Question: APPLICATION ASSIGNMENT #1-ACCT305 (Accounting Cycle) This first Application Assignment is to help you review and complete the Worksheet used by Accountants every day in order

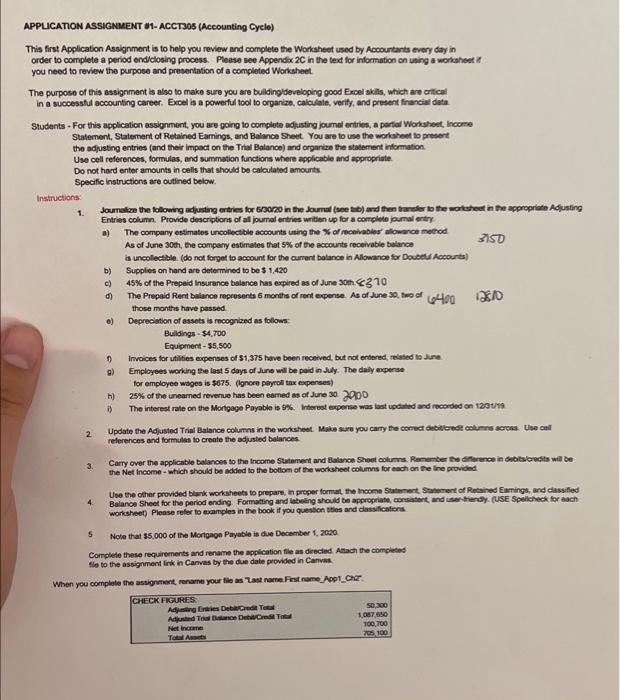

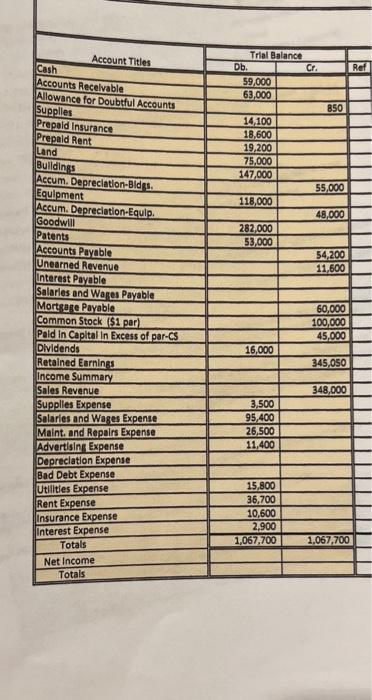

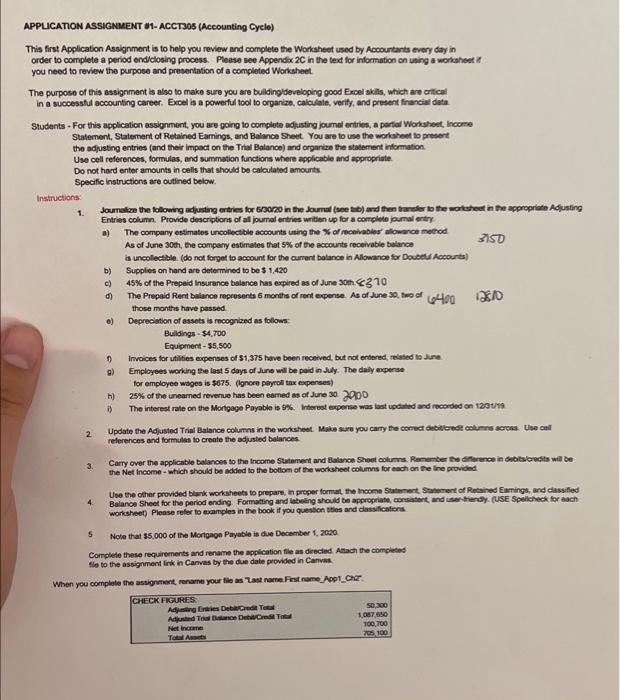

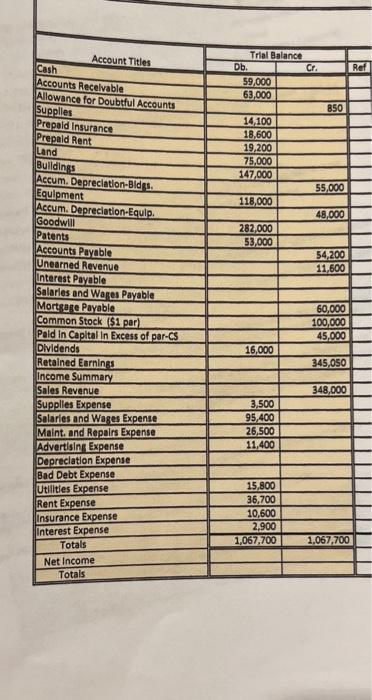

APPLICATION ASSIGNMENT #1-ACCT305 (Accounting Cycle) This first Application Assignment is to help you review and complete the Worksheet used by Accountants every day in order to complete a period end/closing process. Please see Appendix 2C in the text for information on using a worksheet if you need to review the purpose and presentation of a completed Worksheet. The purpose of this assignment is also to make sure you are building/developing good Excel skills, which are critical in a successful accounting career. Excel is a powerful tool to organize, calculate, verify, and present financial data. Students - For this application assignment, you are going to complete adjusting journal entries, a partial Worksheet, Income Statement, Statement of Retained Earnings, and Balance Sheet. You are to use the worksheet to present the adjusting entries (and their impact on the Trial Balance) and organize the statement information. Use cell references, formulas, and summation functions where applicable and appropriate. Do not hard enter amounts in cells that should be calculated amounts. Specific instructions are outlined below. Instructions: 1. 2. 3. 4. 5 Journalize the following adjusting entries for 6/30/20 in the Journal (see tab) and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all journal entries written up for a complete journal entry. a) The company estimates uncollectible accounts using the "% of receivables' allowance method. As of June 30th, the company estimates that 5% of the accounts receivable balance is uncollectible. (do not forget to account for the current balance in Allowance for Doubtful Accounts) Supplies on hand are determined to be $ 1,420 45% of the Prepaid Insurance balance has expired as of June 30th.

APPUCATION ASSIGNakENT E1-ACCTSOS (Accounting Cycle) This first Application Assignment is to help you review and complete the Workaheet used by Accountants every day in order to complete a period end/closing process. Please see Appendx 2C in the texd for information on using a workaheet 8 you neod to reviow the purpose and presentation of a completed Workaheet. The purpose of this assignment is also to make sure you are bulldingldeveloping good Exoel skils, which are oritical in a successtul accounting career. Excel is a powerful tool to organize, calablate, verify, and present financial data. Students - For this application assignment, you are going to complute adfusting joumd entries, a partial Whorkheet, income Statement, Statement of Retained Eamings, and Balance Sheet. You are to use the worksheet to presert the adjusting entries (and their impoct on the Trial Balance) and orparize the staternent information. Use cell references, formulas, and summation functions where applicable and appropriate. Do not hard enter amounts in cells that should be calculated amounts Specific instructions are outlined below. Instructions: Entries column. Provide descriptions of all joumal entries writien up for a complete jamal anty- a) The company estimates uncolectible accounts ining the % of rechivabies' allowance methed As of June 30 h, the compary estimates that 5% of the accounts receivabie bolance 3750 is uncollectible. (do not foryet to account for the current balance in Alowance for Docedu Aocounts) b) Supples on hand are determined to be $1,420 c) 45% of the Prepaid Insurance balance has expied as of June 30th

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock