Question: Applied Computational Finance; Ito's Formula. Please write full calculations. Thank you! 1. Let (W(t))t0 denote a standard Brownian motion. Consider a model of asset price

Applied Computational Finance; Ito's Formula. Please write full calculations. Thank you!

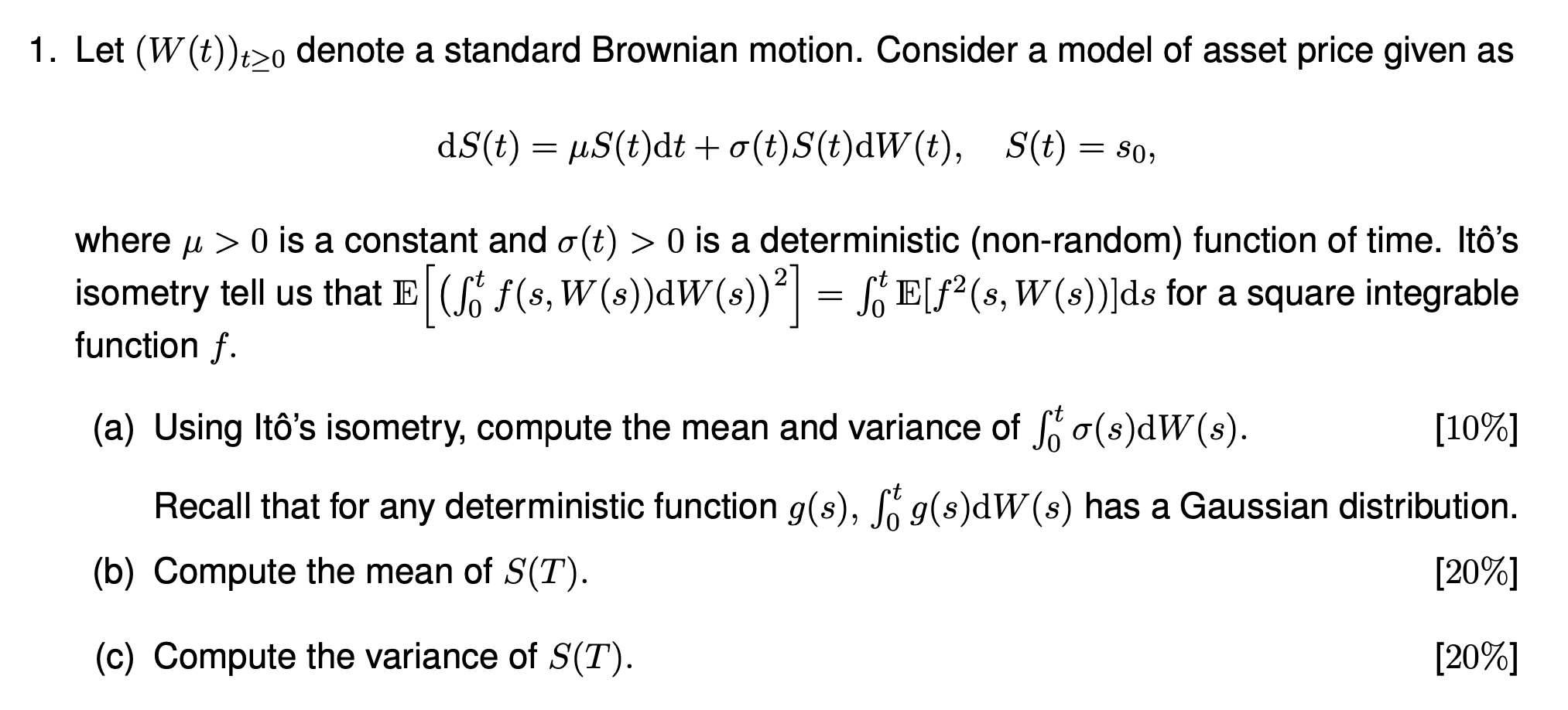

1. Let (W(t))t0 denote a standard Brownian motion. Consider a model of asset price given as dS(t)=S(t)dt+(t)S(t)dW(t),S(t)=s0 where >0 is a constant and (t)>0 is a deterministic (non-random) function of time. It's isometry tell us that E[(0tf(s,W(s))dW(s))2]=0tE[f2(s,W(s))]ds for a square integrable function f. (a) Using It's isometry, compute the mean and variance of 0t(s)dW(s). [10\%] Recall that for any deterministic function g(s),0tg(s)dW(s) has a Gaussian distribution. (b) Compute the mean of S(T). [20\%] (c) Compute the variance of S(T). [20\%]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts