Question: Application Assignment #3 Instructions: Answer the following questions and complete the quiz on DC Connect (called Application Assignment #3). Due date is Monday March 14th

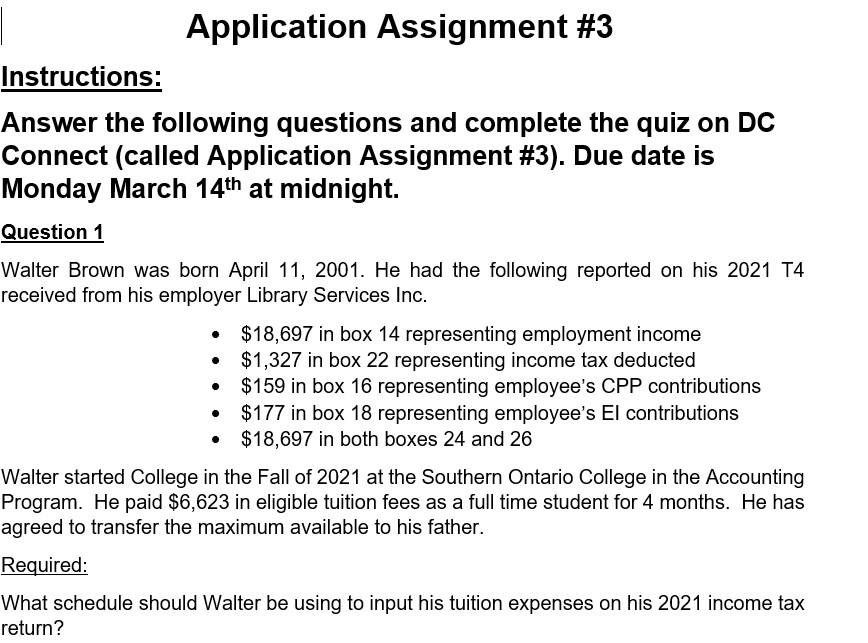

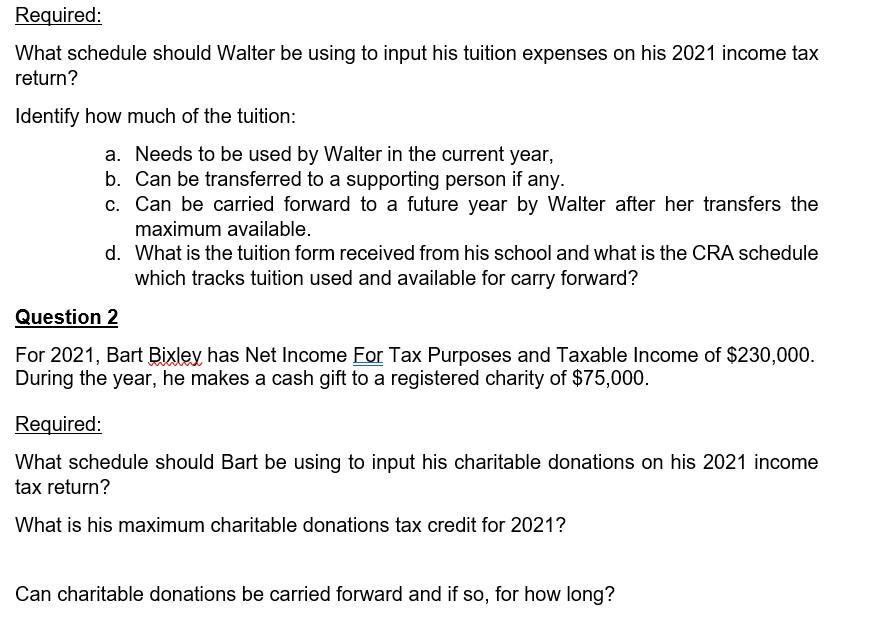

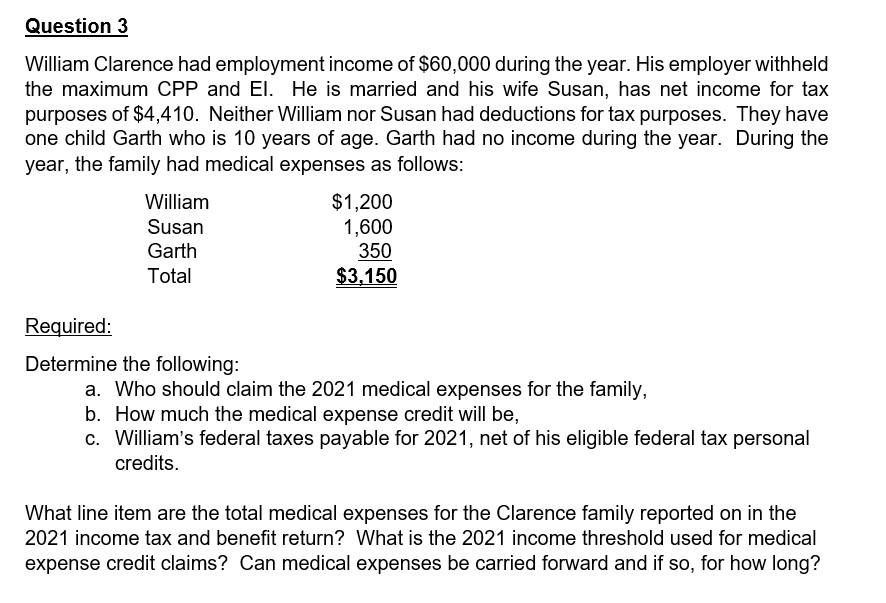

Application Assignment #3 Instructions: Answer the following questions and complete the quiz on DC Connect (called Application Assignment #3). Due date is Monday March 14th at midnight. Question 1 Walter Brown was born April 11, 2001. He had the following reported on his 2021 T4 received from his employer Library Services Inc. $18,697 in box 14 representing employment income $1,327 in box 22 representing income tax deducted $159 in box 16 representing employee's CPP contributions $177 in box 18 representing employee's El contributions $18,697 in both boxes 24 and 26 Walter started College in the Fall of 2021 at the Southern Ontario College in the Accounting Program. He paid $6,623 in eligible tuition fees as a full time student for 4 months. He has agreed to transfer the maximum available to his father. Required: What schedule should Walter be using to input his tuition expenses on his 2021 income tax return? Required: What schedule should Walter be using to input his tuition expenses on his 2021 income tax return? Identify how much of the tuition: a. Needs to be used by Walter in the current year, b. Can be transferred to a supporting person if any. c. Can be carried forward to a future year by Walter after her transfers the maximum available. d. What is the tuition form received from his school and what is the CRA schedule which tracks tuition used and available for carry forward? Question 2 For 2021, Bart Bixley has Net Income For Tax Purposes and Taxable income of $230,000. During the year, he makes a cash gift to a registered charity of $75,000. Required: What schedule should Bart be using to input his charitable donations on his 2021 income tax return? What is his maximum charitable donations tax credit for 2021? Can charitable donations be carried forward and if so, for how long? Question 3 William Clarence had employment income of $60,000 during the year. His employer withheld the maximum CPP and El. He is married and his wife Susan, has net income for tax purposes of $4,410. Neither William nor Susan had deductions for tax purposes. They have one child Garth who is 10 years of age. Garth had no income during the year. During the year, the family had medical expenses as follows: William $1,200 Susan 1,600 Garth 350 Total $3,150 Required: Determine the following: a. Who should claim the 2021 medical expenses for the family, b. How much the medical expense credit will be, c. William's federal taxes payable for 2021, net of his eligible federal tax personal credits. What line item are the total medical expenses for the Clarence family reported on in the 2021 income tax and benefit return? What is the 2021 income threshold used for medical expense credit claims? Can medical expenses be carried forward and if so, for how long? Application Assignment #3 Instructions: Answer the following questions and complete the quiz on DC Connect (called Application Assignment #3). Due date is Monday March 14th at midnight. Question 1 Walter Brown was born April 11, 2001. He had the following reported on his 2021 T4 received from his employer Library Services Inc. $18,697 in box 14 representing employment income $1,327 in box 22 representing income tax deducted $159 in box 16 representing employee's CPP contributions $177 in box 18 representing employee's El contributions $18,697 in both boxes 24 and 26 Walter started College in the Fall of 2021 at the Southern Ontario College in the Accounting Program. He paid $6,623 in eligible tuition fees as a full time student for 4 months. He has agreed to transfer the maximum available to his father. Required: What schedule should Walter be using to input his tuition expenses on his 2021 income tax return? Required: What schedule should Walter be using to input his tuition expenses on his 2021 income tax return? Identify how much of the tuition: a. Needs to be used by Walter in the current year, b. Can be transferred to a supporting person if any. c. Can be carried forward to a future year by Walter after her transfers the maximum available. d. What is the tuition form received from his school and what is the CRA schedule which tracks tuition used and available for carry forward? Question 2 For 2021, Bart Bixley has Net Income For Tax Purposes and Taxable income of $230,000. During the year, he makes a cash gift to a registered charity of $75,000. Required: What schedule should Bart be using to input his charitable donations on his 2021 income tax return? What is his maximum charitable donations tax credit for 2021? Can charitable donations be carried forward and if so, for how long? Question 3 William Clarence had employment income of $60,000 during the year. His employer withheld the maximum CPP and El. He is married and his wife Susan, has net income for tax purposes of $4,410. Neither William nor Susan had deductions for tax purposes. They have one child Garth who is 10 years of age. Garth had no income during the year. During the year, the family had medical expenses as follows: William $1,200 Susan 1,600 Garth 350 Total $3,150 Required: Determine the following: a. Who should claim the 2021 medical expenses for the family, b. How much the medical expense credit will be, c. William's federal taxes payable for 2021, net of his eligible federal tax personal credits. What line item are the total medical expenses for the Clarence family reported on in the 2021 income tax and benefit return? What is the 2021 income threshold used for medical expense credit claims? Can medical expenses be carried forward and if so, for how long

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts