Question: Apply manufacturing overhead and determine under- or overapplication. DO IT! 2.5 (LO 5), AP For Eckstein Company, the predetermined overhead rate is 130% of direct

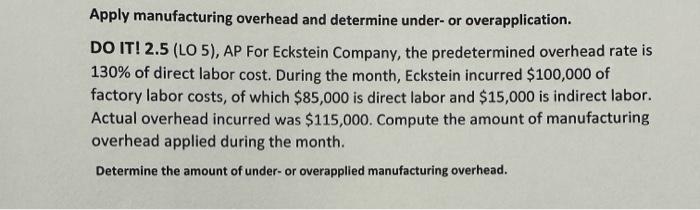

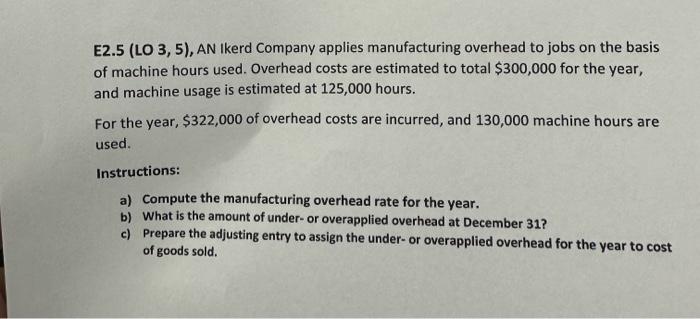

Apply manufacturing overhead and determine under- or overapplication. DO IT! 2.5 (LO 5), AP For Eckstein Company, the predetermined overhead rate is 130% of direct labor cost. During the month, Eckstein incurred $100,000 of factory labor costs, of which $85,000 is direct labor and $15,000 is indirect labor. Actual overhead incurred was $115,000. Compute the amount of manufacturing overhead applied during the month. Determine the amount of under- or overapplied manufacturing overhead. E2.5 (LO 3,5), AN Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are estimated to total $300,000 for the year, and machine usage is estimated at 125,000 hours. For the year, $322,000 of overhead costs are incurred, and 130,000 machine hours are used. Instructions: a) Compute the manufacturing overhead rate for the year. b) What is the amount of under- or overapplied overhead at December 31 ? c) Prepare the adjusting entry to assign the under- or overapplied overhead for the year to cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts