Question: APPLICATION ASSIGNMENT # 5 - ACCT 3 0 5 ( Accounting Cycle ) Students - For this application assignment, you are going to complete

APPLICATION ASSIGNMENT # ACCTAccounting Cycle

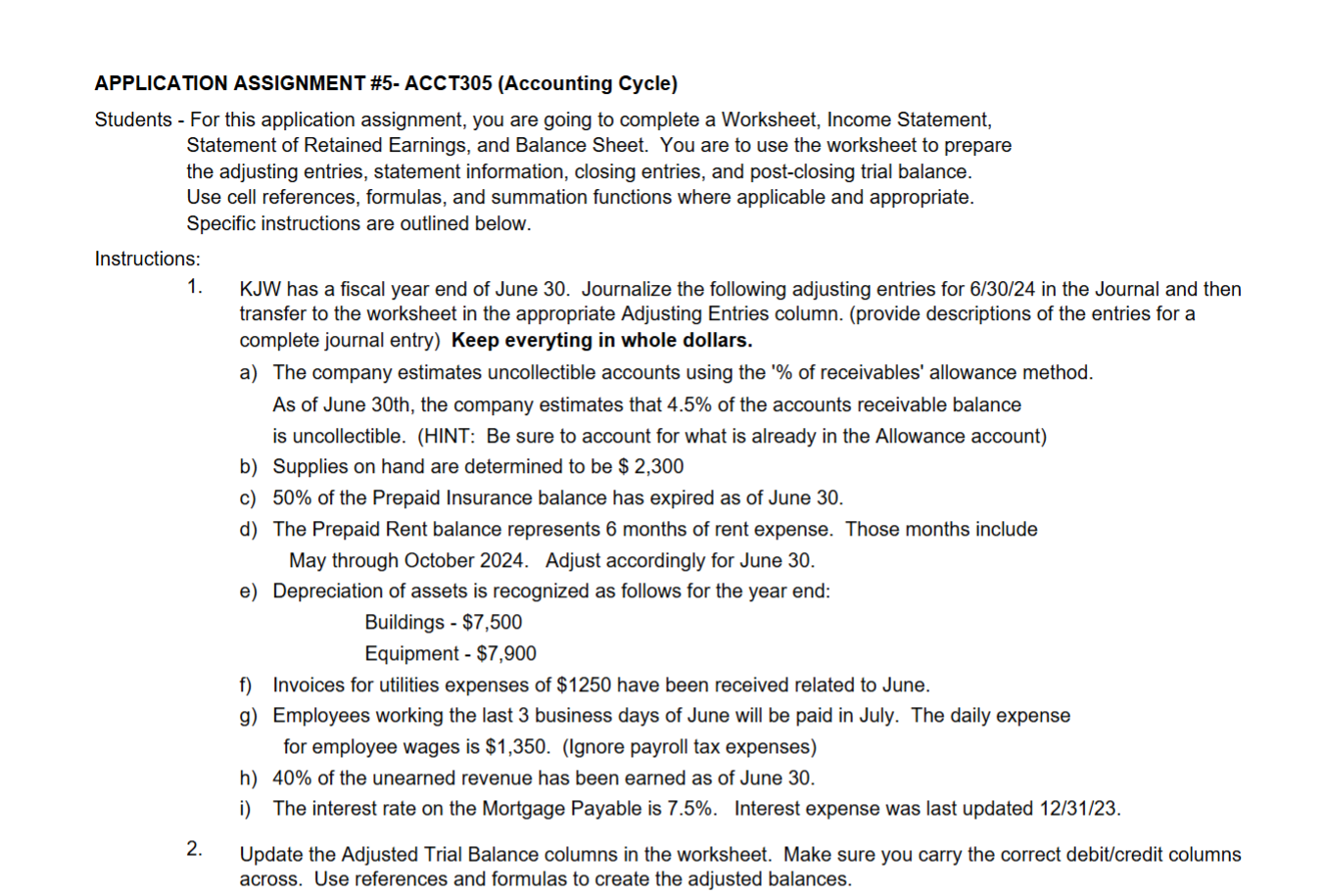

Students For this application assignment, you are going to complete A WORKSHEET, INCOME STATEMENT, STATEMENT OF RETAINED EARNINGS, AND A BALANCE SHEET. PROVIDE ALL FORMULAS, CELL REFRENCES, NO HARD ANSWERS!!!! You are to use the worksheet to prepare the adjusting entries, statement information, closing entries, and postclosing trial balance. Use cell references, formulas, and summation functions where applicable and appropriate. Specific instructions are outlined below.

Instructions:

KJW has a fiscal year end of June Journalize the following adjusting entries for in the Journal and then transfer to the worksheet in the appropriate Adjusting Entries column. provide descriptions of the entries for a complete journal entry Keep everyting in whole dollars.

a The company estimates uncollectible accounts using the of receivables' allowance method.

As of June th the company estimates that of the accounts receivable balance is uncollectible. HINT: Be sure to account for what is already in the Allowance account

b Supplies on hand are determined to be $

c of the Prepaid Insurance balance has expired as of June

d The Prepaid Rent balance represents months of rent expense. Those months include May through October Adjust accordingly for June

e Depreciation of assets is recognized as follows for the year end:

Buildings $

Equipment $

f Invoices for utilities expenses of $ have been received related to June.

g Employees working the last business days of June will be paid in July. The daily expense for employee wages is $ Ignore payroll tax expenses

h of the unearned revenue has been earned as of June

i The interest rate on the Mortgage Payable is Interest expense was last updated

Update the Adjusted Trial Balance columns in the worksheet. Make sure you carry the correct debitcredit columns across. Use references and formulas to create the adjusted balances.

Carry over the applicable balances to the Income Statement and Balance Sheet columns. Remember the difference

in debitscredits will be the Net Income which should be added to the bottom of the worksheet columns for each.

Use the other provided blank worksheets to prepare, in proper format, the Income Statement, Statement of Retained

Earnings, and classified Balance Sheet for the period ending. Formatting and labeling should be appropriate,

consistent, and userfriendly. USE Spellcheck for each worksheet Please refer to examples in the book if you

question titles and classifications.

$ of the Mortgage Payable is due December

Write up the closing journal entries in the Journal and transfer to the Worksheet. Remember, all temporary accounts

are closed during this process. There are four journal entries involved.

Carry over the balances, after closing entries, to the Post Closing Trial Balance on the worksheet. Only permanent

accounts should have balances.

Complete these requirements and rename the application file as directed. Attach the completed

file to the assignment link in Blackboard by the due date provided in Blackboard.

For general and closing journal entries

Always provide descriptions for your journal entries below each entry

Ref Date General Journal Account Titles Debit Credit

Journal Worksheet Income Statement Statement of Retained Earnings Balance Sheet

For general and closing journal entries

Always provide descriptions for your journal entries below each entry

Ref Date General Journal Account Titles Debit Credit

KJW Company Worksheet For the Year Ended June

Trial Balance Adjusting Entries Adjusted Trial Balance Income Statement Balance Sheet Closing Entries PostClosing Trial Balance Account Titles Db Cr Ref Db Cr Ref Db Cr Db Cr Db Cr Ref Db Cr Ref Db Cr Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Prepaid Rent Land Buildings Accum. DepreciationBldgs Equipment Accum. DepreciationEquip. Goodwill Patents Accounts Payable Unearned Revenue interest Payable Salaries and Wages Payable Mortgage Payable Common Stock $ par Paid in Capital in Excess of parCS Dividends Retained Earnings Income Summary Sales Revenue Supplies Expense Salaries and Wages Expense Maint. and Repairs Expense Adv

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock