Question: Applying Integrated Excel: Manufacturing cost flows The T - accounts below summarize a manufacturer's production activity for the year: Raw Materials Inventory Debit Credit 6

Applying Integrated Excel: Manufacturing cost flows

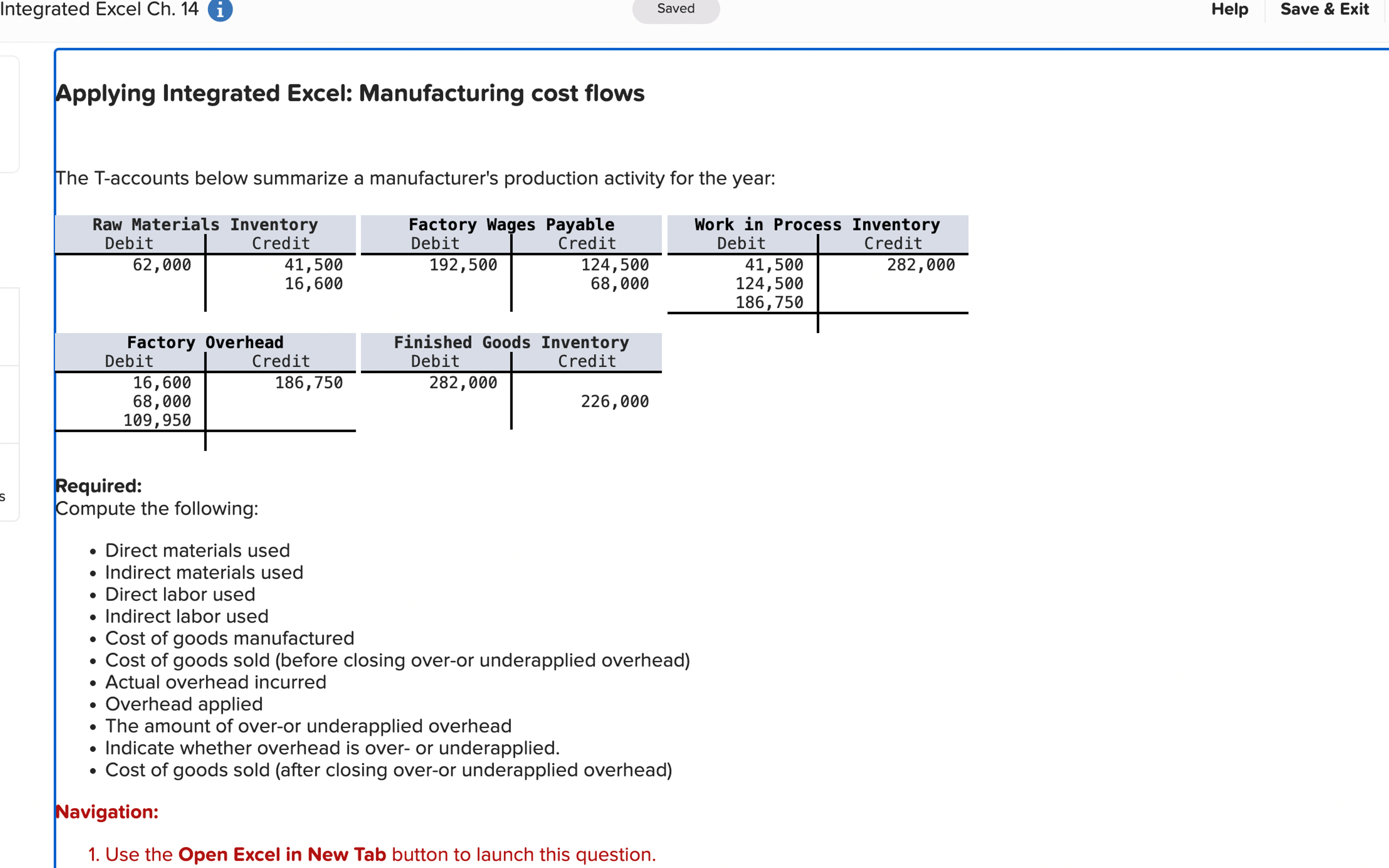

The Taccounts below summarize a manufacturer's production activity for the year:

Raw Materials Inventory

Debit Credit

Factory Wages Payable

Debit Credit

Work in Process Inventory

Debit Credit

Factory Overhead

Debit Credit

Finished Goods Inventory

Debit Credit

Required:

Compute the following:

Direct materials used

Indirect materials used

Direct labor used

Indirect labor used

Cost of goods manufactured

Cost of goods sold before closing overor underapplied overhead

Actual overhead incurred

Overhead applied

The amount of overor underapplied overhead

Indicate whether overhead is over or underapplied.

Cost of goods sold after closing overor underapplied overhead

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock