Question: Applying Integrated Excel: Perpetual: Inventory costing methods FIFO and LIFO Your Company reported the following January purchases and sales data for its only product. The

Applying Integrated Excel: Perpetual: Inventory costing methods FIFO and LIFO

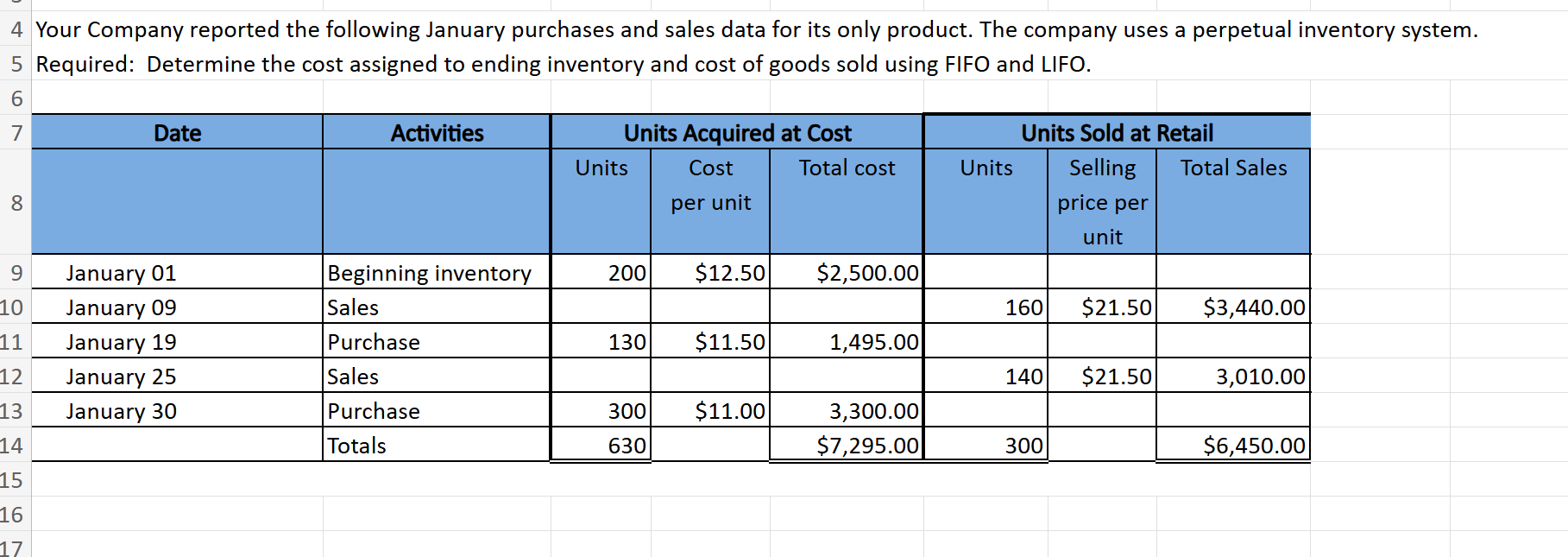

Your Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. Your Company reported the following January purchases and sales data for its only product. The company uses a perpetual inventory system.

Required: Determine the cost assigned to ending inventory and cost of goods sold using FIFO and LIFO. Required: Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.

Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work.

Nothing in this area will be graded, but it will be submitted with your assignment.

Required: Determine the cost assigned to ending inventory and to cost of goods sold using LIFO.

begintabularccccccccc

hline & Date & Activities & multicolumnlUnits Acquired at Cost & multicolumncUnits Sold at Retail

hline & & & Units & Cost per unit & Total cost & Units & Selling price per unit & Total Sales

hline & January & Beginning inventory & & $ & $ & & &

hline & January & Sales & & & & & $ & $

hline & January & Purchase & & $ & & & &

hline & January & Sales & & & & & $ &

hline & January & Purchase & & $ & & & &

hline & & Totals & & & $ & & & $

hline

endtabular

begintabularccccccccccc

hline & Perpetual LIFO & multicolumnlCost of Goods Sold Jan & multicolumnlCost of Goods Sold Jan & multicolumncEnding Inventory

hline & Units available & Units & Cost per unit & begintabularl

Cost of

goods sold

endtabular & Units & begintabularl

Cost

per unit

endtabular & Cost of goods sold & Units & begintabularl

Cost

per unit

endtabular & Inventory

hline & units from beginning inventory & & $ & & & $ & & & $ &

hline & units purchased on January & & $ & & & $ & & & $ &

hline & units purchased on January & & $ & & & $ & & & $ &

hline & Totals & & & $ & & & $ & & & $

hline

endtabular

Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work.

Question Data

FIFO

LIFO

Workbook Statistics

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock