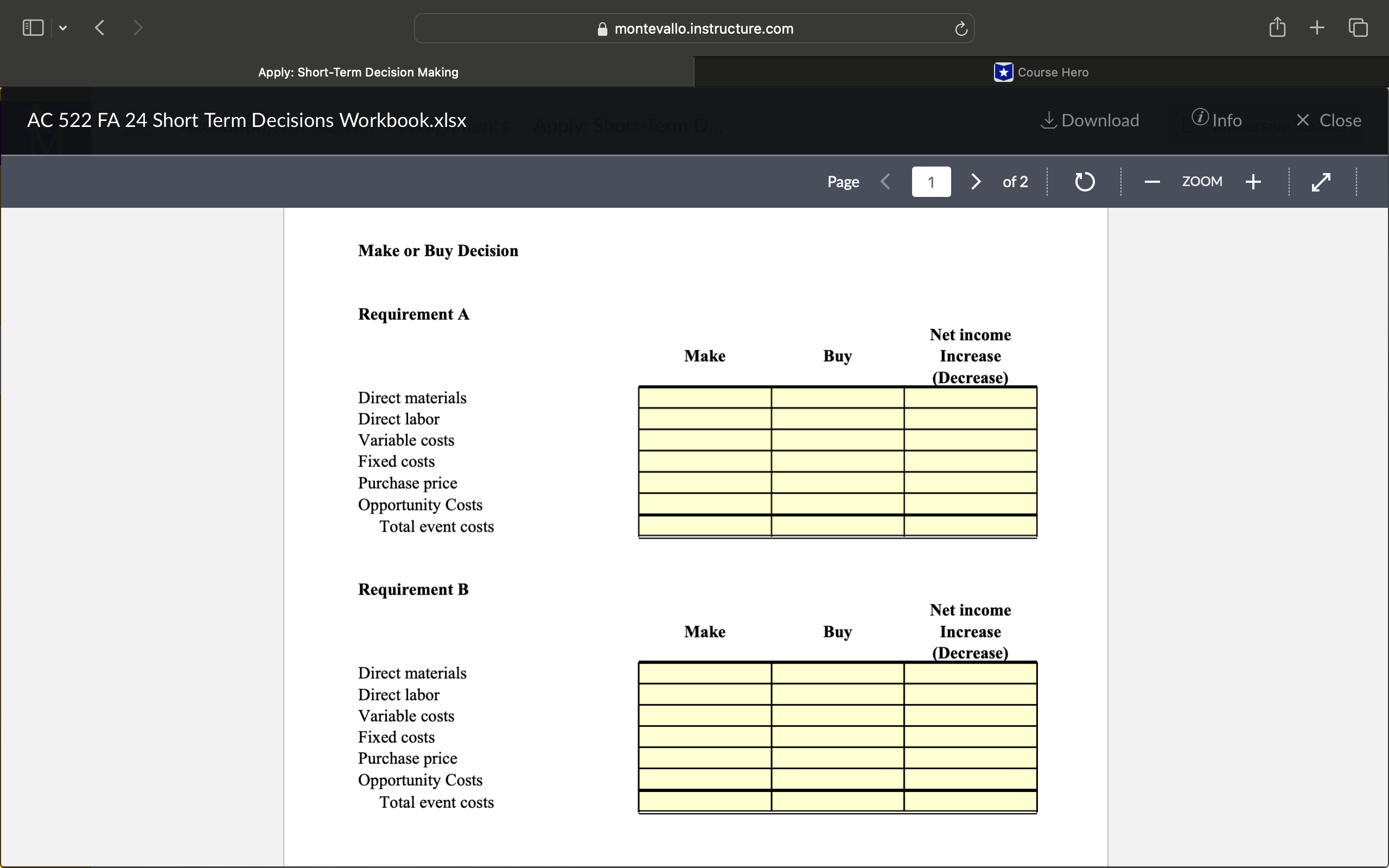

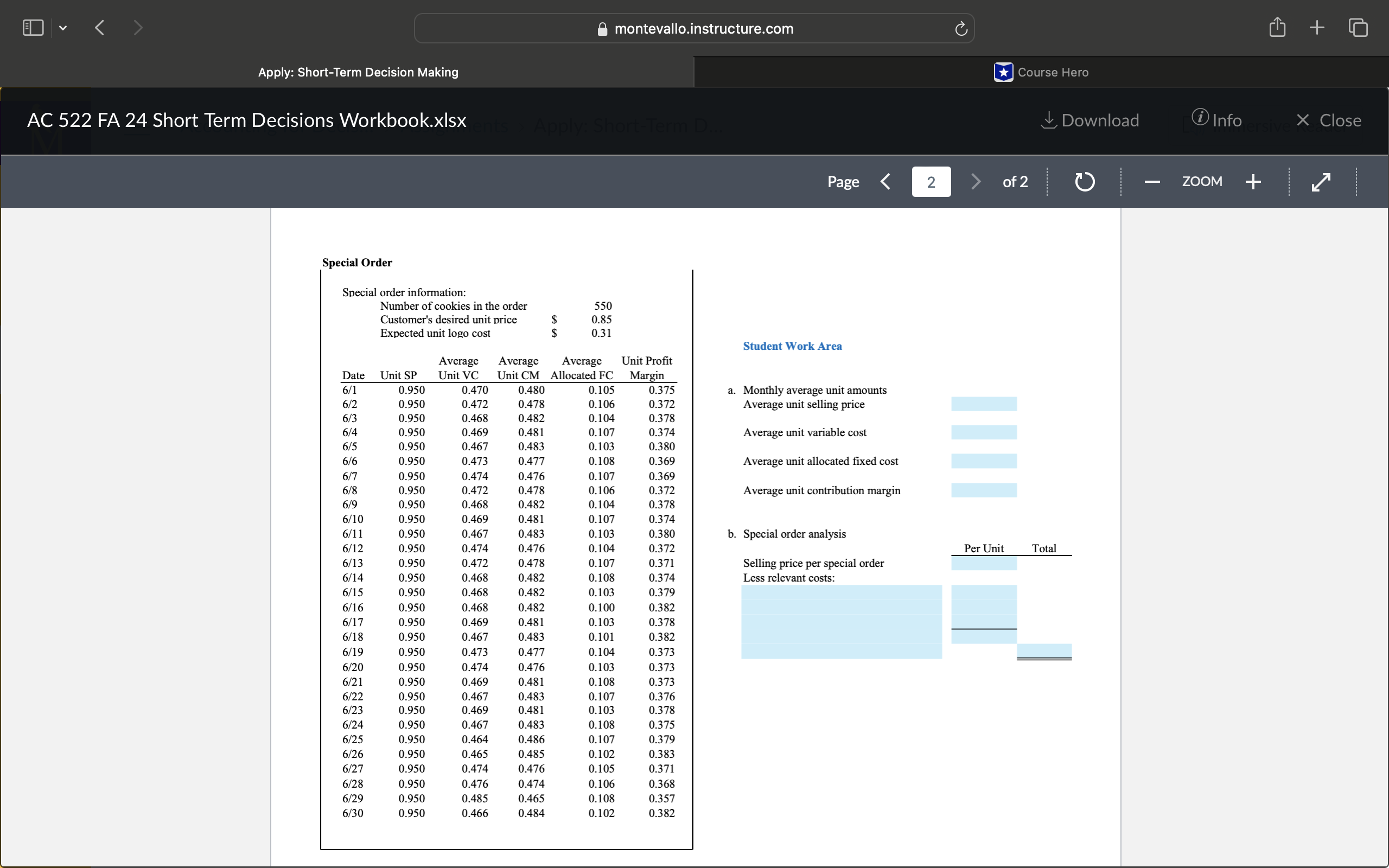

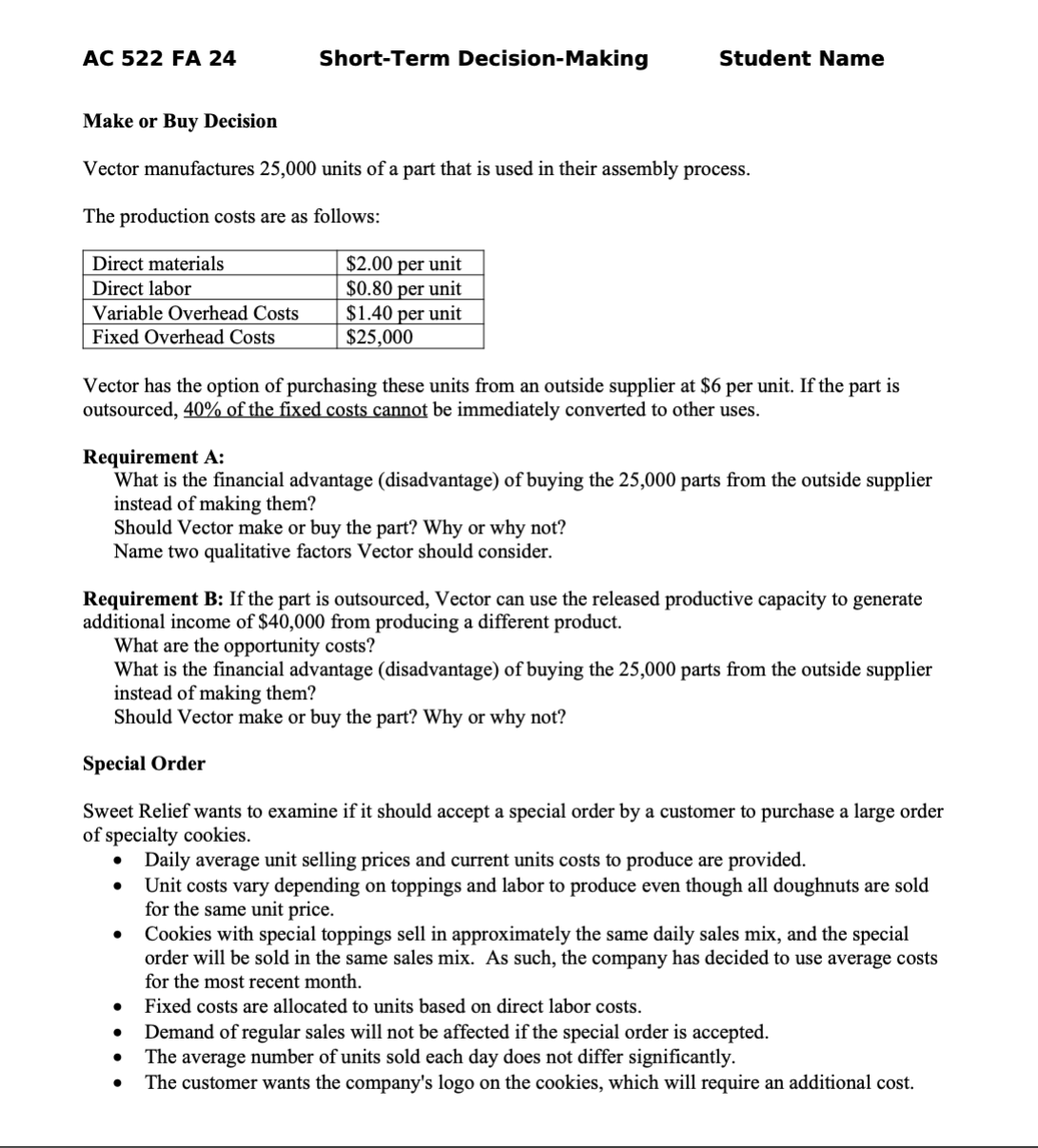

Question: Apply: Short-Term Decision Making AC 522 FA 24 Short Term Decisions Workbook.xIsx Make or Buy Decision Requirement A Direct materials Direct labor Variable costs Fixed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts