Question: Apple stock is trading at S = $200 while a put option on Apple that expires in one year with strike price $220 is trading

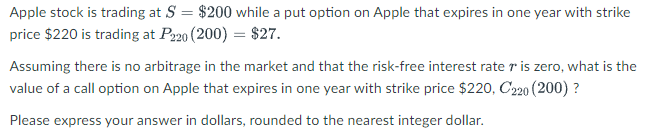

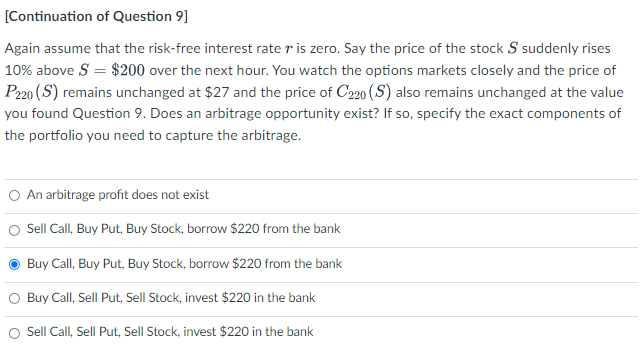

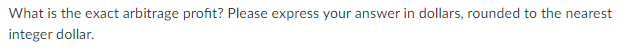

Apple stock is trading at S = $200 while a put option on Apple that expires in one year with strike price $220 is trading at P220 (200) = $27. Assuming there is no arbitrage in the market and that the risk-free interest rate r is zero, what is the value of a call option on Apple that expires in one year with strike price $220, C220 (200) ? Please express your answer in dollars, rounded to the nearest integer dollar. [Continuation of Question 9] Again assume that the risk-free interest rate r is zero. Say the price of the stock S suddenly rises 10% above S = $200 over the next hour. You watch the options markets closely and the price of P220 (S) remains unchanged at $27 and the price of C220 (S) also remains unchanged at the value you found Question 9. Does an arbitrage opportunity exist? If so, specify the exact components of the portfolio you need to capture the arbitrage. An arbitrage profit does not exist Sell Call, Buy Put, Buy Stock, borrow $220 from the bank Buy Call, Buy Put, Buy Stock, borrow $220 from the bank O Buy Call, Sell Put, Sell Stock, invest $220 in the bank Sell Call, Sell Put, Sell Stock, invest $220 in the bank What is the exact arbitrage profit? Please express your answer in dollars, rounded to the nearest integer dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts