Question: Apply It: Corporate Formation Total points: - - / 5 Attempts left: 1 Solo Services, Inc. was a corporation A business of this type considered

Apply It: Corporate Formation

Total points:

Attempts left:

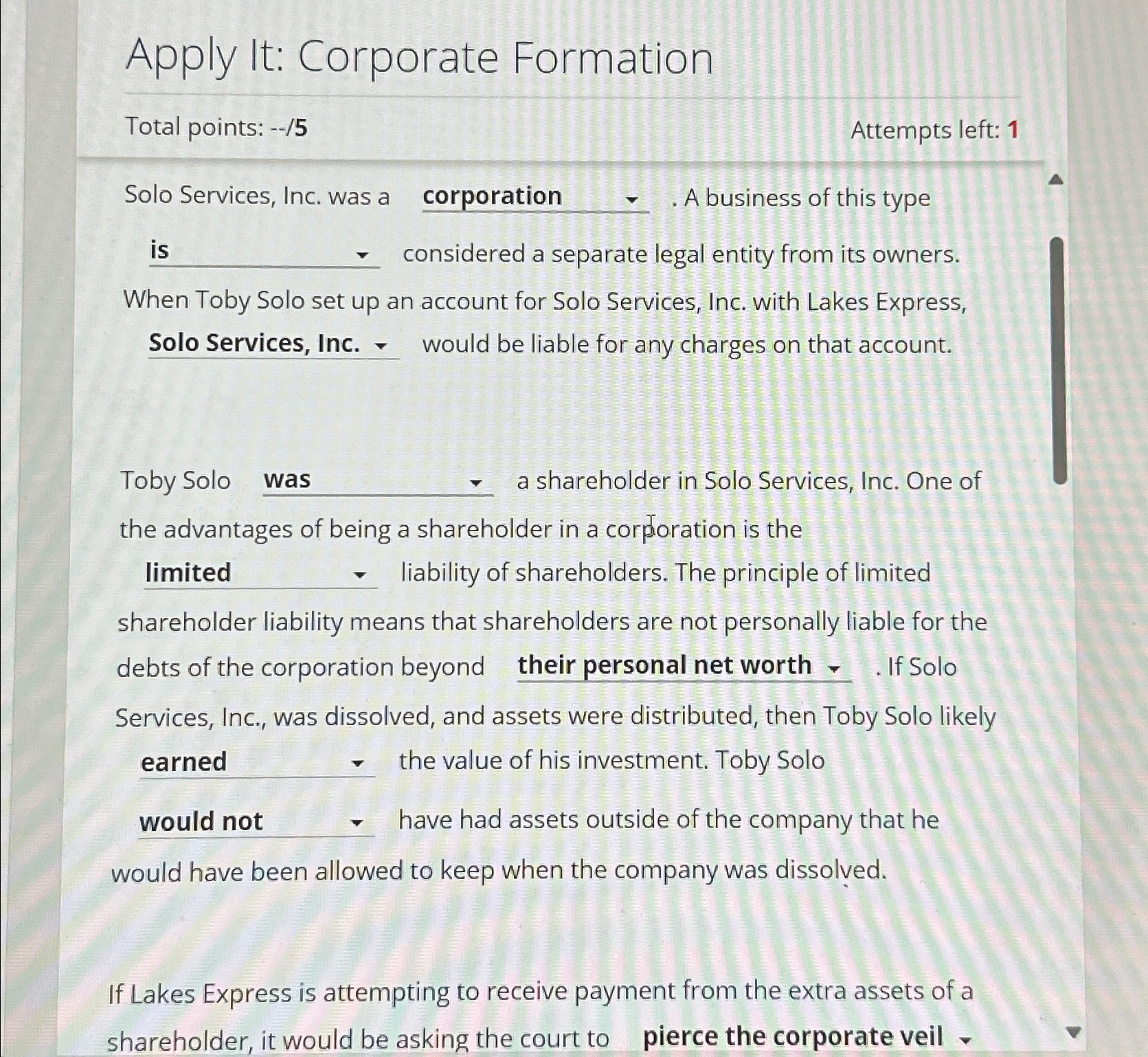

Solo Services, Inc. was a corporation A business of this type considered a separate legal entity from its owners.

When Toby Solo set up an account for Solo Services, Inc. with Lakes Express, Solo Services, Inc. would be liable for any charges on that account.

Toby Solo was a shareholder in Solo Services, Inc. One of the advantages of being a shareholder in a corporation is the

limited liability of shareholders. The principle of limited shareholder liability means that shareholders are not personally liable for the debts of the corporation beyond their personal net worth If Solo Services, Inc., was dissolved, and assets were distributed, then Toby Solo likely earned the value of his investment. Toby Solo

would not have had assets outside of the company that he would have been allowed to keep when the company was dissolved.

If Lakes Express is attempting to receive payment from the extra assets of a shareholder, it would be asking the court to pierce the corporate veil

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock