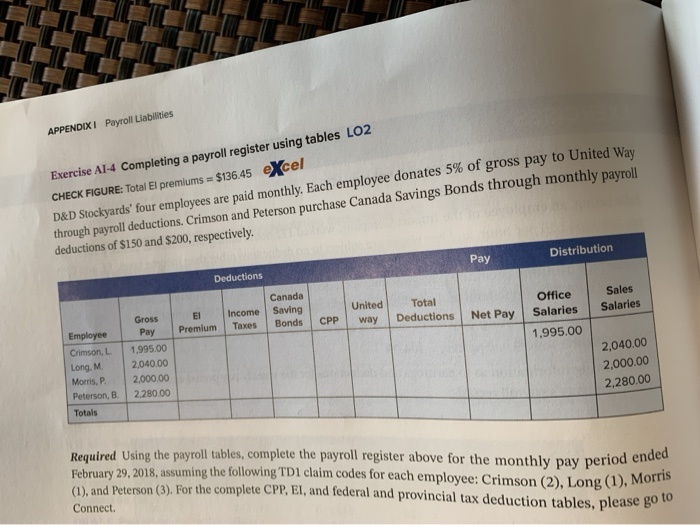

Question: APPENDIX I Payroll Liabilities Exercise AI-4 Completing a payroll register using tables LO2 CHECK FIGURE: Total El premiums = $136.45 eXcel D&D Stockyards' four employees

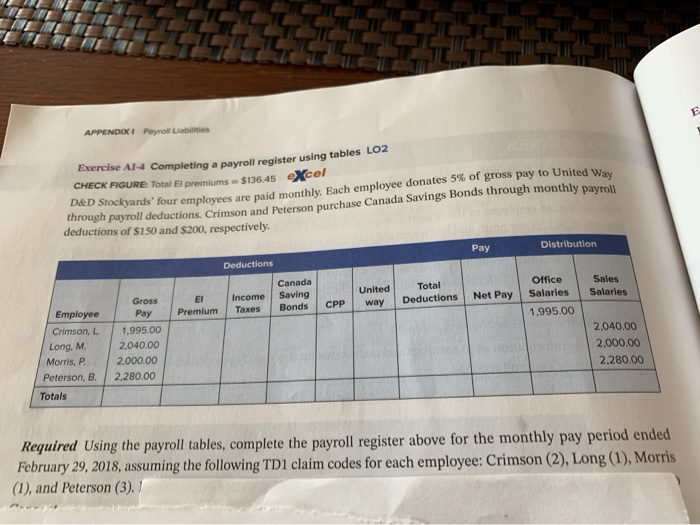

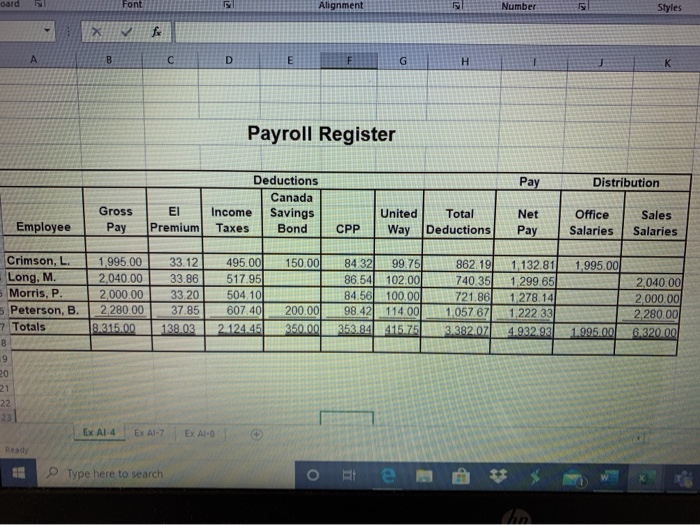

APPENDIX I Payroll Liabilities Exercise AI-4 Completing a payroll register using tables LO2 CHECK FIGURE: Total El premiums = $136.45 eXcel D&D Stockyards' four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200, respectively. Distribution Pay Deductions Canada Saving Bonds Sales Salaries Income Taxes Total Deductions United way Premium Net Pay CPP Office Salaries 1.995.00 Employee Crimson, L Gross Pay 1,995.00 2,040,00 2,000.00 2.280.00 Long.M 2,040.00 2,000.00 2,280.00 Morris, P Peterson, B Totals Required Using the payroll tables, complete the payroll register above for the monthly pay period ended February 29, 2018, assuming the following TDI claim codes for each employee: Crimson (2), Long (1), Morris (1), and Peterson (3). For the complete CPP, EI, and federal and provincial tax deduction tables, please go to Connect E APPENDIXI Payroll Liabilities Exercise A14 Completing a payroll register using tables L02 CHECK FIGURE Total El premiums = $136.45 eXcel D&D Stockyards four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200, respectively. Distribution Pay Deductions Canada Saving Bonds Sales Salaries Total Deductions Income Taxes EI Premium United way Net Pay Office Salaries 1.995.00 CPP Employee Crimson, L. Long, M. Morris, P. Peterson, B. Totals Gross Pay 1.995.00 2,040.00 2.000.00 2.280.00 2,040.00 2,000.00 2.280.00 Required Using the payroll tables, complete the payroll register above for the monthly pay period ended February 29, 2018, assuming the following TD1 claim codes for each employee: Crimson (2), Long (1), Morris (1), and Peterson (3). / oard Font Alignment Number Styles > fix A B D E G H K Payroll Register Pay Distribution Gross Pay Deductions Canada Income Savings Taxes Bond El Premium Employee United Total Way Deductions Net Pay CPP Office Salaries Sales Salaries 150.00 1,995.00 Crimson, L. Long, M. Morris, P. 5 Peterson, B. 7 Totals 1.995.00 2,040.00 2,000.00 2.280.00 8.315.00 33.12 33.86 33.20 37.85 138.03 495.00 517.95 504.10 607 401 2.124.45 84 32 99.75 86.54 102.00 84.56 100.00 98.42 114.00 353.84 415.75 862.19 740.35 721.86 1,057 67 3.382.07 1,132.81 1.299.651 1.278.141 1,222 33 4.932.93 200.00 350.00 2,040.00 2.000.00 2.280.00 6.320.00 1.995.00 8 19 20 21 22 231 Ex Al-4 EX A1-7 Ex Al- Ready Type here to search o e ** $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts