Question: APPLY YOUR KNOWLEDGE Serial Case C12-71 (Learning Objectives 4, 5: Calculate and analyze ratios and earnings quality for a company in the restaurant industry) Note:

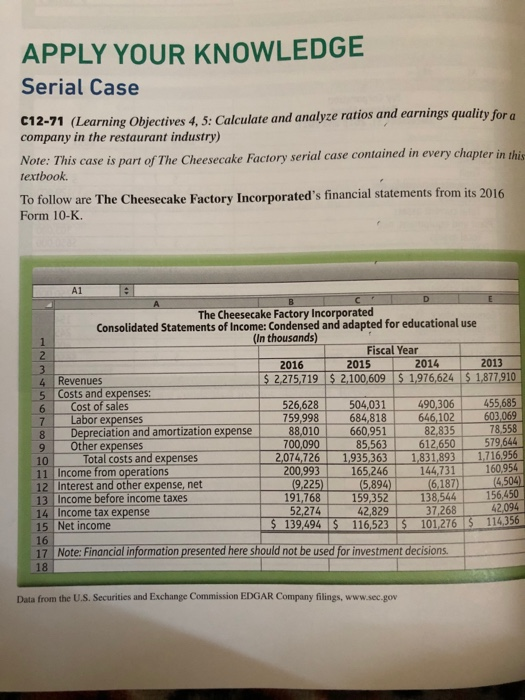

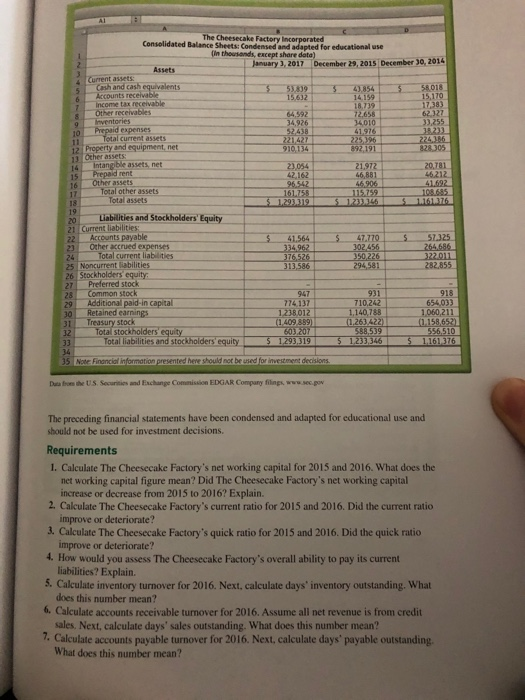

APPLY YOUR KNOWLEDGE Serial Case C12-71 (Learning Objectives 4, 5: Calculate and analyze ratios and earnings quality for a company in the restaurant industry) Note: This case is part of The Cheesecake Factory serial case contained in every chapter in this textbook. To follow are The Cheesecake Factory Incorporated's financial statements from its 2016 Form 10-K. The Cheesecake Factory Incorporated Consolidated Statements of Income: Condensed and adapted for educational use (In thousands) Fiscal Year 2016 2015 2014 2013 Revenues $ 2.275,719 $ 2,100,609 $ 1,976,624 $ 1,877910 5 Costs and expenses: Cost of sales 526,628 504,031 490,306 455,685 Labor expenses 759,998 684,818 646,102 603,069 Depreciation and amortization expense 88,010 660,951 8 2,835 78,558 Other expenses 700,090 85,563 | 612,650 579,644 10 Total costs and expenses 2,074,726 1.935,363 1,831,893 1,716,956 11 Income from operations 200,993 165,246 144,731 12 Interest and other expense, net 19,225) (5,894) 6,187) 13 Income before income taxes 191,768 159,352 138,544 156.450 14 Income tax expense 52,274 42,829 37,268 42,094 15 Net income $ 139,494 $ 116,523 $ 101,276 5 114,356 16 17 Note: Financial information presented here should not be used for investment decisions. 18 Data from the U.S. Securities and Exchange Commission EDGAR Company filings, www.sec.gov 1419 The Cheesecake Factory incorporated Consolidated Balance Sheets Condensed and apted for educational use Olin thousands, except share data) January 3, 2017 December 23, 2015 December 30, 2014 Assets Cash and chequivalents 5 539809 2018 Accounts receivable 157632 Income tax c able 18739 Other Receivables 34.926 34010 Prepaid expenses 52438 41.976 Total current assets 2212273 2243M 12 Property and equipment net 910-134 892. 191 BOS Other assets 14 Intangible assets net 23.054 20.781 42162 6212 Other assets 96542 41.6922 Total other assets 161753 115,759 1081685 Total assets 5122 1.161.376 41.564 47,770 57.325 3502226 376,526 | 313,586 294581 322.011 282,855 20 Liabilities and Stockholders' Equity 21 Current liabilities 22 Accounts payable 23 Other accrued expenses Total current liabilities 25 Noncurrent abilities 26 Stockholders equity 27 Preferred stock 28 Common stock 29 Additional paid in capital 30 Retained earnings 31 Treasury stock Total stockholders' equity 33 Total liabilities and stockholders equity 947 918 774 137 123.8.012 (14091889 0207 1.293,319 931 T10.242 1.140788 (1.2614223 366539 1223346 65403) 1060.211 (1.158,652 556,510 1661376 $ 5 Note Financial information presented here should not be used for investment decisions Duro US Se n d Exchange Commi EDGAR Company filingswww.sec.gov The preceding financial statements have been condensed and adapted for educational use and should not be used for investment decisions. Requirements 1. Calculate The Cheesecake Factory's net working capital for 2015 and 2016. What does the net working capital figure mean? Did The Cheesecake Factory's net working capital increase or decrease from 2015 to 2016? Explain. 2. Calculate The Cheesecake Factory's current ratio for 2015 and 2016. Did the current ratio improve or deteriorate? 3. Calculate The Cheesecake Factory's quick ratio for 2015 and 2016. Did the quick ratio improve or deteriorate? 4. How would you assess The Cheesecake Factory's overall ability to pay its current liabilities? Explain. 5. Calculate inventory turnover for 2016. Next, calculate days'inventory outstanding. What does this number mean? 6. Calculate accounts receivable turnover for 2016. Assume all net revenue is from credit sales. Next, calculate days' sales outstanding. What does this number mean? 7. Calculate accounts payable turnover for 2016. Next, calculate days payable outstanding, What does this number mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts