Question: ApplyIHY LALU A company purchased equipment with a cost of $96,000. Residual value at the end I useful life is estimated to be $24,000. The

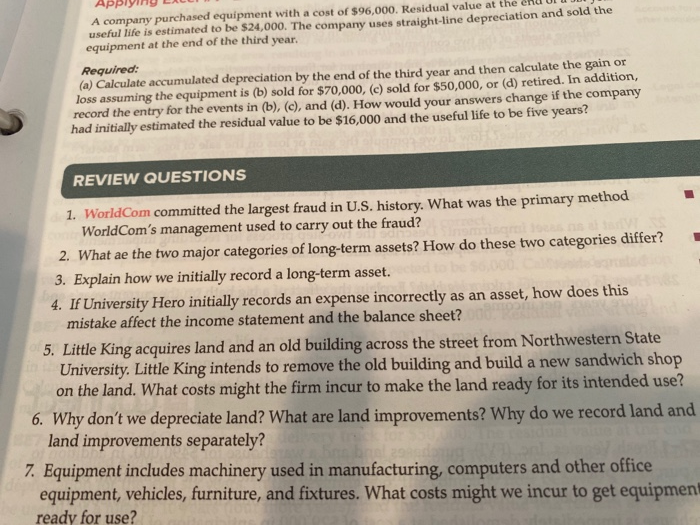

ApplyIHY LALU A company purchased equipment with a cost of $96,000. Residual value at the end I useful life is estimated to be $24,000. The company uses straight-line depreciation and sold the equipment at the end of the third year. Required: (a) Calculate accumulated depreciation by the end of the third year and then calculate the gain or loss assuming the equipment is (b) sold for $70,000, (c) sold for $50,000, or (d) retired. In addition, record the entry for the events in (b), (c), and (d). How would your answers change if the company had initially estimated the residual value to be $16,000 and the useful life to be five years? REVIEW QUESTIONS 1. World Com committed the largest fraud in U.S. history. What was the primary method WorldCom's management used to carry out the fraud? 2. What ae the two major categories of long-term assets? How do these two categories differ? 3. Explain how we initially record a long-term asset. 4. If University Hero initially records an expense incorrectly as an asset, how does this mistake affect the income statement and the balance sheet? 5. Little King acquires land and an old building across the street from Northwestern State University. Little King intends to remove the old building and build a new sandwich shop on the land. What costs might the firm incur to make the land ready for its intended use? 6. Why don't we depreciate land? What are land improvements? Why do we record land and land improvements separately? 7. Equipment includes machinery used in manufacturing, computers and other office equipment, vehicles, furniture, and fixtures. What costs might we incur to get equipment ready for use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts