Question: Application Problem 9-10A Dividend Aristocrat Inc. (DA) borrowed $186,000 from Grow Business Bank to finance the purchase of equipment costing $139,500 and to provide $46,500

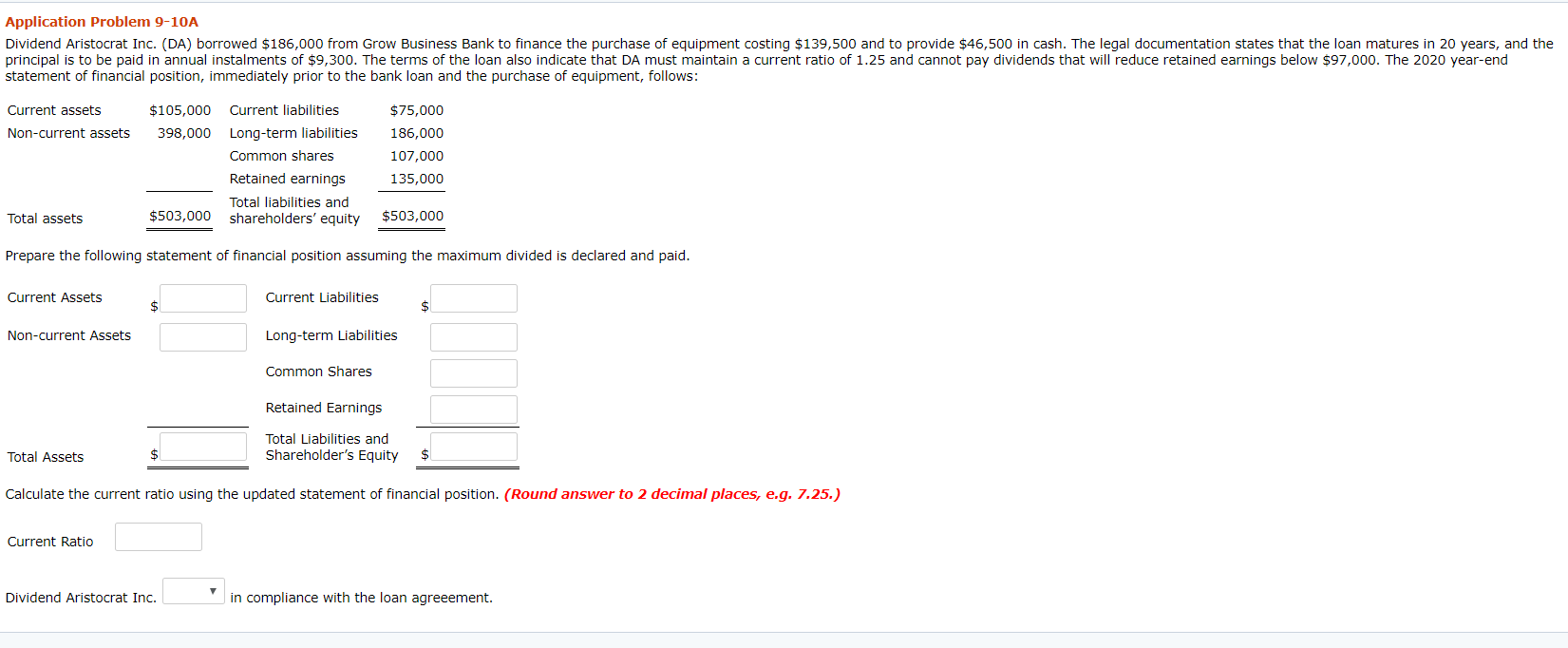

Application Problem 9-10A Dividend Aristocrat Inc. (DA) borrowed $186,000 from Grow Business Bank to finance the purchase of equipment costing $139,500 and to provide $46,500 in cash. The legal documentation states that the loan matures in 20 years, and the principal is to be paid in annual instalments of $9,300. The terms of the loan also indicate that DA must maintain a current ratio of 1.25 and cannot pay dividends that will reduce retained earnings below $97,000. The 2020 year-end statement of financial position, immediately prior to the bank loan and the purchase of equipment, follows: Current assets Non-current assets $105,000 398,000 Current liabilities Long-term liabilities Common shares Retained earnings Total liabilities and shareholders' equity $75,000 186,000 107,000 135,000 Total assets $503,000 $503,000 Prepare the following statement of financial position assuming the maximum divided is declared and paid. Current Assets Current Liabilities $ Non-current Assets Long-term Liabilities Common Shares Retained Earnings Total Liabilities and Shareholder's Equity Total Assets $ Calculate the current ratio using the updated statement of financial position. (Round answer to 2 decimal places, e.g. 7.25.) Current Ratio Dividend Aristocrat Inc. in compliance with the loan agreeement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts