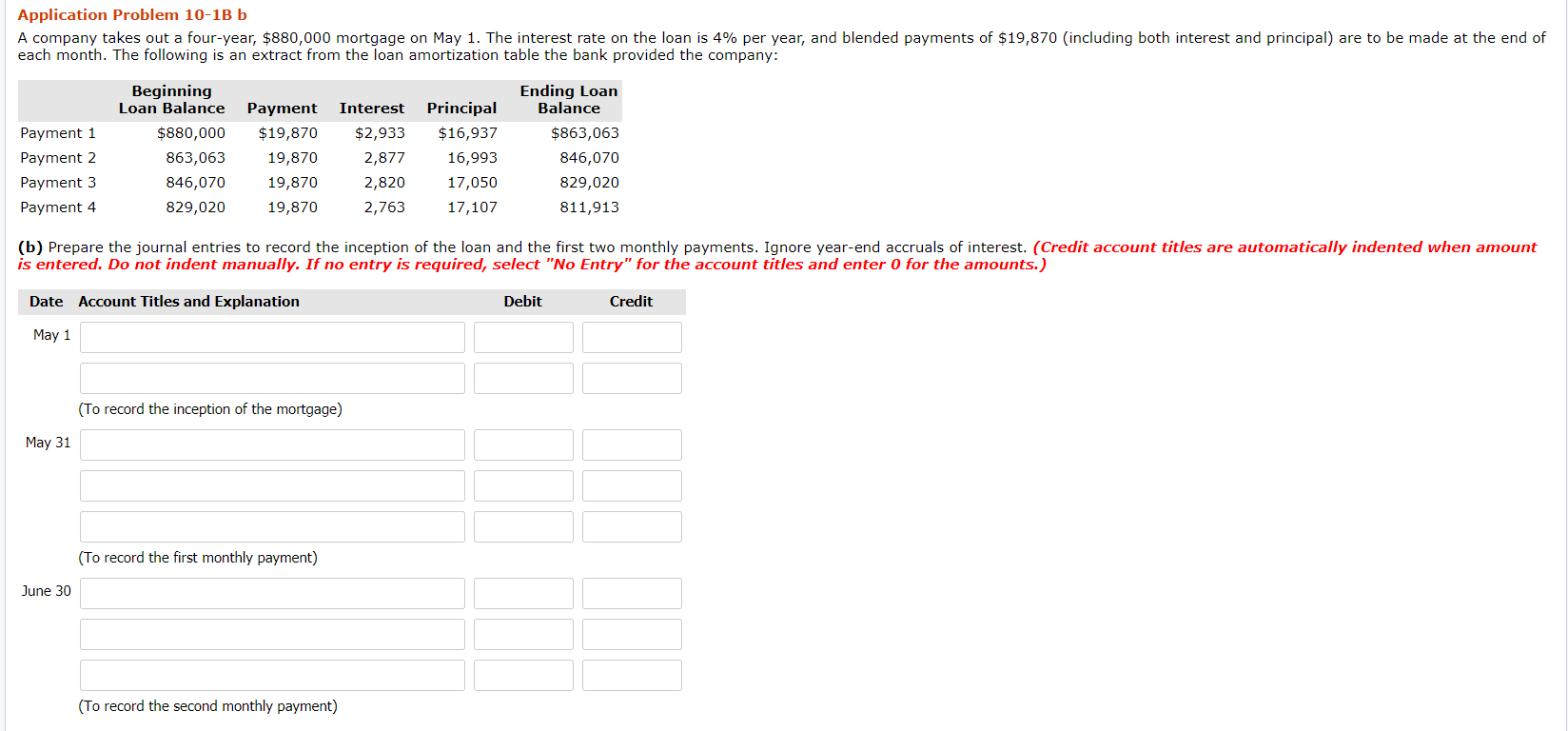

Question: Application Problem 10-13 b A company takes out a four-year, $880,000 mortgage on May 1. The interest rate on the loan is 4% per year,

Application Problem 10-13 b A company takes out a four-year, $880,000 mortgage on May 1. The interest rate on the loan is 4% per year, and blended payments of $19,870 (including both interest and principal) are to be made at the end of each month. The following is an extract from the loan amortization table the bank provided the company: Payment 1 Payment 2 Payment 3 Payment 4 Beginning Loan Balance $880,000 863,063 846,070 829,020 Payment $19,870 19,870 19,870 19,870 Interest $2,933 2,877 2,820 2,763 Principal $16,937 16,993 17,050 17,107 Ending Loan Balance $863,063 846,070 829,020 811,913 (b) Prepare the journal entries to record the inception of the loan and the first two monthly payments. Ignore year-end accruals of interest. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit May 1 (To record the inception of the mortgage) May 31 (To record the first monthly payment) June 30 (To record the second monthly payment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts