Question: Apply the statistical concepts and techniques covered in this week's reading about one-way analysis of variance (ANOVA). An investment analyst is evaluating the 10-year mean

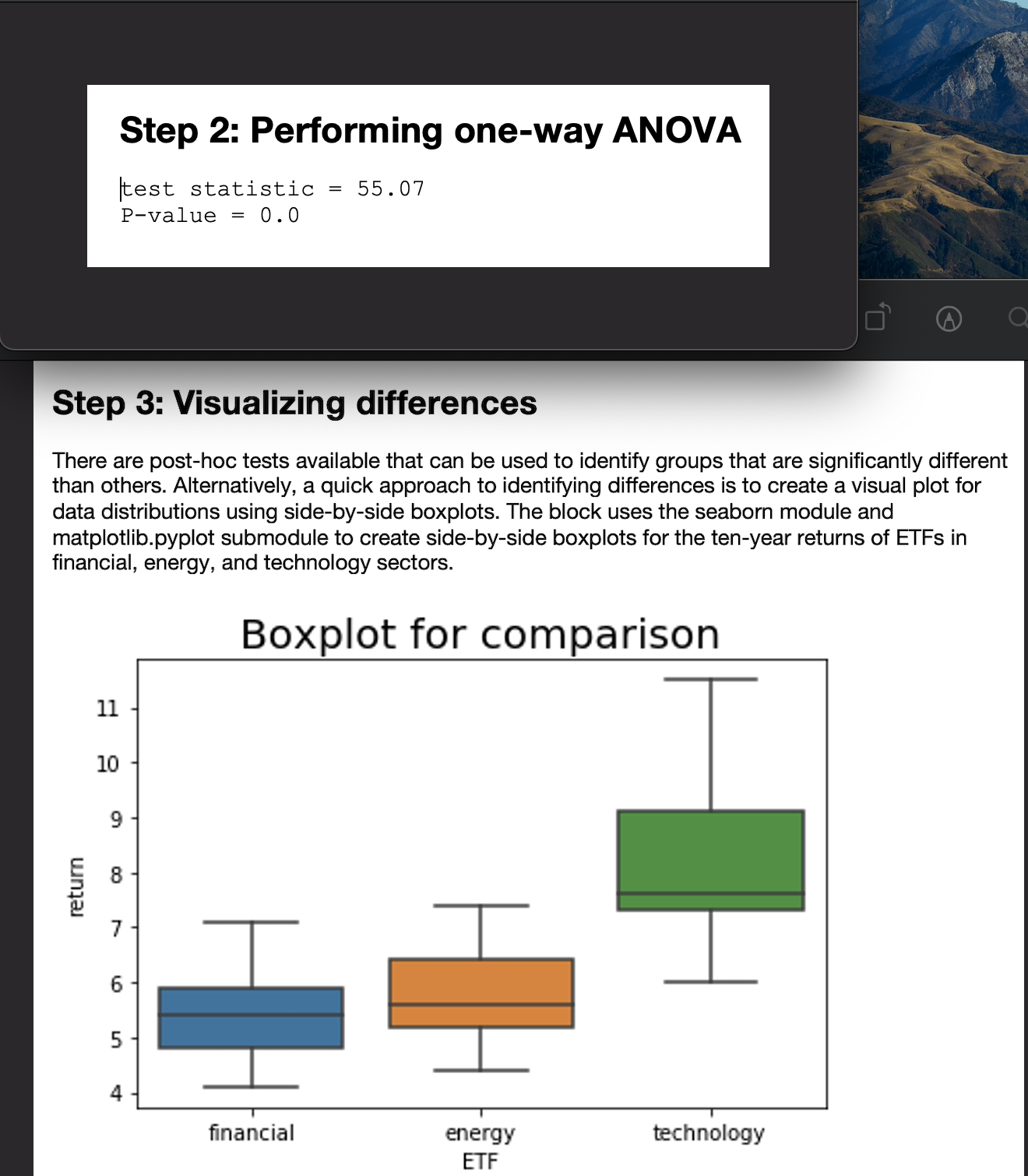

Apply the statistical concepts and techniques covered in this week's reading about one-way analysis of variance (ANOVA). An investment analyst is evaluating the 10-year mean return on investment for industry-specific exchange-traded funds (ETFs) for three sectors: financial, energy, and technology. The analyst obtains a random sample of 30 ETFs for each sector and calculates the 10-year return of each ETF. The analyst has provided you with this data set. Run Step 1 in the Python script to upload the data file.

Using the sample data, perform one-way analysis of variance (ANOVA). Evaluate whether the average return ofat least oneof the industry-specific ETFs is significantly different. Use a 5% level of significance.

In your initial post, address the following items:

- Define the null and alternative hypothesis in mathematical terms and in words.

- Report the level of significance.

- Include the test statistic and the P-value. See Step 2 in the Python script.

- Provide your conclusion and interpretation of the test. Should the null hypothesis be rejected? Why or why not?

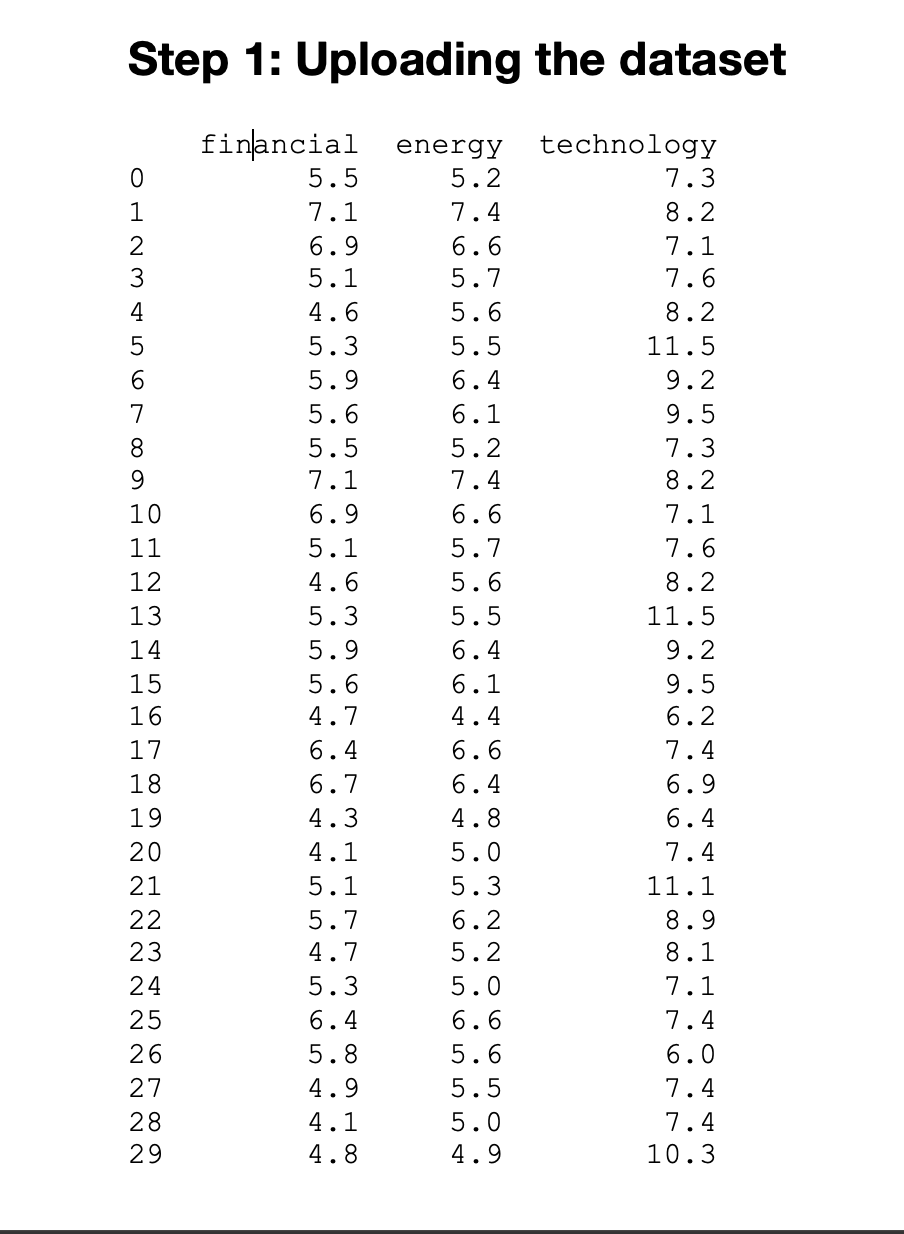

- Does a side-by-side of the 10-year returns of ETFs from the three sectors confirm your conclusion of the hypothesis test? Why or why not? See Step 3 in the Python script.

Step 2: Performing one-way ANOVA test statistic = 55. 07 P-value = 0.0 Step 3: Visualizing differences There are post-hoc tests available that can be used to identify groups that are significantly different than others. Alternatively, a quick approach to identifying differences is to create a visual plot for data distributions using side-by-side boxplots. The block uses the seaborn module and matplotlib.pyplot submodule to create side-by-side boxplots for the ten-year returns of ETFs in financial, energy, and technology sectors. Boxplot for comparison 11 10 LO return H Un financial energy technology ETF\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts