Question: Appendix E Specimen Financial Statements: Walmart Inc. The following are Walmart Inc. s financial statements as presented in the companys annual report for the year

Appendix E Specimen Financial Statements: Walmart Inc.

The following are Walmart Inc.s financial statements as presented in the companys annual report for the year ended January 31, 2021. The complete annual report, including notes to the financial statements, is available at the companys website.

| Walmart Inc. Consolidated Statements of Income (Amounts in millions, except per share data) | ||||||

| Fiscal Years Ended January 31, | ||||||

| 2021 | 2020 | 2019 | ||||

| Revenues: | ||||||

| Net sales | $555,233 | $519,926 | $510,329 | |||

| Membership and other income | 3,918 | 4,038 | 4,076 | |||

| Total revenues | 559,151 | 523,964 | 514,405 | |||

| Costs and expenses: | ||||||

| Cost of sales | 420,315 | 394,605 | 385,301 | |||

| Operating, selling, general and administrative expenses | 116,288 | 108,791 | 107,147 | |||

| Operating income | 22,548 | 20,568 | 21,957 | |||

| Interest: | ||||||

| Debt | 1,976 | 2,262 | 1,975 | |||

| Finance, capital lease and financing obligations | 339 | 337 | 371 | |||

| Interest income | (121) | (189) | (217) | |||

| Interest, net | 2,194 | 2,410 | 2,129 | |||

| Other (gains) and losses | (210) | (1,958) | 8,368 | |||

| Income before income taxes | 20,564 | 20,116 | 11,460 | |||

| Provision for income taxes | 6,858 | 4,915 | 4,281 | |||

| Consolidated net income | 13,706 | 15,201 | 7,179 | |||

| Consolidated net income attributable to noncontrolling interest | (196) | (320) | (509) | |||

| Consolidated net income attributable to Walmart | $13,510 | $14,881 | $6,670 | |||

| Net income per common share: | ||||||

| Basic net income per common share attributable to Walmart | $4.77 | $5.22 | $2.28 | |||

| Diluted net income per common share attributable to Walmart | 4.75 | 5.19 | 2.26 | |||

| Weighted-average common shares outstanding: | ||||||

| Basic | 2,831 | 2,850 | 2,929 | |||

| Diluted | 2,847 | 2,868 | 2,945 | |||

| Dividends declared per common share | $2.16 | $2.12 | $2.08 | |||

See accompanying notes.

| Walmart Inc. Consolidated Statements of Comprehensive Income (Amounts in millions) | ||||||||

| Fiscal Years Ended January 31, | ||||||||

| 2021 | 2020 | 2019 | ||||||

| Consolidated net income | $13,706 | $15,201 | $7,179 | |||||

| Consolidated net income attributable to noncontrolling interest | (196) | (320) | (509) | |||||

| Consolidated net income attributable to Walmart | 13,510 | 14,881 | 6,670 | |||||

| Other comprehensive income (loss), net of income taxes | ||||||||

| Currency translation and other | 842 | 286 | (226) | |||||

| Net investment hedges | (221) | 122 | 272 | |||||

| Cash flow hedges | 235 | (399) | (290) | |||||

| Minimum pension liability | (30) | (1,244) | 131 | |||||

| Other comprehensive income (loss), net of income taxes | 826 | (1,235) | (113) | |||||

| Other comprehensive (income) loss attributable to noncontrolling interest | 213 | (28) | 188 | |||||

| Other comprehensive income (loss) attributable to Walmart | 1,039 | (1,263) | 75 | |||||

| Comprehensive income, net of income taxes | 14,532 | 13,966 | 7,066 | |||||

| Comprehensive (income) loss attributable to noncontrolling interest | 17 | (348) | (321) | |||||

| Comprehensive income attributable to Walmart | $14,549 | $13,618 | $6,745 | |||||

See accompanying notes.

| Walmart Inc. Consolidated Balance Sheets (Amounts in millions) | ||||

| As of January 31, | ||||

| 2021 | 2020 | |||

| ASSETS | ||||

| Current assets: | ||||

| Cash and cash equivalents | $17,741 | $9,465 | ||

| Receivables, net | 6,516 | 6,284 | ||

| Inventories | 44,949 | 44,435 | ||

| Prepaid expenses and other | 20,861 | 1,622 | ||

| Total current assets | 90,067 | 61,806 | ||

| Property and equipment, net | 92,201 | 105,208 | ||

| Operating lease right-of-use assets | 13,642 | 17,424 | ||

| Finance lease right-of-use assets, net | 4,005 | 4,417 | ||

| Goodwill | 28,983 | 31,073 | ||

| Other long-term assets | 23,598 | 16,567 | ||

| Total assets | $252,496 | $236,495 | ||

| LIABILITIES AND EQUITY | ||||

| Current liabilities: | ||||

| Short-term borrowings | $ 224 | $575 | ||

| Accounts payable | 49,141 | 46,973 | ||

| Accrued liabilities | 37,966 | 22,296 | ||

| Accrued income taxes | 242 | 280 | ||

| Long-term debt due within one year | 3,115 | 5,362 | ||

| Operating lease obligations due within one year | 1,466 | 1,793 | ||

| Finance lease obligations due within one year | 491 | 511 | ||

| Total current liabilities | 92,645 | 77,790 | ||

| Long-term debt | 41,194 | 43,714 | ||

| Long-term operating lease obligations | 12,909 | 16,171 | ||

| Long-term finance lease obligations | 3,847 | 4,307 | ||

| Deferred income taxes and other | 14,370 | 12,961 | ||

| Commitments and contingencies | ||||

| Equity: | ||||

| Common stock | 282 | 284 | ||

| Capital in excess of par value | 3,646 | 3,247 | ||

| Retained earnings | 88,763 | 83,943 | ||

| Accumulated other comprehensive loss | (11,766) | (12,805) | ||

| Total Walmart shareholders equity | 80,925 | 74,669 | ||

| Noncontrolling interest | 6,606 | 6,883 | ||

| Total equity | 87,531 | 81,552 | ||

| Total liabilities and equity | $252,496 | $236,495 | ||

See accompanying notes.

| Walmart Inc. Consolidated Statements of Shareholders Equity (Amounts in millions) | ||||||||||||||||

| Common Stock | Capital in Excess of Par Value | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total Walmart Shareholders Equity | Noncontrolling Interest | Total Equity | ||||||||||

| Shares | Amount | |||||||||||||||

| Balances as of February 1, 2018 | 2,952 | $295 | $2,648 | $85,107 | $(10,181) | $77,869 | $2,953 | $80,822 | ||||||||

| Adoption of new accounting standards, net of income taxes | 2,361 | (1,436) | 925 | (1) | 924 | |||||||||||

| Consolidated net income | 6,670 | 6,670 | 509 | 7,179 | ||||||||||||

| Other comprehensive income (loss), net of income taxes | 75 | 75 | (188) | (113) | ||||||||||||

| Cash dividends declared ($2.08 per share) | (6,102) | (6,102) | (6,102) | |||||||||||||

| Purchase of Company stock | (80) | (8) | (245) | (7,234) | (7,487) | (7,487) | ||||||||||

| Cash dividend declared to noncontrolling interest | (488) | (488) | ||||||||||||||

| Noncontrolling interest of acquired entity | 4,345 | 4,345 | ||||||||||||||

| Other | 6 | 1 | 562 | (17) | 546 | 8 | 554 | |||||||||

| Balances as of January 31, 2019 | 2,878 | 288 | 2,965 | 80,785 | (11,542) | 72,496 | 7,138 | 79,634 | ||||||||

| Adoption of new accounting standards on February 1, 2019, net of income taxes | (266) | (266) | (34) | (300) | ||||||||||||

| Consolidated net income | 14,881 | 14,881 | 320 | 15,201 | ||||||||||||

| Other comprehensive income (loss), net of income taxes | (1,263) | (1,263) | 28 | (1,235) | ||||||||||||

| Cash dividends declared ($2.12 per share) | (6,048) | (6,048) | (6,048) | |||||||||||||

| Purchase of Company stock | (53) | (5) | (199) | (5,435) | (5,639) | (5,639) | ||||||||||

| Cash dividend declared to noncontrolling interest | (475) | (475) | ||||||||||||||

| Other | 7 | 1 | 481 | 26 | 508 | (94) | 414 | |||||||||

| Balances as of January 31, 2020 | 2,832 | 284 | 3,247 | 83,943 | (12,805) | 74,669 | 6,883 | 81,552 | ||||||||

| Consolidated net income | 13,510 | 13,510 | 196 | 13,706 | ||||||||||||

| Other comprehensive income (loss), net of income taxes | 1,039 | 1,039 | (213) | 826 | ||||||||||||

| Cash dividends declared ($2.16 per share) | (6,116) | (6,116) | (6,116) | |||||||||||||

| Purchase of Company stock | (20) | (2) | (97) | (2,559) | (2,658) | (2,658) | ||||||||||

| Cash dividends declared to noncontrolling interest | (365) | (365) | ||||||||||||||

| Other | 9 | 496 | (15) | 481 | 105 | 586 | ||||||||||

| Balances as of January 31, 2021 | 2,821 | $282 | $3,646 | $88,763 | $(11,766) | $80,925 | $6,606 | $87,531 | ||||||||

See accompanying notes.

| Walmart Inc. Consolidated Statements of Cash Flows (Amounts in millions) | ||||||

| Fiscal Years Ended January 31, | ||||||

| 2021 | 2020 | 2019 | ||||

| Cash flows from operating activities: | ||||||

| Consolidated net income | $13,706 | $15,201 | $ 7,179 | |||

| Adjustments to reconcile consolidated net income to net cash provided by operating activities: | ||||||

| Depreciation and amortization | 11,152 | 10,987 | 10,678 | |||

| Net unrealized and realized (gains) and losses | (8,589) | (1,886) | 3,516 | |||

| Losses on disposal of business operations | 8,401 | 15 | 4,850 | |||

| Asda pension contribution | (1,036) | |||||

| Deferred income taxes | 1,911 | 320 | (499) | |||

| Other operating activities | 1,521 | 1,981 | 1,734 | |||

| Changes in certain assets and liabilities, net of effects of acquisitions and dispositions: | ||||||

| Receivables, net | (1,086) | 154 | (368) | |||

| Inventories | (2,395) | (300) | (1,311) | |||

| Accounts payable | 6,966 | (274) | 1,831 | |||

| Accrued liabilities | 4,623 | 186 | 183 | |||

| Accrued income taxes | (136) | (93) | (40) | |||

| Net cash provided by operating activities | 36,074 | 25,255 | 27,753 | |||

| Cash flows from investing activities: | ||||||

| Payments for property and equipment | (10,264) | (10,705) | (10,344) | |||

| Proceeds from the disposal of property and equipment | 215 | 321 | 519 | |||

| Proceeds from the disposal of certain operations | 56 | 833 | 876 | |||

| Payments for business acquisitions, net of cash acquired | (180) | (56) | (14,656) | |||

| Other investing activities | 102 | 479 | (431) | |||

| Net cash used in investing activities | (10,071) | (9,128) | (24,036) | |||

| Cash flows from financing activities: | ||||||

| Net change in short-term borrowings | (324) | (4,656) | (53) | |||

| Proceeds from issuance of long-term debt | 5,492 | 15,872 | ||||

| Repayments of long-term debt | (5,382) | (1,907) | (3,784) | |||

| Dividends paid | (6,116) | (6,048) | (6,102) | |||

| Purchase of Company stock | (2,625) | (5,717) | (7,410) | |||

| Dividends paid to noncontrolling interest | (434) | (555) | (431) | |||

| Other financing activities | (1,236) | (908) | (629) | |||

| Net cash used in financing activities | (16,117) | (14,299) | (2,537) | |||

| Effect of exchange rates on cash, cash equivalents and restricted cash | 235 | (69) | (438) | |||

| Net increase in cash, cash equivalents and restricted cash | 10,121 | 1,759 | 742 | |||

| Cash and cash equivalents reclassified as assets held for sale | (1,848) | |||||

| Cash, cash equivalents and restricted cash at beginning of year | 9,515 | 7,756 | 7,014 | |||

| Cash, cash equivalents and restricted cash at end of year | $17,788 | $ 9,515 | $ 7,756 | |||

| Supplemental disclosure of cash flow information: | ||||||

| Income taxes paid | $5,271 | $3,616 | $3,982 | |||

| Interest paid | 2,216 | 2,464 | 2,348 | |||

See accompanying notes.

Appendix D Specimen Financial Statements: Amazon.com, Inc.

Amazon.com, Inc. is the worlds largest online retailer. It also produces consumer electronicsnotably the Kindle e-book reader and the Alexa digital assistant in its Echo speakersand is a major provider of cloud computing services. The following are Amazons financial statements as presented in the companys 2020 annual report. The complete annual report, including notes to the financial statements, is available at the companys website.

| AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) | ||||||

| Year Ended December 31, | ||||||

| 2018 | 2019 | 2020 | ||||

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD | $21,856 | $32,173 | $36,410 | |||

| OPERATING ACTIVITIES: | ||||||

| Net income | 10,073 | 11,588 | 21,331 | |||

| Adjustments to reconcile net income to net cash from operating activities: | ||||||

| Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other | 15,341 | 21,789 | 25,251 | |||

| Stock-based compensation | 5,418 | 6,864 | 9,208 | |||

| Other operating expense (income), net | 274 | 164 | (71) | |||

| Other expense (income), net | 219 | (249) | (2,582) | |||

| Deferred income taxes | 441 | 796 | (554) | |||

| Changes in operating assets and liabilities: | ||||||

| Inventories | (1,314) | (3,278) | (2,849) | |||

| Accounts receivable, net and other | (4,615) | (7,681) | (8,169) | |||

| Accounts payable | 3,263 | 8,193 | 17,480 | |||

| Accrued expenses and other | 472 | (1,383) | 5,754 | |||

| Unearned revenue | 1,151 | 1,711 | 1,265 | |||

| Net cash provided by (used in) operating activities | 30,723 | 38,514 | 66,064 | |||

| INVESTING ACTIVITIES: | ||||||

| Purchases of property and equipment | (13,427) | (16,861) | (40,140) | |||

| Proceeds from property and equipment sales and incentives | 2,104 | 4,172 | 5,096 | |||

| Acquisitions, net of cash acquired, and other | (2,186) | (2,461) | (2,325) | |||

| Sales and maturities of marketable securities | 8,240 | 22,681 | 50,237 | |||

| Purchases of marketable securities | (7,100) | (31,812) | (72,479) | |||

| Net cash provided by (used in) investing activities | (12,369) | (24,281) | (59,611) | |||

| FINANCING ACTIVITIES: | ||||||

| Proceeds from short-term debt, and other | 886 | 1,402 | 6,796 | |||

| Repayments of short-term debt, and other | (813) | (1,518) | (6,177) | |||

| Proceeds from long-term debt | 182 | 871 | 10,525 | |||

| Repayments of long-term debt | (155) | (1,166) | (1,553) | |||

| Principal repayments of finance leases | (7,449) | (9,628) | (10,642) | |||

| Principal repayments of financing obligations | (337) | (27) | (53) | |||

| Net cash provided by (used in) financing activities | (7,686) | (10,066) | (1,104) | |||

| Foreign currency effect on cash, cash equivalents, and restricted cash | (351) | 70 | 618 | |||

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 10,317 | 4,237 | 5,967 | |||

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD | $32,173 | $36,410 | $42,377 | |||

See accompanying notes to consolidated financial statements.

| AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share data) | ||||||

| Year Ended December 31, | ||||||

| 2018 | 2019 | 2020 | ||||

| Net product sales | $141,915 | $160,408 | $215,915 | |||

| Net service sales | 90,972 | 120,114 | 170,149 | |||

| Total net sales | 232,887 | 280,522 | 386,064 | |||

| Operating expenses: | ||||||

| Cost of sales | 139,156 | 165,536 | 233,307 | |||

| Fulfillment | 34,027 | 40,232 | 58,517 | |||

| Technology and content | 28,837 | 35,931 | 42,740 | |||

| Marketing | 13,814 | 18,878 | 22,008 | |||

| General and administrative | 4,336 | 5,203 | 6,668 | |||

| Other operating expense (income), net | 296 | 201 | (75) | |||

| Total operating expenses | 220,466 | 265,981 | 363,165 | |||

| Operating income | 12,421 | 14,541 | 22,899 | |||

| Interest income | 440 | 832 | 555 | |||

| Interest expense | (1,417) | (1,600) | (1,647) | |||

| Other income (expense), net | (183) | 203 | 2,371 | |||

| Total non-operating income (expense) | (1,160) | (565) | 1,279 | |||

| Income before income taxes | 11,261 | 13,976 | 24,178 | |||

| Provision for income taxes | (1,197) | (2,374) | (2,863) | |||

| Equity-method investment activity, net of tax | 9 | (14) | 16 | |||

| Net income | $ 10,073 | $ 11,588 | $ 21,331 | |||

| Basic earnings per share | $20.68 | $23.46 | $42.64 | |||

| Diluted earnings per share | $20.14 | $23.01 | $41.83 | |||

| Weighted-average shares used in computation of earnings per share: | ||||||

| Basic | 487 | 494 | 500 | |||

| Diluted | 500 | 504 | 510 | |||

See accompanying notes to consolidated financial statements.

| AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) | ||||||

| Year Ended December 31, | ||||||

| 2018 | 2019 | 2020 | ||||

| Net income | $10,073 | $11,588 | $21,331 | |||

| Other comprehensive income (loss): | ||||||

| Net change in foreign currency translation adjustments: | ||||||

| Foreign currency translation adjustments, net of tax of $6, $(5), and $(36) | (538) | 78 | 561 | |||

| Reclassification adjustment for foreign currency translation included in Other operating expense (income), net, net of tax of $0, $29, and $0 | (108) | |||||

| Net foreign currency translation adjustments | (538) | (30) | 561 | |||

| Net change in unrealized gains (losses) on available-for-sale debt securities: | ||||||

| Unrealized gains (losses), net of tax of $0, $(12), and $(83) | (17) | 83 | 273 | |||

| Reclassification adjustment for losses (gains) included in Other income (expense), net, net of tax of $0, $0, and $8 | 8 | (4) | (28) | |||

| Net unrealized gains (losses) on available-for-sale debt securities | (9) | 79 | 245 | |||

| Total other comprehensive income (loss) | (547) | 49 | 806 | |||

| Comprehensive income | $ 9,526 | $11,637 | $22,137 | |||

See accompanying notes to consolidated financial statements.

| AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (In millions, except per share data) | ||||

| December 31, | ||||

| 2019 | 2020 | |||

| ASSETS | ||||

| Current assets: | ||||

| Cash and cash equivalents | $ 36,092 | $ 42,122 | ||

| Marketable securities | 18,929 | 42,274 | ||

| Inventories | 20,497 | 23,795 | ||

| Accounts receivable, net and other | 20,816 | 24,542 | ||

| Total current assets | 96,334 | 132,733 | ||

| Property and equipment, net | 72,705 | 113,114 | ||

| Operating leases | 25,141 | 37,553 | ||

| Goodwill | 14,754 | 15,017 | ||

| Other assets | 16,314 | 22,778 | ||

| Total assets | $225,248 | $321,195 | ||

| LIABILITIES AND STOCKHOLDERS EQUITY | ||||

| Current liabilities: | ||||

| Accounts payable | $ 47,183 | $ 72,539 | ||

| Accrued expenses and other | 32,439 | 44,138 | ||

| Unearned revenue | 8,190 | 9,708 | ||

| Total current liabilities | 87,812 | 126,385 | ||

| Long-term lease liabilities | 39,791 | 52,573 | ||

| Long-term debt | 23,414 | 31,816 | ||

| Other long-term liabilities | 12,171 | 17,017 | ||

| Commitments and contingencies (Note 7) | ||||

| Stockholders equity: | ||||

| Preferred stock, $0.01 par value: | ||||

| Authorized shares 500 | ||||

| Issued and outstanding shares none | ||||

| Common stock, $0.01 par value: | ||||

| Authorized shares 5,000 | ||||

| Issued shares 521 and 527 | ||||

| Outstanding shares 498 and 503 | 5 | 5 | ||

| Treasury stock, at cost | (1,837) | (1,837) | ||

| Additional paid-in capital | 33,658 | 42,865 | ||

| Accumulated other comprehensive income (loss) | (986) | (180) | ||

| Retained earnings | 31,220 | 52,551 | ||

| Total stockholders equity | 62,060 | 93,404 | ||

| Total liabilities and stockholders equity | $225,248 | $321,195 | ||

See accompanying notes to consolidated financial statements.

| AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS EQUITY (In millions) | ||||||||||||||

| Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Total Stockholders Equity | ||||||||||

| Shares | Amount | Treasury Stock | ||||||||||||

| Balance as of January 1, 2018 | 484 | $5 | $(1,837) | $21,389 | $(484) | $ 8,636 | $27,709 | |||||||

| Cumulative effect of change in accounting principles related to revenue recognition, income taxes, and financial instruments | (4) | 916 | 912 | |||||||||||

| Net income | 10,073 | 10,073 | ||||||||||||

| Other comprehensive income (loss) | (547) | (547) | ||||||||||||

| Exercise of common stock options | 7 | |||||||||||||

| Stock-based compensation and issuance of employee benefit plan stock | 5,402 | 5,402 | ||||||||||||

| Balance as of December 31, 2018 | 491 | 5 | (1,837) | 26,791 | (1,035) | 19,625 | 43,549 | |||||||

| Cumulative effect of change in accounting principle related to leases | 7 | 7 | ||||||||||||

| Net income | 11,588 | 11,588 | ||||||||||||

| Other comprehensive income (loss) | 49 | 49 | ||||||||||||

| Exercise of common stock options | 7 | |||||||||||||

| Stock-based compensation and issuance of employee benefit plan stock | 6,867 | 6,867 | ||||||||||||

| Balance as of December 31, 2019 | 498 | 5 | (1,837) | 33,658 | (986) | 31,220 | 62,060 | |||||||

| Net income | 21,331 | 21,331 | ||||||||||||

| Other comprehensive income (loss) | 806 | 806 | ||||||||||||

| Exercise of common stock options | 5 | |||||||||||||

| Stock-based compensation and issuance of employee benefit plan stock | 9,207 | 9,207 | ||||||||||||

| Balance as of December 31, 2020 | 503 | $5 | $(1,837) | $42,865 | $(180) | $52,551 | $93,404 | |||||||

See accompanying notes to consolidated financial statements.

I need answers to b1 please thanks

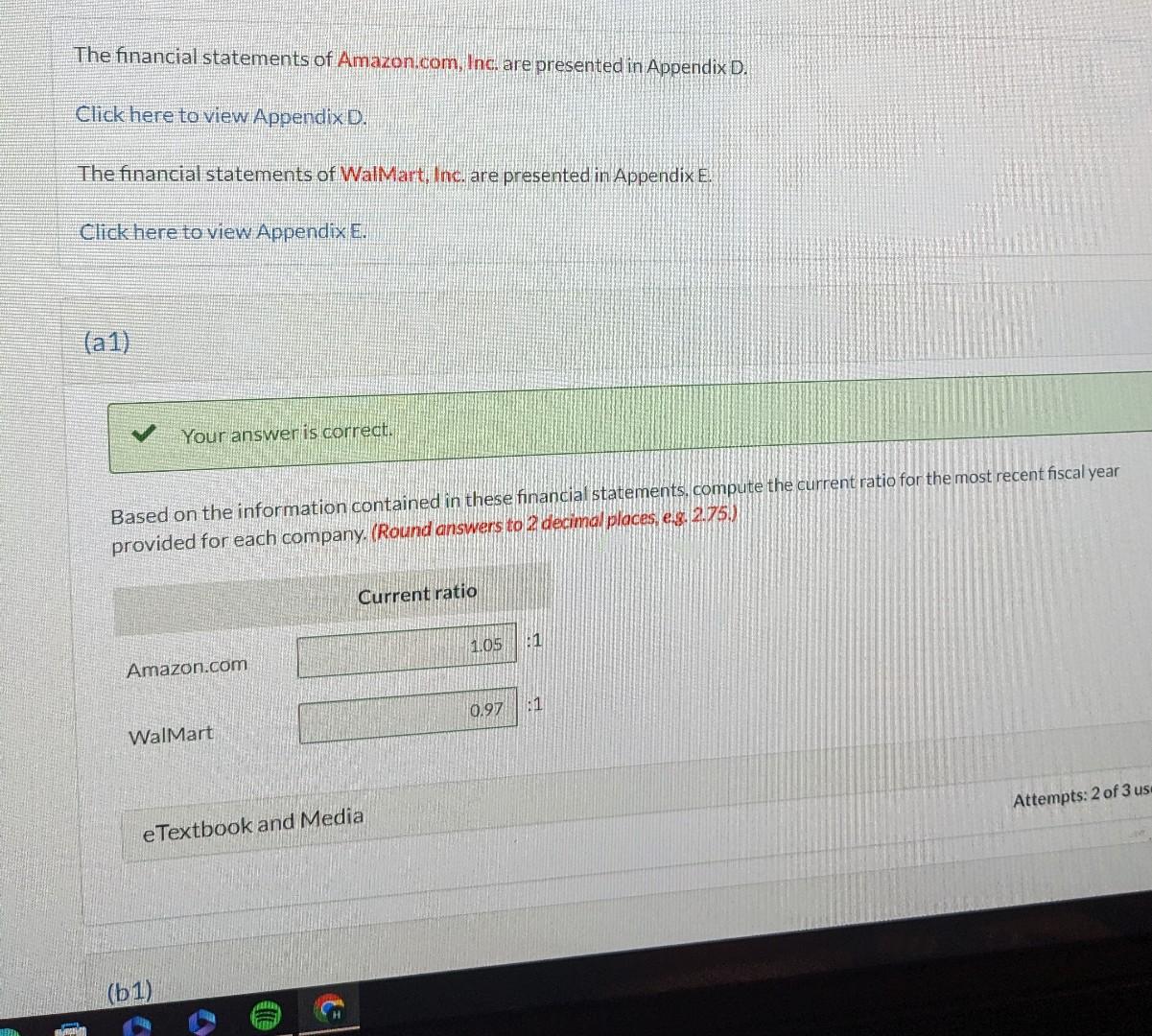

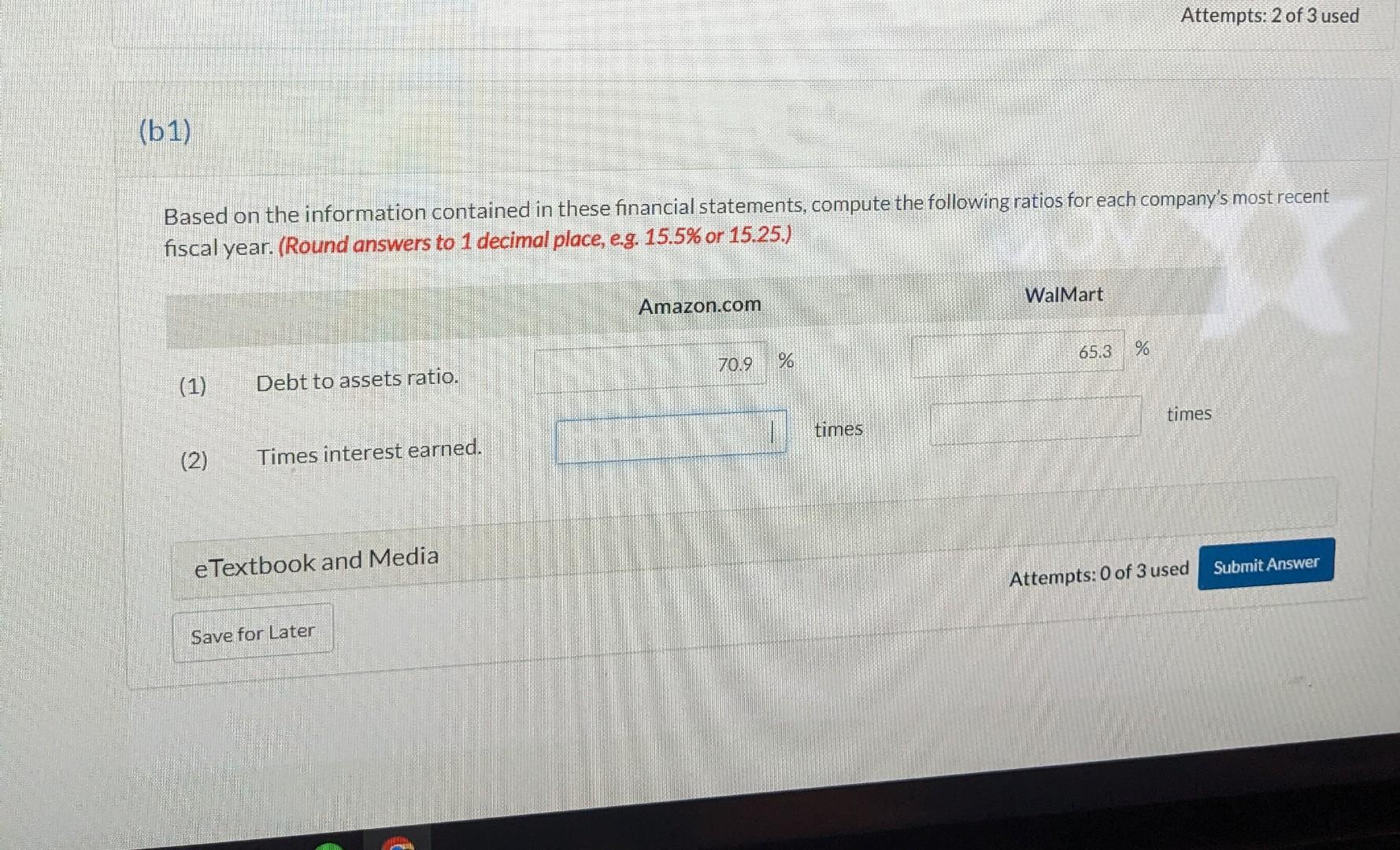

The financial statements of Amazon.com, Inc. are presented in Appendix D. Click here to view AppendixD. The financial statements of WalMart, lnc, are presented in Appendix E. Clickhere to view Appendix E. (a1) Your answer is correct. Based on the information contained in these financial statements, compute the current ratio for the most recent fiscal year provided for each company. (Round answers to 2 decimal places, e.3.2.75.) Based on the information contained in these financial statements, compute the following ratios for each company's most recent fiscal year. (Round answers to 1 decimal place, e.g. 15.5% or 15.25. )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts