Question: Application of the NPV method [LO 11 The Two Bit Mining Company has constructed a town at Big Bore, near the site of a rich

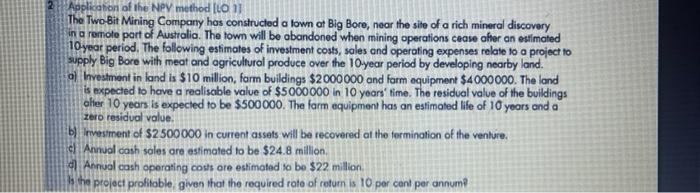

Application of the NPV method [LO 11 The Two Bit Mining Company has constructed a town at Big Bore, near the site of a rich mineral discovery in a remote part of Australia. The town will be abandoned when mining operations cease after an estimated 10 year period. The following estimates of investment costs, sales and operating expenses relate to a project to supply Big Bore with meat and agricultural produce over the 10year period by developing nearby land. ol Investment in land is $10 million, farm buildings $2000000 and form equipment $4000000. The land is expected to have a realisable value of $5000000 in 10 years' time. The residual value of the buildings oler 10 years is expected to be $500000. The farm equipment has an estimated life of 10 years and a zero residual value b) Investment of $2500000 in current assets will be recovered at the termination of the venture, dh Annual cash soles are estimated to be $24.8 million, Annual cash operating costs ore estimated to be $22 million, th the project profitoble, given that the required rate of return is 10 per cent per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts