Question: appendix F problem 1 17. For tax year 2020 , the Hausers had a Federal income tax overpayment of $150, which they applied to their

appendix F problem 1

appendix F problem 1

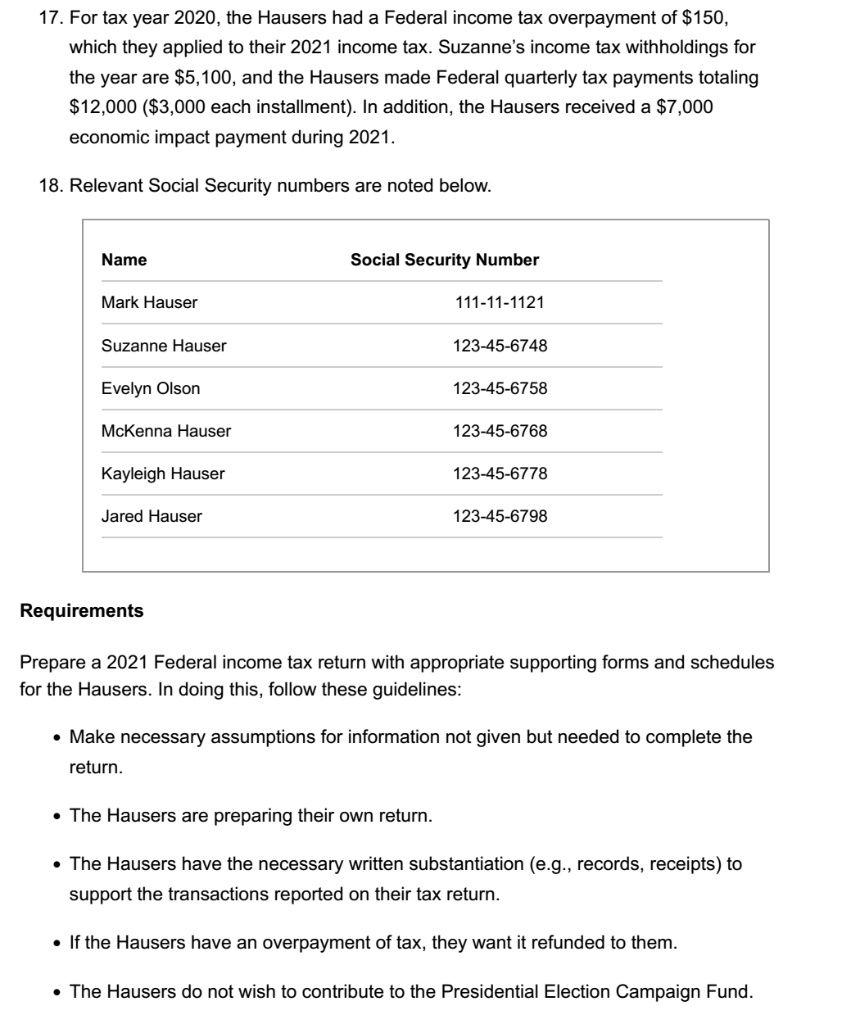

17. For tax year 2020 , the Hausers had a Federal income tax overpayment of $150, which they applied to their 2021 income tax. Suzanne's income tax withholdings for the year are $5,100, and the Hausers made Federal quarterly tax payments totaling $12,000($3,000 each installment). In addition, the Hausers received a $7,000 economic impact payment during 2021. 18. Relevant Social Security numbers are noted below. Requirements Prepare a 2021 Federal income tax return with appropriate supporting forms and schedules for the Hausers. In doing this, follow these guidelines: - Make necessary assumptions for information not given but needed to complete the return. - The Hausers are preparing their own return. - The Hausers have the necessary written substantiation (e.g., records, receipts) to support the transactions reported on their tax return. - If the Hausers have an overpayment of tax, they want it refunded to them. - The Hausers do not wish to contribute to the Presidential Election Campaign Fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts