Question: Apply Your Knowledge Question 4 , P 1 1 - 5 9 A ( similar to ) HW Score: 5 0 % , 1 0

Apply Your Knowledge

Question PA similar to

HW Score: of points

Part of

Points: of

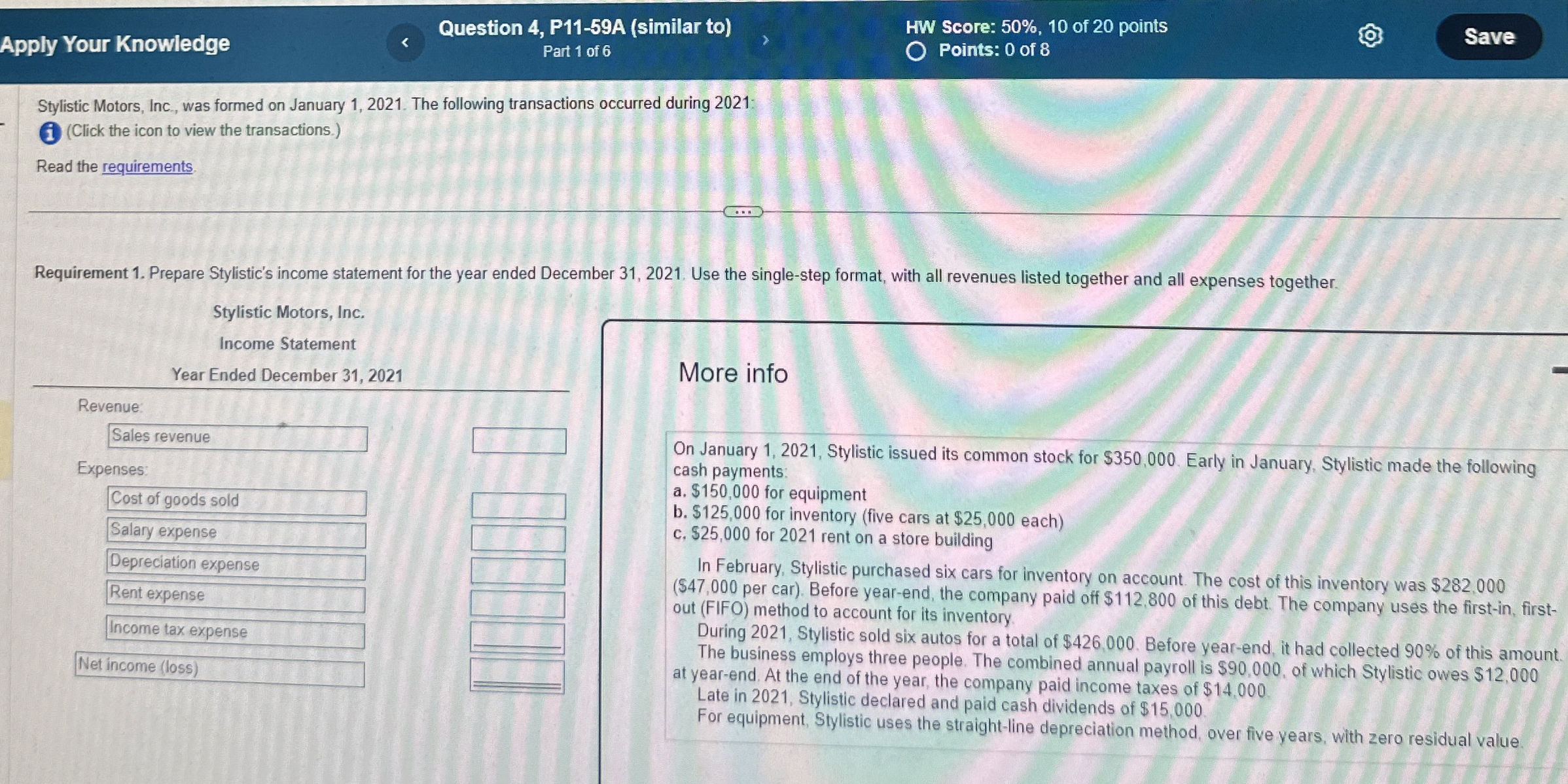

Stylistic Motors, Inc., was formed on January The following transactions occurred during :

Click the icon to view the transactions.

Read the requirements

Requirement Prepare Stylistic's income statement for the year ended December Use the singlestep format, with all revenues listed together and all expenses together.

Stylistic Motors, Inc.

Income Statement

Year Ended December

Revenue:

Sales revenue

Expenses:

Cost of goods sold

Salary expense

Depreciation expense

Rent expense

Income tax expense

Net income loss

Net income loss

More info

On January Stylistic issued its common stock for $ Early in January, Stylistic made the following cash payments:

a $ for equipment

b $ for inventory five cars at $ each

c $ for rent on a store building

In February. Stylistic purchased six cars for inventory on account. The cost of this inventory was $ $ per car Before yearend, the company paid off $ of this debt. The company uses the firstin firstout FIFO method to account for its inventory.

During Stylistic sold six autos for a total of $ Before yearend, it had collected of this amount. The business employs three people. The combined annual payroll is $ of which Stylistic owes $ at yearend. At the end of the year, the company paid income taxes of $

Late in Stylistic declared and paid cash dividends of $

For equipment, Stylistic uses the straightline depreciation method, over five years, with zero residual value.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock