Question: Appendix: The following information was disclosed during the audit of Flounder Inc. 1. Year Amount Due per Tax Return $130,600 103,600 2020 2021 2. On

Appendix:

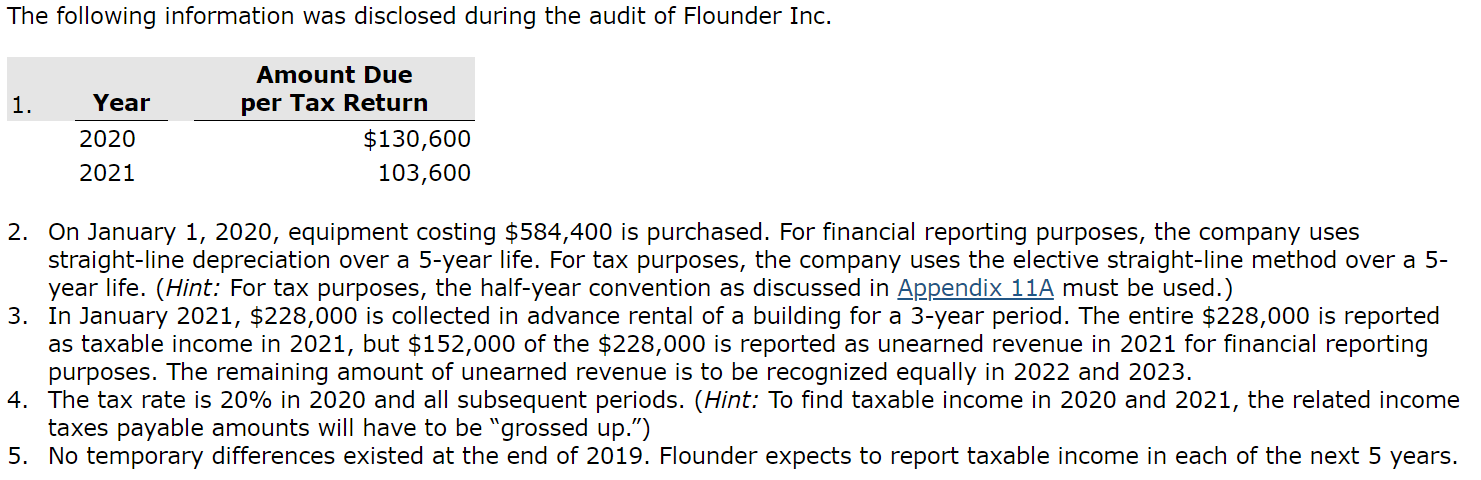

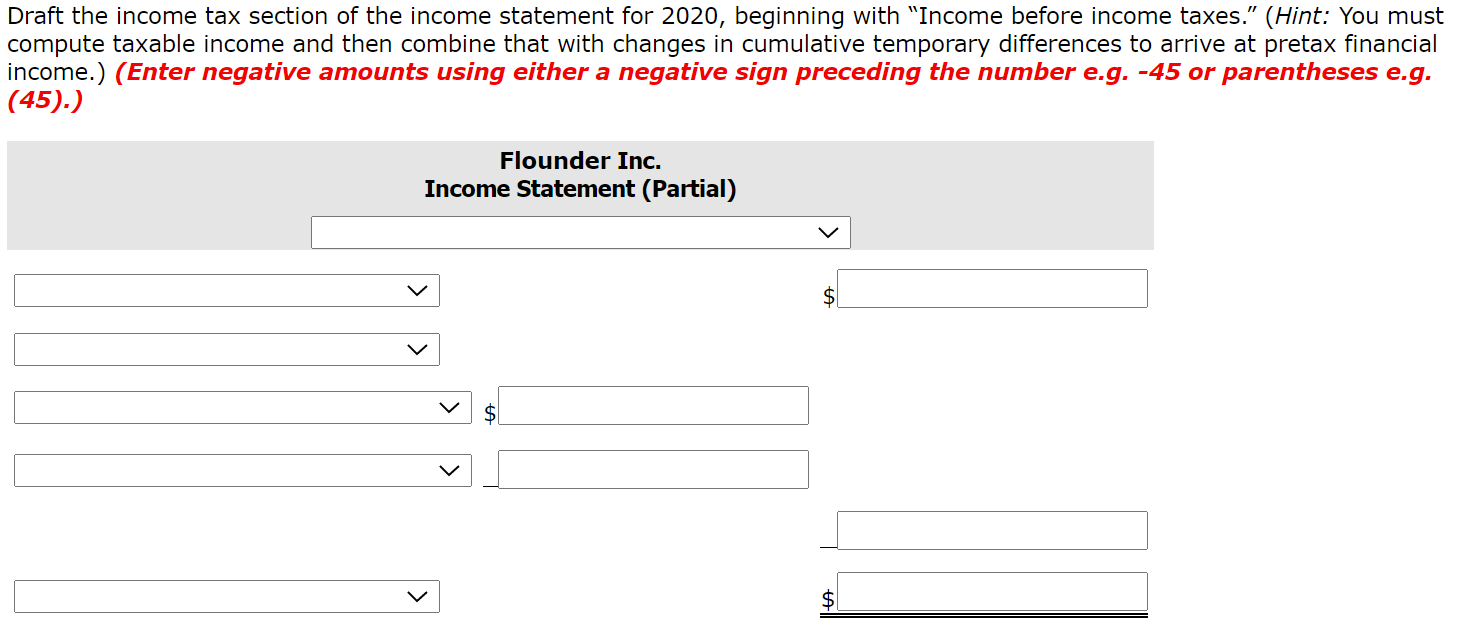

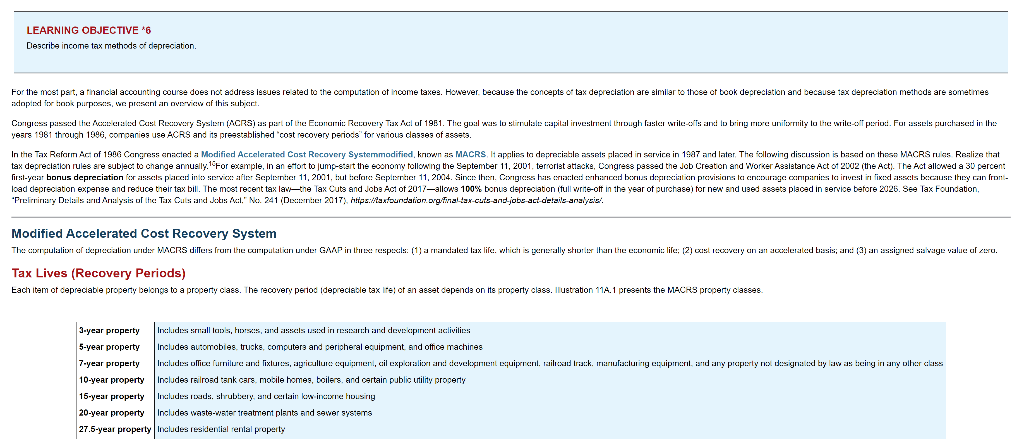

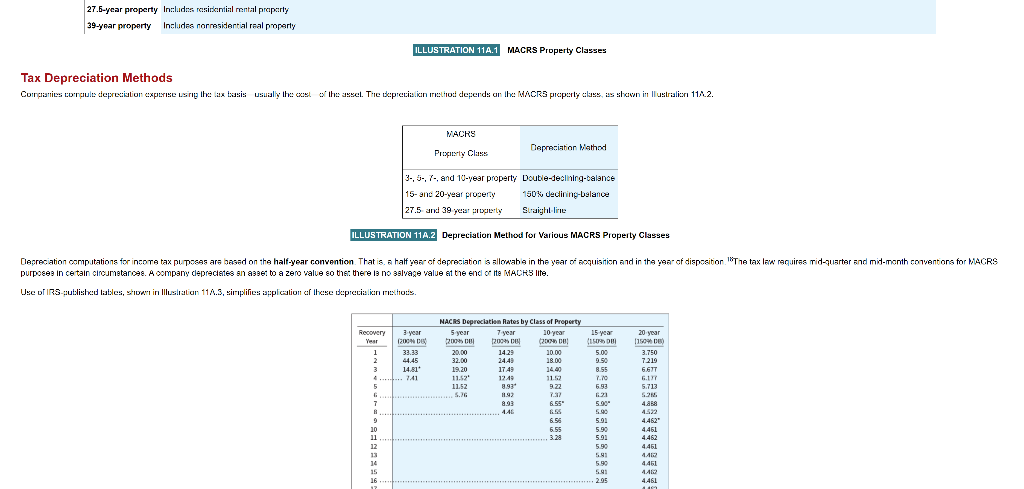

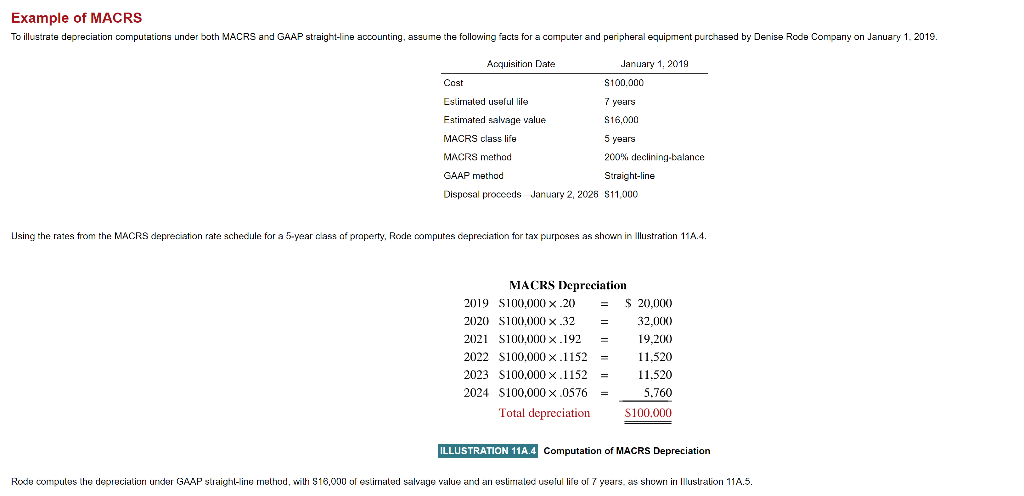

The following information was disclosed during the audit of Flounder Inc. 1. Year Amount Due per Tax Return $130,600 103,600 2020 2021 2. On January 1, 2020, equipment costing $584,400 is purchased. For financial reporting purposes, the company uses straight-line depreciation over a 5-year life. For tax purposes, the company uses the elective straight-line method over a 5- year life. (Hint: For tax purposes, the half-year convention as discussed in Appendix 11A must be used.) 3. In January 2021, $228,000 is collected in advance rental of a building for a 3-year period. The entire $228,000 is reported as taxable income in 2021, but $152,000 of the $228,000 is reported as unearned revenue in 2021 for financial reporting purposes. The remaining amount of unearned revenue is to be recognized equally in 2022 and 2023. 4. The tax rate is 20% in 2020 and all subsequent periods. (Hint: To find taxable income in 2020 and 2021, the related income taxes payable amounts will have to be "grossed up.") 5. No temporary differences existed at the end of 2019. Flounder expects to report taxable income in each of the next 5 years. LEARNING OBJECTIVE 46 Describe income tax methods of depreciation For the most part, a financial accounting course does not address lesues reated to the computation of income taxes. However, because the concepts of tax depreciation are similar to those of took depreciation and because tex deprecation methode are sometimes rocopted for ton purposes, we present an Drvice af this sub ect. Congress passed the record Cast Recovery System (ACRS) is part of the Economic Recovery Tax Act of 1961. The goal was lustruale capital investment tough faster wilcols and to bring me unifoxrnity to the site of periut. Forssels purchased in the years 1981 through 1996, companies use ACRS and its preestablished cost recovery periods for various classes of assets. In the Tax Reform Ac of 1998 Congress enacted a Modified Accelerated Cost Recovery Systemmodified, known MACRS, Itapalies ta depreciable assets placed in service in 1997 and later. The following discussion is based on the MACRS rucs Realize that tax depreciation rules are subject to change annusly. For example, in an effort to jump-start the economy following the September 11, 2001. terrorist attacke, Congress passed the Job Creaton and Worker Assistance Act of 2002 (the act. The Act allowed a 30 percen: first-year bonus depreciation for assct paced into services Septentcr 11, 2001, tuttofare: September 11, 2004. Since then. Congress has led banccd bonus depreciation provisions la charge companies la invest in fixed assis because they in front- Icad deprecaton expense and reduce their tax bill. The most recent tax lathe Tax Outs and Jobs Act of 2017-allows 100% bonus depreciation full write-off in the year of purchase) for new and used assets placed in service before 2026. See lax Foundation, "Preliminary Details and Analysis of the Tax Outstand Jokes Mol." No. 241 (Desene 2017), tips:/asfoundation.org ina-ax-cuts-and.jobe-act-details-analysis. Modified Accelerated Cost Recovery System The congullin af procation under MACRS dillers from the computation under GMP in the respecls: (1) a marcated lisx lifc. which is generally sur les han lle economic life: (2) xsexcery an in accuslerated basis; and (3) an issigris salvage vluc altxu. Tax Lives (Recovery Periods) Each item of cepreciable property belongs to a property cass. The recovery period idepreciable tax ite of an asset cepends on its property class. Ilustration 11A.1 presents the MACRS property c asses 3-year property Includes small toplis, Poils, aard scals used in research and developilivilian 5-year property Includes automobies, trucks, computers and peripheral ecuipment and office irachines 7-year property Includes olice furnilure and fixtures, agriculture equireni, cil explcralixt and development superenal tailand track irurusaluring cruipirant, and any property no designed by law as teirg in any olhar class 10-year property Includes railroad tank cars mobile homes, toilersand certain public utility property 15-year property Includes Tidsskrubbery, and vallain kow incore housing 20-year property Includes waste-water treatment plants and sewer systems 27.5-year property Includes residential rental property 27.6-year property Includes reiniktil rental properly 39-year property Includes normesidential real properly ILLUSTRATION 11A.1 MACRS Property Classes Tax Depreciation Methods Cuinigaies corpul depreciation CXCITISC ST has taxtasis usually the cost of the sect. The precision is to depends on the MACRS piperly clases shawn in Illustration 11A2. MACRS Depreciation Mathod Prixiy Class 3-, 6-7, and 10-year property Double-declining-balance 15-ang 20-year progerty 150% declining-balance 27.5 and 39 yetist gerly Sutaithil lirie ILLUSTRATION 11A.2 Depreciation Method for Various MACRS Property Classes Depreciation computations for income tax purposes are based on the half-year convention. That is a half year of depreciation is allowable in the year of acquisition and in the year of disposition. The tax law requires rid-quarter and mid- month conventors for MACRS purposes in ce tain circumstances. A company depreciates an asset to a zero valve so that there is no 3slvage value at the end of ite MADR3 lite. Use of RS gutslis tables, sin lilusalan 11A.3, simplifies application of these specialkinto Recovery 3 3 year Year 12000 1 33.33 2 44.45 3 14.81" ......... 741 5 NACES Depreciation Rates by Class of Property 5 year 7 year 10 year 2005 200% 2009 20.00 14.29 30.00 32.00 244) som 28.00 19.20 1749 11.52 12:49 11.52 11.52 9.22 S.NG 11.92 993 6.55 4.AL 6.58 6.55 3.28 15 year (150D 5.00 9.50 8.55 7.10 6.93 6.21 509 5.99 591 5.90 5.91 5.99 20 year 1150% ) 3.750 7219 12 6.67T 6.17 5.713 7 4.88 9 10 11 12 13 14 15 16. 4.462" 4451 4.462 4451 4412 4451 442 4.461 11 5.90 5.91 205 Example of MACRS To illustrate depreciation computations under both MACRS and GAAP straight-line accounting, assume the following facts for a computer and peripheral equipment purchased by Denise Rode Company on January 1, 2019 Acquisition Data January 1, 2019 Cast S100.000 Estimated useful life 7 years Estimated salvage value $16.000 MACRS class life 5 years MACRS method 200%. declining balance GAAP method Straight-line Disposal proceeds January 2, 2026 S11,000 LJsing the rates from the MACRS depreciation rate schedule for a 5-year class of property, Rode computes depreciation for tax purposes as shown in Illustration 11A.4. MACRS Depreciation 2019 5100.000 X.20) $ 20,000 2020 $100,000 X.32 32,000) 2021 S100.000 X.192 19,200) 2022 S100,000 X.1152 11.520 2023 $100.000 X.1152 11.520 2024 $100,000 X.0576 5.760 Total depreciation $100.000 ILLUSTRATION 11A.4 Computation of MACRS Depreciation Rode compules the depreciation under GAAP straight-line melhod, will $16,000 or estimated salvage value and an estimated uselul life of 7 years as shown in Illustration 11A.5. The following information was disclosed during the audit of Flounder Inc. 1. Year Amount Due per Tax Return $130,600 103,600 2020 2021 2. On January 1, 2020, equipment costing $584,400 is purchased. For financial reporting purposes, the company uses straight-line depreciation over a 5-year life. For tax purposes, the company uses the elective straight-line method over a 5- year life. (Hint: For tax purposes, the half-year convention as discussed in Appendix 11A must be used.) 3. In January 2021, $228,000 is collected in advance rental of a building for a 3-year period. The entire $228,000 is reported as taxable income in 2021, but $152,000 of the $228,000 is reported as unearned revenue in 2021 for financial reporting purposes. The remaining amount of unearned revenue is to be recognized equally in 2022 and 2023. 4. The tax rate is 20% in 2020 and all subsequent periods. (Hint: To find taxable income in 2020 and 2021, the related income taxes payable amounts will have to be "grossed up.") 5. No temporary differences existed at the end of 2019. Flounder expects to report taxable income in each of the next 5 years. LEARNING OBJECTIVE 46 Describe income tax methods of depreciation For the most part, a financial accounting course does not address lesues reated to the computation of income taxes. However, because the concepts of tax depreciation are similar to those of took depreciation and because tex deprecation methode are sometimes rocopted for ton purposes, we present an Drvice af this sub ect. Congress passed the record Cast Recovery System (ACRS) is part of the Economic Recovery Tax Act of 1961. The goal was lustruale capital investment tough faster wilcols and to bring me unifoxrnity to the site of periut. Forssels purchased in the years 1981 through 1996, companies use ACRS and its preestablished cost recovery periods for various classes of assets. In the Tax Reform Ac of 1998 Congress enacted a Modified Accelerated Cost Recovery Systemmodified, known MACRS, Itapalies ta depreciable assets placed in service in 1997 and later. The following discussion is based on the MACRS rucs Realize that tax depreciation rules are subject to change annusly. For example, in an effort to jump-start the economy following the September 11, 2001. terrorist attacke, Congress passed the Job Creaton and Worker Assistance Act of 2002 (the act. The Act allowed a 30 percen: first-year bonus depreciation for assct paced into services Septentcr 11, 2001, tuttofare: September 11, 2004. Since then. Congress has led banccd bonus depreciation provisions la charge companies la invest in fixed assis because they in front- Icad deprecaton expense and reduce their tax bill. The most recent tax lathe Tax Outs and Jobs Act of 2017-allows 100% bonus depreciation full write-off in the year of purchase) for new and used assets placed in service before 2026. See lax Foundation, "Preliminary Details and Analysis of the Tax Outstand Jokes Mol." No. 241 (Desene 2017), tips:/asfoundation.org ina-ax-cuts-and.jobe-act-details-analysis. Modified Accelerated Cost Recovery System The congullin af procation under MACRS dillers from the computation under GMP in the respecls: (1) a marcated lisx lifc. which is generally sur les han lle economic life: (2) xsexcery an in accuslerated basis; and (3) an issigris salvage vluc altxu. Tax Lives (Recovery Periods) Each item of cepreciable property belongs to a property cass. The recovery period idepreciable tax ite of an asset cepends on its property class. Ilustration 11A.1 presents the MACRS property c asses 3-year property Includes small toplis, Poils, aard scals used in research and developilivilian 5-year property Includes automobies, trucks, computers and peripheral ecuipment and office irachines 7-year property Includes olice furnilure and fixtures, agriculture equireni, cil explcralixt and development superenal tailand track irurusaluring cruipirant, and any property no designed by law as teirg in any olhar class 10-year property Includes railroad tank cars mobile homes, toilersand certain public utility property 15-year property Includes Tidsskrubbery, and vallain kow incore housing 20-year property Includes waste-water treatment plants and sewer systems 27.5-year property Includes residential rental property 27.6-year property Includes reiniktil rental properly 39-year property Includes normesidential real properly ILLUSTRATION 11A.1 MACRS Property Classes Tax Depreciation Methods Cuinigaies corpul depreciation CXCITISC ST has taxtasis usually the cost of the sect. The precision is to depends on the MACRS piperly clases shawn in Illustration 11A2. MACRS Depreciation Mathod Prixiy Class 3-, 6-7, and 10-year property Double-declining-balance 15-ang 20-year progerty 150% declining-balance 27.5 and 39 yetist gerly Sutaithil lirie ILLUSTRATION 11A.2 Depreciation Method for Various MACRS Property Classes Depreciation computations for income tax purposes are based on the half-year convention. That is a half year of depreciation is allowable in the year of acquisition and in the year of disposition. The tax law requires rid-quarter and mid- month conventors for MACRS purposes in ce tain circumstances. A company depreciates an asset to a zero valve so that there is no 3slvage value at the end of ite MADR3 lite. Use of RS gutslis tables, sin lilusalan 11A.3, simplifies application of these specialkinto Recovery 3 3 year Year 12000 1 33.33 2 44.45 3 14.81" ......... 741 5 NACES Depreciation Rates by Class of Property 5 year 7 year 10 year 2005 200% 2009 20.00 14.29 30.00 32.00 244) som 28.00 19.20 1749 11.52 12:49 11.52 11.52 9.22 S.NG 11.92 993 6.55 4.AL 6.58 6.55 3.28 15 year (150D 5.00 9.50 8.55 7.10 6.93 6.21 509 5.99 591 5.90 5.91 5.99 20 year 1150% ) 3.750 7219 12 6.67T 6.17 5.713 7 4.88 9 10 11 12 13 14 15 16. 4.462" 4451 4.462 4451 4412 4451 442 4.461 11 5.90 5.91 205 Example of MACRS To illustrate depreciation computations under both MACRS and GAAP straight-line accounting, assume the following facts for a computer and peripheral equipment purchased by Denise Rode Company on January 1, 2019 Acquisition Data January 1, 2019 Cast S100.000 Estimated useful life 7 years Estimated salvage value $16.000 MACRS class life 5 years MACRS method 200%. declining balance GAAP method Straight-line Disposal proceeds January 2, 2026 S11,000 LJsing the rates from the MACRS depreciation rate schedule for a 5-year class of property, Rode computes depreciation for tax purposes as shown in Illustration 11A.4. MACRS Depreciation 2019 5100.000 X.20) $ 20,000 2020 $100,000 X.32 32,000) 2021 S100.000 X.192 19,200) 2022 S100,000 X.1152 11.520 2023 $100.000 X.1152 11.520 2024 $100,000 X.0576 5.760 Total depreciation $100.000 ILLUSTRATION 11A.4 Computation of MACRS Depreciation Rode compules the depreciation under GAAP straight-line melhod, will $16,000 or estimated salvage value and an estimated uselul life of 7 years as shown in Illustration 11A.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts