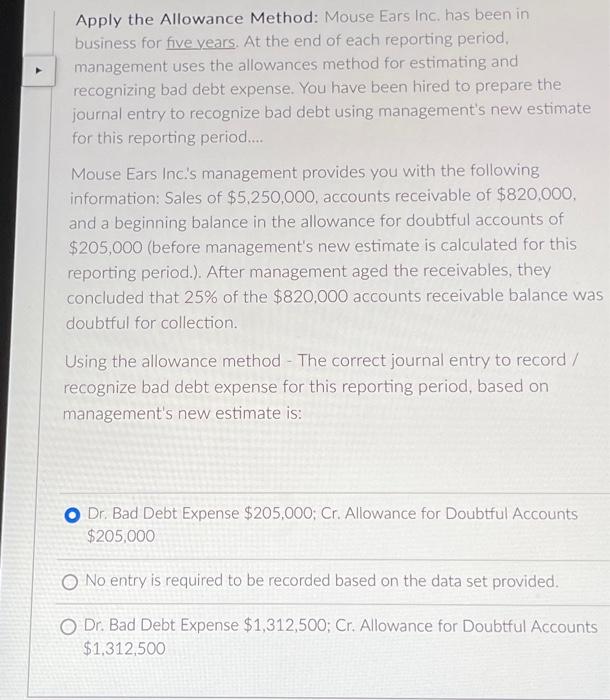

Question: Apply the Allowance Method: Mouse Ears Inc. has been in business for five vears. At the end of each reporting period, management uses the allowances

Apply the Allowance Method: Mouse Ears Inc. has been in business for five vears. At the end of each reporting period, management uses the allowances method for estimating and recognizing bad debt expense. You have been hired to prepare the journal entry to recognize bad debt using management's new estimate for this reporting period.... Mouse Ears Inc's management provides you with the following information: Sales of $5,250,000, accounts receivable of $820,000, and a beginning balance in the allowance for doubtful accounts of $205,000 (before management's new estimate is calculated for this reporting period.). After management aged the receivables, they concluded that 25% of the $820,000 accounts receivable balance was doubtful for collection. Using the allowance method - The correct journal entry to record / recognize bad debt expense for this reporting period, based on management's new estimate is: Dr. Bad Debt Expense $205,000; Cr. Allowance for Doubtful Accounts $205,000 No entry is required to be recorded based on the data set provided. Dr. Bad Debt Expense $1,312,500; Cr. Allowance for Doubtful Accounts $1,312,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts