Question: MGT 337: SUPPLY CHAIN MANAGEMENT - EVALUATION 2 Apply the cost plus (should cost) framework presented in class to complete the questions below. Complete

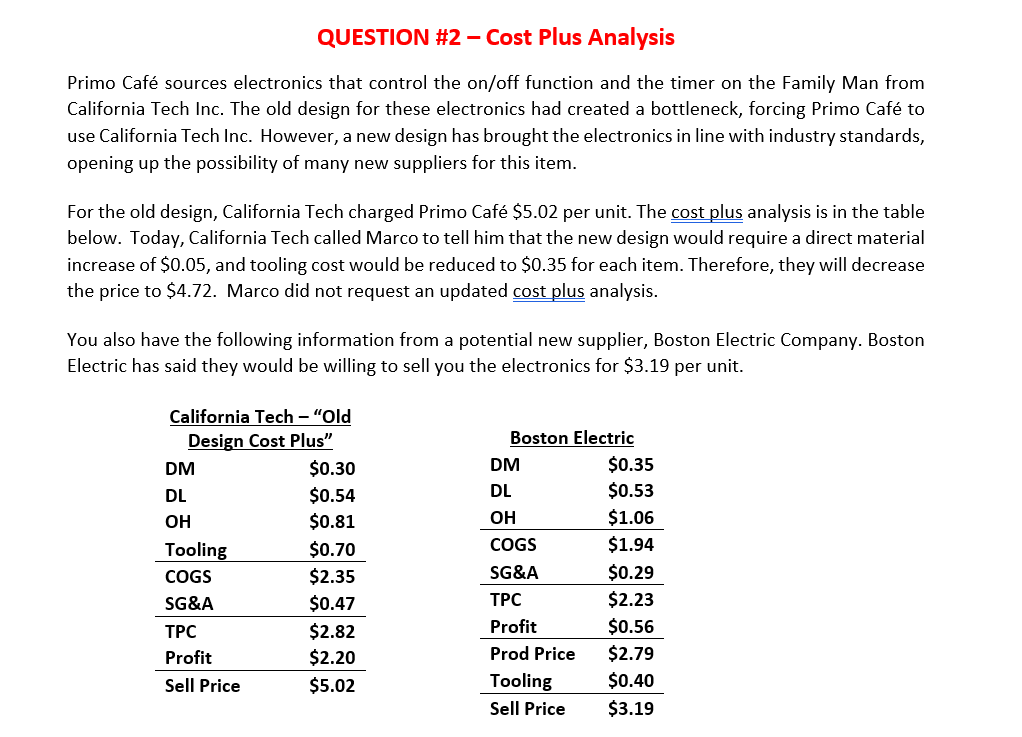

MGT 337: SUPPLY CHAIN MANAGEMENT - EVALUATION 2 Apply the cost plus (should cost) framework presented in class to complete the questions below. Complete all calculations in the excel file that you will upload with your exam. 1. Using California Tech's old design cost plus analysis, create a cost plus analysis that applies the changes to direct material costs and tooling costs that were identified. With just these changes, what should the price of the new design from California Tech? 2. Create additional cost plus analyses for each supplier with any other adjustments that you think are relevant. 3. What might be an appropriate range of best and worst prices that you would want to consider when negotiating price with each supplier? Why? 4. Marco is willing to negotiate with both suppliers and wants a recommendation on how Primo Caf should proceed in discussions with each supplier. Be sure to reference your analysis in the recommendation. QUESTION #2 - Cost Plus Analysis Primo Caf sources electronics that control the on/off function and the timer on the Family Man from California Tech Inc. The old design for these electronics had created a bottleneck, forcing Primo Caf to use California Tech Inc. However, a new design has brought the electronics in line with industry standards, opening up the possibility of many new suppliers for this item. For the old design, California Tech charged Primo Caf $5.02 per unit. The cost plus analysis is in the table below. Today, California Tech called Marco to tell him that the new design would require a direct material increase of $0.05, and tooling cost would be reduced to $0.35 for each item. Therefore, they will decrease the price to $4.72. Marco did not request an updated cost plus analysis. You also have the following information from a potential new supplier, Boston Electric Company. Boston Electric has said they would be willing to sell you the electronics for $3.19 per unit. California Tech - "Old Design Cost Plus" Boston Electric DM $0.30 DM $0.35 DL $0.54 DL $0.53 OH $0.81 OH $1.06 Tooling $0.70 COGS $1.94 COGS $2.35 SG&A $0.29 SG&A $0.47 TPC $2.23 TPC $2.82 Profit $0.56 Profit $2.20 Prod Price $2.79 Sell Price $5.02 Tooling $0.40 Sell Price $3.19 Since Primo will be buying a standard product, you found that the average overhead rate for this industry should be 120% and the average profit mark-up should be about 20%. SG&A mark-up is considered acceptable at about 15% of COGS. Marco likes California Tech Inc. because they have been willing to accommodate changes in demand. California Tech has also had an excellent track record in terms of getting the electronics to Primo Caf on time. Marco doesn't know much about Boston Electric except for the cost information above and he is somewhat hesitant to make the switch to an unknown supplier for this part.

Step by Step Solution

There are 3 Steps involved in it

To complete the analysis lets go through each step 1 Cost Plus Analysis for California Techs New Design Old Costs Direct Materials DM 030 Direct Labor ... View full answer

Get step-by-step solutions from verified subject matter experts