Question: Apply the MacDonald methodology to solve the case? Case AERO You are an audit manager at Lion Tamer (LT) LLP. You are working on the

Apply the MacDonald methodology to solve the case?

Case AERO

You are an audit manager at Lion Tamer (LT) LLP. You are working on the planning for the year-end audit of AERO Inc. AERO has been LT's client for 10 years. It is a medium-size private client. Founded in 2006, the company is specialized in precision manufacturing for the aerospace industry. Its main lines of products are aluminum, titanium and stainless-steel engine components. Thanks to constant innovation and competitive assembly processes, the company is very cost-effective and is recognized as a reliable, efficient and fast-responding supplier by all aerospace market stakeholders. AERO owns two manufacturing sites and employs 128 individuals. Building on a tradition of quality and on the excellent leadership of Jack Page, the CEO and founding owner, the company has recently introduced state-of-the-art management tools, and a new strategic plan which includes ambitious research and development investment objectives for the future. The industry has always been extremely competitive. Furthermore, due to environmental concerns regarding travelling by plane, and the recent pandemic-related travel restrictions, AERO main clients have been experiencing a significant slowdown in recent years. AERO nevertheless manages to do well compared to the rest of the industry thanks to an ambitious cost reduction plan. Over the years, Mona Tylsa, the engagement partner, has managed to build a solid relationship with Jack, based on mutual trust. It is not your first time working on this audit engagement, so you know that for the first years of the audit, internal controls were inadequate and that the accounting personnel (chief accountant and bookkeeper) were rather underqualified for their responsibilities. At the time, extensive audit evidence was required, and numerous audit adjustments were necessary. However, thanks to Mona's constant recommendations, internal controls improved gradually, and the accounting team has received a lot of training. In the last five years, there were normally not a lot of audit adjustments required and the extent of the evidence accumulation was gradually reduced. You are working on the audit plan for the current year's audit. You have taken notes during a recent meeting with the client, and summarized some key elements found in the prior year audit file and in the initial planning audit papers prepared by the audit senior (Exhibit 1), you have also obtained forecast data for the current year (2022) (Exhibit 2). You are now rushing to finish drafting a preliminary audit planning memo based on what you have learnt so far. At this preliminary stage, the planning memo will only include the risk assessment, a preliminary discussion about materiality, and an indication of key risky areas that will necessitate increased audit effort this year. You need to bring the memo to the audit partner on Monday.

Exhibit 1 - AERO audit planning - Preparation Notes

1. Notes from last year's (2021) audit file:

The senior in charge of the tests of control last year noted that these tests took longer than expected because of the use of several new junior auditors in the team, of a change in the client accounting system to computerize the inventory and other accounting records, and of the existence of a few more differences than what was found in the past. However, the results of the control tests were not alarming and did not conduct to a revaluation of the control risk. At yearend, based on a relatively reduced sample, inventory substantive tests performed by the audit junior revealed several items in the inventory that were overstated as the result of programming errors for the pricing of work in progress in the new computer system and of the inclusion of some items received in early January 2022 in the final inventory listing for December 2021 which had been printed one week after the inventory count had actually been taken. Each of the errors found were fortunately below performance materiality and did not conduct to any adjustment

2. To administer the company's finances AERO Inc. employs Julius (CFO), Jing (Chief Accountant) and Sam (bookkeeper). Jing was very experienced, she had done all the financial statement preparation for AERO since the company's inception and she retired in February 2022. It took more than three months to replace her, and Sam, the bookkeeper, has worked very hard during that period, with almost no supervision. Thankfully, a new chief accountant, Sophia has joined the accounting team in May 2022. She already knows the company because she is the wife of the head of the IT department.

3. In the past, the accounting records were done on a simple accounting software and were using a lot of paper documents and manual controls. Since the implementation of the new information system developed in-house by the IT department in 2021, many automated controls are now in place and permit to monitor the inventory quantities and costing in real time, for all the different product references.

4. In early 2022, two members of the IT team have abruptly resigned. In order to further improve the internal controls on the inventory, Jack has hired a team of consultants to finalize the integration of the new accounting software modules and to develop an improved interface between the cost accounting system and the perpetual inventory system. For that reason, the costing and pricing problems encountered last year should be solved this year. Jack is confident that we will be able to rely on the controls for the audit of the inventory-related transactions (purchases - production - inventory - sales).

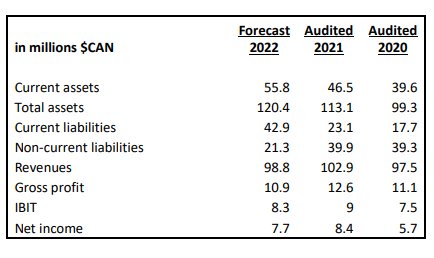

Exhibit 2: Summarized financial data

Forecast Audited Audited in millions $CAN 2022 2021 2020 Current assets 55.8 46.5 39.6 Total assets 120.4 113.1 99.3 Current liabilities 42.9 23.1 17.7 Non-current liabilities 21.3 39.9 39.3 Revenues 98.8 102.9 97.5 Gross profit 10.9 12.6 11.1 IBIT 8.3 LD 7.5 Net income 7.7 8.4 5.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts