Question: Application Problem 10-5A a, c-d Sawada Insurance Ltd. issues bonds with a face value of $100 million that mature in 12 years. The bonds carry

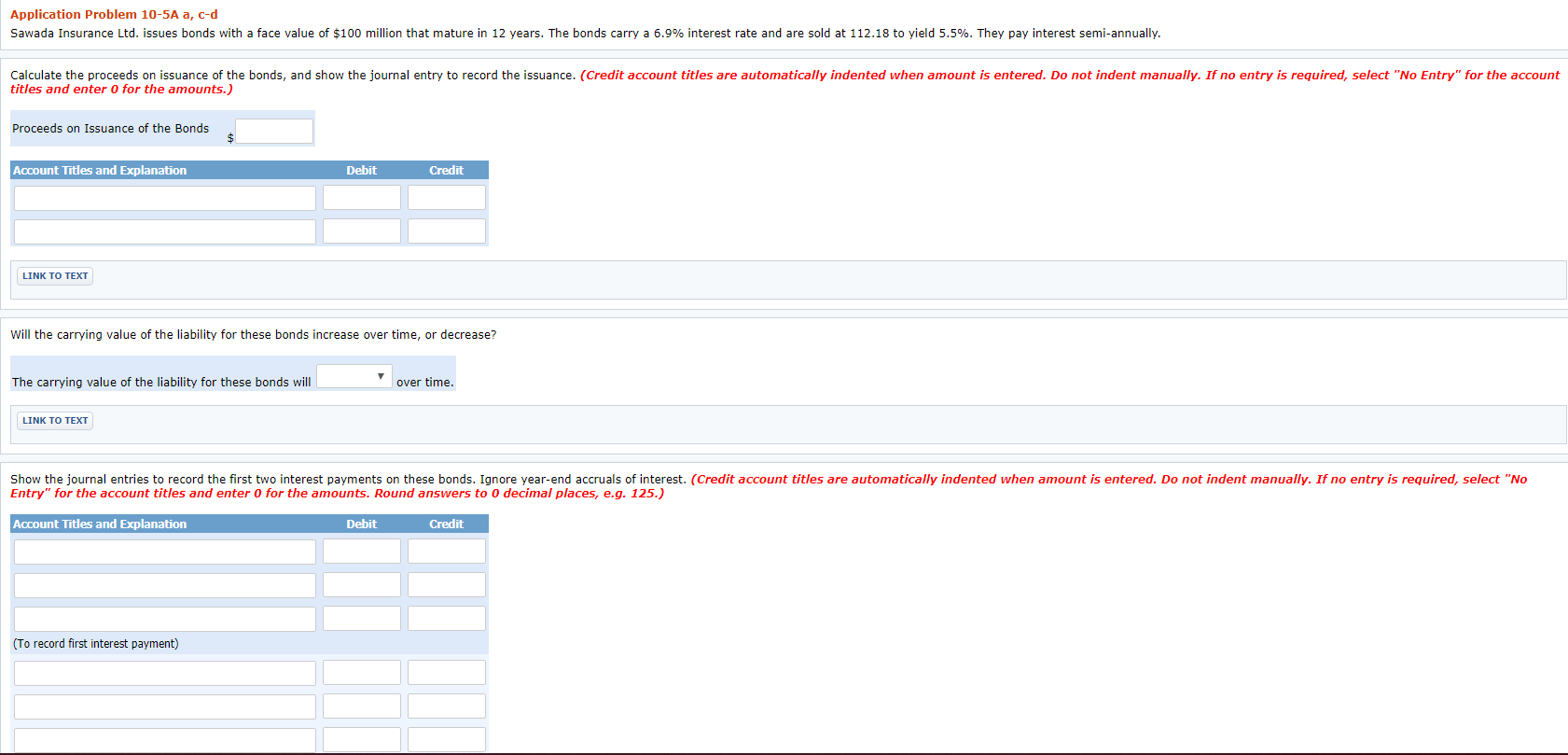

Application Problem 10-5A a, c-d Sawada Insurance Ltd. issues bonds with a face value of $100 million that mature in 12 years. The bonds carry a 6.9% interest rate and are sold at 112.18 to yield 5.5%. They pay interest semi-annually. Calculate the proceeds on issuance of the bonds, and show the journal entry to record the issuance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Proceeds on Issuance of the Bonds Account Titles and Explanation Debit Credit LINK TO TEXT Will the carrying value of the liability for these bonds increase over time, or decrease? The carrying value of the liability for these bonds will over time. LINK TO TEXT Show the journal entries to record the first two interest payments on these bonds. Ignore year-end accruals of interest. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 125.) Account Titles and Explanation Debit Credit (To record first interest payment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts