Laundry expenses 4.289 Accounting fees 1,850 Office expenses Utilities All of the above amounts relate to the business portion of the Bed & Breakfast: the personal portion is accounted for separately. The Rock Glen House B&B uses the cashe method of accounting and has no inventory. The employer tax ID number is 95-1234567 3. The Clifdens made estimated federal income tax payments of $2,000 and estimated state income tax payments of $6,000 (all made during 2019). 4. Lulu worked about 1,000 hours as a substitute schoolteacher with the local school dis- trict. She also spent $276 out-of-pocket for various supplies for her classroom. For the current year, Lulu's Form W-2 from the school district showed the following: 2,400 6,350 - file 256-43-8819 43-7654321 Temecula Valley Unified School Dist. 31350 Rancho Vista Rd. Temecula, CA 92592 13.700.00 13.700.00 13,700.00 1.694.00 849 40 198.65 1 Lulu B. Cinden 33333 Fume Blanc Way Temecula, CA 92591 CA 13,700.00 400.00 W-2 page and tak 2019 Statement Depy To BOERALT Additional Comprehensive Tax Return Problems D-7 $1,480 X X 845 1,000 X 5. Gregory is retired from the U.S. Navy. His annual statement from the Navy, Form 1099-R is on Page D-12. 6. Gregory and Lulu paid (and can substantiate the following amounts during the year: Mastercard interest Dental expenses (orthodontics for Gary) 5,457 California state income tax (for 2018) V 2.130 Charitable contributions V4,875 Deductible interest on home (personal portion) 9,631 Real estate taxes (personal portion) V3,830 Life insurance premiums Automobile registration fees (deductible portion) 45 Tax return preparation fee 475 X Contributions to Donald Trump's re-election campaign 7. During the year, Gregory and Lulu received the following qualifying dividends and interest: Interest: Bob's Big Bank V $ 381 Bank of Ireland 271 City of Temecula Tax Exempt Bonds 1,490 Vintage Bank See 1099-INT (Page D-12) Qualified dividends: Southwest Airlines Heinz Foods 550 Also, Lulu owns Series EE U.S. savings bonds. During the year, the bond redemp- tion value increased by $1,300. Lulu has not elected the accrual method for these bonds. There were no Irish taxes paid on the interest from the Bank of Ireland. All the above stocks, bonds, and bank accounts are community property. 8. Lulu has a stock portfolio. During the year, she sold the following stock, shown on her Forms 1099-B as follows (basis was provided to the IRS in all cases): Gold Co. Green Co Sales price $8,114 See $1,449 Basis 3,803 Form 2,578 Date acquired 02/11/19 1099-B 10/31/14 Date sold 06/19/19 (Page D-12) 10/23/19 $ 250 v Y Orange Co schD 9. Lulu paid her ex-husband $4,800 alimony in the current year, as required under the 2002 divorce decree. Her ex-husband's name is Hector Leach and his Social Security number is 566-23-5431. 10. Gregory does all the significant work in the Bed & Breakfast and therefore he pays self- employment tax on 100 percent of the earnings from the B&B. X 11. During the year, Gregory's uncle Martin died. Martin had a $50,000 life insurance policy that named Gregory as the beneficiary. Gregory received the check for the benefits pay- able under the policy on November 30 of the current year. Martin also left Gregory a parcel of land with an appraised value of $120,000.X 12. Gary is a general partner in a partnership that owns a boutique hotel in northern California and leases the property to a hotel management company. Gary does not materially participate in the partnership activity but the partnership activity does rise to the level of a trade or business. The Schedule K-1 from the partnership is shown on Pago D-9 13. Lulu was not eligible for health care benefits due to the part-time nature of her job, thus health insurance for the Clifden household was purchased by Gregory. The Clifdens purchased health insurance through the Covered California program and received the Form 1095-A shown on Page D-11. They had no other health insurance during 2019. Assume that the self-employed health insurance deduction is $1,424. The Clifdens did not claim an advance premium credit. Required: Gregory and Lulu have come to you to prepare their 2019 federal income tax return. Do not complete a California state income tax return. Gregory and Lulu have given you several IRS forms (see Pages D-11 and D-12). Make realistic assumptions about any missing data (addresses, etc.) that you need. Do not file a federal Form 4952.X The following is a list of the forms and schedules that you will need to complete the tax return: Form 1040 Schedule E Schedule 1 Schedule SE Schedule 2 Form 8812 Schedule 3 Form 8949 Schedule A Form 8962 Schedule B Form 8995 Schedule C Child Tax Credit Worksheet Schedule D Qualified Dividends and Capital Gain Tax Worksheet Note: The forms included in Appendix D are provided for the student to work on only one of the two additional comprehensive problems. If desired, additional tax forms may be obtained from the IRS website at www.irs.gov. Additional Comprehensive Tax Return Problems DAT! Tom 1095-A Health Insurance Marketplace Statement VOID OMB No. 1545-2232 2019 Do not attach to your tax return. Keep for your records. CORRECTED Go to www.irs.govi Form 1095A for instructions and the latest Information Part Recipient Information 1 Marketplace dete 2 Manatico-assigned policy number 3 Policy issuer's name 31-1234567 A1000HT Covered California 5 Recipient's SSN Recipient's date of bir Gregory R. Clifden 543-88-9756 05/04/1976 7 Recipient's spouse's name 8 Recipient's spouse's SSN Recipients se's date of birth Lulu B. Clifden 256-43-8819 06/12/1977 10 Policy start date 11 Policy termination date 12 Street address including spartment 05/01/2019 12/31/2019 33333 Fume Blanc Way 13 City or town 14 State of province 15 Country and ZIP or foreign postal code Temecula CA 92591 Part II Covered Individuals A Covered individual name B. Covered individuals C. Covered individu D. Coverage are E. Coverage lendale 16 Gregory R. Clifden 543-88-9756 05/04/1976 05/01/2019 12/31/2019 17 Lulu B. Clifden 256-43-8819 06/12/1977 05/01/2019 12/31/2019 18 Gerald Clifden 466-74-1131 04/16/2002 05/01/2019 12/31/2019 465-76-8375 19 Gary Clifden 12/02/2007 05/01/2019 12/31/2019 20 Glenn Clifden 475-23-1426 01/13/2009 OS/01/2019 12/31/2019 Part III Coverage Information Month A Monthly enrollment premiums 8. Monthly second lowest cost silver C. Monthly advance payment of plan (SLCSP) premium premium tax credit 21 January 22 February 23 March 24 April 1,533 1,621 0 25 May 1.533 1,621 0 26 June 1,533 1.621 0 27 July 1,533 1,621 0 28 August 1,533 1,621 0 29 September 1,533 1,621 0 30 October 1,533 1,621 0 21 November 1,533 1,621 0 December 0 33 Annual Total 12,264 12,968 For Privacy Act and Paperwork Reduction Act Notice, se separate instructions. Cat. No. 607000 Form 1095-A 01 D-12 Appendix D CORRECT checked 14,545.00 2019 Dibution from Retirementar Prochaingan IRAR, Insurance Contracts United States Navy Retired Benefits Center Cleveland, OH 43267 14,545.00 1000R Copy Report this Income on your federal tax form shows federal income bax 4, with this copy to 543-88-9765 1.487.12 Identifica aerea S Number Gregory R. Clifden Song) The information is 33333 Fume Blanc Way Temecula, CA 92591 10 cm 11 FATA 350.00 CA 14,545.00 12 4 y dib? 55 Lowe 16 of cry CORRECTED checked MERE Proceeds From Broker and Transactions Bear Stearns 269 Wall Street New York, NY 10001 Deco0 Gold Company Common 03/27/2019 09/18/2019 12,100.00 14.188.00 Copy For Rent 11-4396782 256-43-8819 Lulu B. Cliden The important 33333 Fume Blanc Way Temecula, CA 92591 5 Kamp for your records CORRECTED checked 2019 | | | Interest Income Vintage Bank 6792 Main Street Temecula, CA 92591 1,403.80 For 1090-INT NOPOST 543-88-9756 Copy For Recent Honda 96-8724390 om v Gregory R. Clifden 33333 Fume Blanc Way Temecula, CA 92591 TATOA fondo or your record Additional Comprehensive Tax Return Problems D-9 2019 151119 Amended 1 OMB No 1545-0123 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items Ordinary business income 15 Credits 1 Schedule K-1 (Form 1065) Department of the Tre mal Revenue Service Forcadw year 2018 being 2019 anding Partner's Share of Income, Deductions, Credits, etc. Bee back of form and parte intructions Part 1 Information About the Partnership A Proyer robe 11-234212 Partnership's name, and ZIP code Wine Acres Partner 581 Coombs Street, Napa, CA 94559 12V 2019 BIO.NO FILE Part II Information About the Partner Purtrar's drying sumber Donate TIN of a disregarded entity See Instructions) 543-609756 F Partner's name, adresse ZIP code Gregory R. Cliden 33333 Fume Blanc Way, Temecula, CA 92591 Quiddende de Dividend equivalents There 7 Royale . Net short-term capital gain Tarpt income and nordeductible expenses Netlong-term captain (900) Collectibles 28 ginom 11 Unrecaptured section 1250 gain 3 General partner or LLC Umited partner or other LLC membranager Domestic partner Disregarded entity Name of beneficial owner What type of any partner individual this partur arrement plan (SEP), check here Puter's we of proto, and capital intruction Being Ending 2 2% LOG 2 % 2% 2 2 Check it decrease is due to ale or exchange of partnership interest 2 Notection 1231 gain 19 Distribution A 11 One income 400 20 Other information 12 Section 1 deduction Partners are ofte Z 1,578 Beginning 4,679 Ending 4,679 13 Other deductions 5 Noncours Qualified norecourse S 5 $ Recourse L 14 Selemployment Gaming 1,578 Partner's Capital Account Analysis Tax Basis Capital Beginning capital account $. 13256 Capital contributed during the year $ 0 Current year net income $ 690 Other reach plantor Withdrawal distributions $ 400 Ending capital out 13.546 More than one for purposes 22 More than one y forvetty purposes "See attached statement for additional Information M Did the partner contribute property with a built-in gain oro? Yes Yes attachment. See Instructions N Partner's Share of Net Unrecognized Section 704 Gain or Lo Beginning Ending For Paperwork Reduction Act Notice, see Instructions for Form 1056 www.insgow For 1086 For IRS Use Only Cat No. 11394 Schedule 1 Form 1068 2019 Appendix D ndont's cals N Comprehensive Problem Two Gregory and Lulu Clifden's Tax Return Gregor R. and Lulu B. Clifden live with their family at the Rock Glen House Bed & Breakfast, which Gregory operates. The Bed & Breakfast (B&B) is located at 33333 fume Blanc Way. Temecula, CA 92591. Gregory (born May 4, 1976) and Lulu (born June 12, 1977) enjoy good health and eyesight. The Clifdens have three sons. Gerald was born April 16, 2002, Gary was born December 2, 2007, and Glenn was born January 13, 2009. All three boys live at home and the Clifdens provide more than 50% of their support. 2. The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year: Room rental income $137,896 Vending machine income 2.100 Advertising expense 4,810 Depreciation for book and tax purposes 18,100 V Mortgage interest on the B&B 22.987 Wages of cleaning people 17,540 Taxes and licenses 6,420 Supplies consumed 18.870 Business insurance 6,300 V Laundry expenses 4.289 Accounting fees 1,850 Office expenses Utilities All of the above amounts relate to the business portion of the Bed & Breakfast: the personal portion is accounted for separately. The Rock Glen House B&B uses the cashe method of accounting and has no inventory. The employer tax ID number is 95-1234567 3. The Clifdens made estimated federal income tax payments of $2,000 and estimated state income tax payments of $6,000 (all made during 2019). 4. Lulu worked about 1,000 hours as a substitute schoolteacher with the local school dis- trict. She also spent $276 out-of-pocket for various supplies for her classroom. For the current year, Lulu's Form W-2 from the school district showed the following: 2,400 6,350 - file 256-43-8819 43-7654321 Temecula Valley Unified School Dist. 31350 Rancho Vista Rd. Temecula, CA 92592 13.700.00 13.700.00 13,700.00 1.694.00 849 40 198.65 1 Lulu B. Cinden 33333 Fume Blanc Way Temecula, CA 92591 CA 13,700.00 400.00 W-2 page and tak 2019 Statement Depy To BOERALT Additional Comprehensive Tax Return Problems D-7 $1,480 X X 845 1,000 X 5. Gregory is retired from the U.S. Navy. His annual statement from the Navy, Form 1099-R is on Page D-12. 6. Gregory and Lulu paid (and can substantiate the following amounts during the year: Mastercard interest Dental expenses (orthodontics for Gary) 5,457 California state income tax (for 2018) V 2.130 Charitable contributions V4,875 Deductible interest on home (personal portion) 9,631 Real estate taxes (personal portion) V3,830 Life insurance premiums Automobile registration fees (deductible portion) 45 Tax return preparation fee 475 X Contributions to Donald Trump's re-election campaign 7. During the year, Gregory and Lulu received the following qualifying dividends and interest: Interest: Bob's Big Bank V $ 381 Bank of Ireland 271 City of Temecula Tax Exempt Bonds 1,490 Vintage Bank See 1099-INT (Page D-12) Qualified dividends: Southwest Airlines Heinz Foods 550 Also, Lulu owns Series EE U.S. savings bonds. During the year, the bond redemp- tion value increased by $1,300. Lulu has not elected the accrual method for these bonds. There were no Irish taxes paid on the interest from the Bank of Ireland. All the above stocks, bonds, and bank accounts are community property. 8. Lulu has a stock portfolio. During the year, she sold the following stock, shown on her Forms 1099-B as follows (basis was provided to the IRS in all cases): Gold Co. Green Co Sales price $8,114 See $1,449 Basis 3,803 Form 2,578 Date acquired 02/11/19 1099-B 10/31/14 Date sold 06/19/19 (Page D-12) 10/23/19 $ 250 v Y Orange Co schD 9. Lulu paid her ex-husband $4,800 alimony in the current year, as required under the 2002 divorce decree. Her ex-husband's name is Hector Leach and his Social Security number is 566-23-5431. 10. Gregory does all the significant work in the Bed & Breakfast and therefore he pays self- employment tax on 100 percent of the earnings from the B&B. X 11. During the year, Gregory's uncle Martin died. Martin had a $50,000 life insurance policy that named Gregory as the beneficiary. Gregory received the check for the benefits pay- able under the policy on November 30 of the current year. Martin also left Gregory a parcel of land with an appraised value of $120,000.X 12. Gary is a general partner in a partnership that owns a boutique hotel in northern California and leases the property to a hotel management company. Gary does not materially participate in the partnership activity but the partnership activity does rise to the level of a trade or business. The Schedule K-1 from the partnership is shown on Pago D-9 13. Lulu was not eligible for health care benefits due to the part-time nature of her job, thus health insurance for the Clifden household was purchased by Gregory. The Clifdens purchased health insurance through the Covered California program and received the Form 1095-A shown on Page D-11. They had no other health insurance during 2019. Assume that the self-employed health insurance deduction is $1,424. The Clifdens did not claim an advance premium credit. Required: Gregory and Lulu have come to you to prepare their 2019 federal income tax return. Do not complete a California state income tax return. Gregory and Lulu have given you several IRS forms (see Pages D-11 and D-12). Make realistic assumptions about any missing data (addresses, etc.) that you need. Do not file a federal Form 4952.X The following is a list of the forms and schedules that you will need to complete the tax return: Form 1040 Schedule E Schedule 1 Schedule SE Schedule 2 Form 8812 Schedule 3 Form 8949 Schedule A Form 8962 Schedule B Form 8995 Schedule C Child Tax Credit Worksheet Schedule D Qualified Dividends and Capital Gain Tax Worksheet Note: The forms included in Appendix D are provided for the student to work on only one of the two additional comprehensive problems. If desired, additional tax forms may be obtained from the IRS website at www.irs.gov. Additional Comprehensive Tax Return Problems DAT! Tom 1095-A Health Insurance Marketplace Statement VOID OMB No. 1545-2232 2019 Do not attach to your tax return. Keep for your records. CORRECTED Go to www.irs.govi Form 1095A for instructions and the latest Information Part Recipient Information 1 Marketplace dete 2 Manatico-assigned policy number 3 Policy issuer's name 31-1234567 A1000HT Covered California 5 Recipient's SSN Recipient's date of bir Gregory R. Clifden 543-88-9756 05/04/1976 7 Recipient's spouse's name 8 Recipient's spouse's SSN Recipients se's date of birth Lulu B. Clifden 256-43-8819 06/12/1977 10 Policy start date 11 Policy termination date 12 Street address including spartment 05/01/2019 12/31/2019 33333 Fume Blanc Way 13 City or town 14 State of province 15 Country and ZIP or foreign postal code Temecula CA 92591 Part II Covered Individuals A Covered individual name B. Covered individuals C. Covered individu D. Coverage are E. Coverage lendale 16 Gregory R. Clifden 543-88-9756 05/04/1976 05/01/2019 12/31/2019 17 Lulu B. Clifden 256-43-8819 06/12/1977 05/01/2019 12/31/2019 18 Gerald Clifden 466-74-1131 04/16/2002 05/01/2019 12/31/2019 465-76-8375 19 Gary Clifden 12/02/2007 05/01/2019 12/31/2019 20 Glenn Clifden 475-23-1426 01/13/2009 OS/01/2019 12/31/2019 Part III Coverage Information Month A Monthly enrollment premiums 8. Monthly second lowest cost silver C. Monthly advance payment of plan (SLCSP) premium premium tax credit 21 January 22 February 23 March 24 April 1,533 1,621 0 25 May 1.533 1,621 0 26 June 1,533 1.621 0 27 July 1,533 1,621 0 28 August 1,533 1,621 0 29 September 1,533 1,621 0 30 October 1,533 1,621 0 21 November 1,533 1,621 0 December 0 33 Annual Total 12,264 12,968 For Privacy Act and Paperwork Reduction Act Notice, se separate instructions. Cat. No. 607000 Form 1095-A 01 D-12 Appendix D CORRECT checked 14,545.00 2019 Dibution from Retirementar Prochaingan IRAR, Insurance Contracts United States Navy Retired Benefits Center Cleveland, OH 43267 14,545.00 1000R Copy Report this Income on your federal tax form shows federal income bax 4, with this copy to 543-88-9765 1.487.12 Identifica aerea S Number Gregory R. Clifden Song) The information is 33333 Fume Blanc Way Temecula, CA 92591 10 cm 11 FATA 350.00 CA 14,545.00 12 4 y dib? 55 Lowe 16 of cry CORRECTED checked MERE Proceeds From Broker and Transactions Bear Stearns 269 Wall Street New York, NY 10001 Deco0 Gold Company Common 03/27/2019 09/18/2019 12,100.00 14.188.00 Copy For Rent 11-4396782 256-43-8819 Lulu B. Cliden The important 33333 Fume Blanc Way Temecula, CA 92591 5 Kamp for your records CORRECTED checked 2019 | | | Interest Income Vintage Bank 6792 Main Street Temecula, CA 92591 1,403.80 For 1090-INT NOPOST 543-88-9756 Copy For Recent Honda 96-8724390 om v Gregory R. Clifden 33333 Fume Blanc Way Temecula, CA 92591 TATOA fondo or your record Additional Comprehensive Tax Return Problems D-9 2019 151119 Amended 1 OMB No 1545-0123 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items Ordinary business income 15 Credits 1 Schedule K-1 (Form 1065) Department of the Tre mal Revenue Service Forcadw year 2018 being 2019 anding Partner's Share of Income, Deductions, Credits, etc. Bee back of form and parte intructions Part 1 Information About the Partnership A Proyer robe 11-234212 Partnership's name, and ZIP code Wine Acres Partner 581 Coombs Street, Napa, CA 94559 12V 2019 BIO.NO FILE Part II Information About the Partner Purtrar's drying sumber Donate TIN of a disregarded entity See Instructions) 543-609756 F Partner's name, adresse ZIP code Gregory R. Cliden 33333 Fume Blanc Way, Temecula, CA 92591 Quiddende de Dividend equivalents There 7 Royale . Net short-term capital gain Tarpt income and nordeductible expenses Netlong-term captain (900) Collectibles 28 ginom 11 Unrecaptured section 1250 gain 3 General partner or LLC Umited partner or other LLC membranager Domestic partner Disregarded entity Name of beneficial owner What type of any partner individual this partur arrement plan (SEP), check here Puter's we of proto, and capital intruction Being Ending 2 2% LOG 2 % 2% 2 2 Check it decrease is due to ale or exchange of partnership interest 2 Notection 1231 gain 19 Distribution A 11 One income 400 20 Other information 12 Section 1 deduction Partners are ofte Z 1,578 Beginning 4,679 Ending 4,679 13 Other deductions 5 Noncours Qualified norecourse S 5 $ Recourse L 14 Selemployment Gaming 1,578 Partner's Capital Account Analysis Tax Basis Capital Beginning capital account $. 13256 Capital contributed during the year $ 0 Current year net income $ 690 Other reach plantor Withdrawal distributions $ 400 Ending capital out 13.546 More than one for purposes 22 More than one y forvetty purposes "See attached statement for additional Information M Did the partner contribute property with a built-in gain oro? Yes Yes attachment. See Instructions N Partner's Share of Net Unrecognized Section 704 Gain or Lo Beginning Ending For Paperwork Reduction Act Notice, see Instructions for Form 1056 www.insgow For 1086 For IRS Use Only Cat No. 11394 Schedule 1 Form 1068 2019

Step by Step Solution

There are 3 Steps involved in it

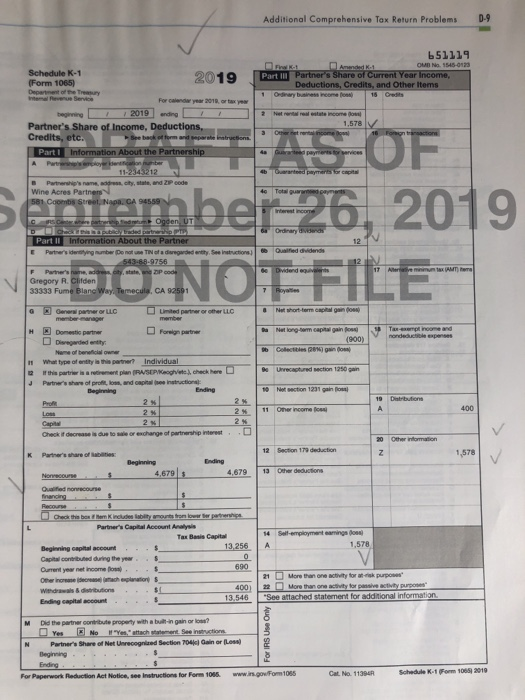

Get step-by-step solutions from verified subject matter experts