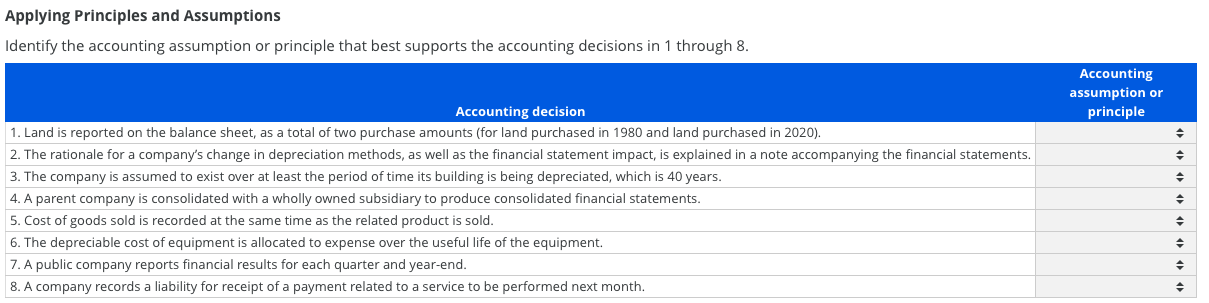

Question: Applying Principles and Assumptions Identify the accounting assumption or principle that best supports the accounting decisions in 1 through 8. Accounting assumption or principle Accounting

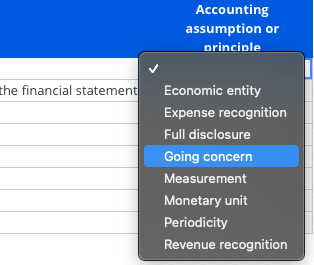

Applying Principles and Assumptions Identify the accounting assumption or principle that best supports the accounting decisions in 1 through 8. Accounting assumption or principle Accounting decision 1. Land is reported on the balance sheet, as a total of two purchase amounts (for land purchased in 1980 and land purchased in 2020). 2. The rationale for a company's change in depreciation methods, as well as the financial statement impact, is explained in a note accompanying the financial statements. 3. The company is assumed to exist over at least the period of time its building is being depreciated, which is 40 years. 4. A parent company is consolidated with a wholly owned subsidiary to produce consolidated financial statements. 5. Cost of goods sold is recorded at the same time as the related product is sold. 6. The depreciable cost of equipment is allocated to expense over the useful life of the equipment. 7. A public company reports financial results for each quarter and year-end. 8. A company records a liability for receipt of a payment related to a service to be performed next month. . Accounting assumption or principle the financial statement Economic entity Expense recognition Full disclosure Going concern Measurement Monetary unit Periodicity Revenue recognition Applying Principles and Assumptions Identify the accounting assumption or principle that best supports the accounting decisions in 1 through 8. Accounting assumption or principle Accounting decision 1. Land is reported on the balance sheet, as a total of two purchase amounts (for land purchased in 1980 and land purchased in 2020). 2. The rationale for a company's change in depreciation methods, as well as the financial statement impact, is explained in a note accompanying the financial statements. 3. The company is assumed to exist over at least the period of time its building is being depreciated, which is 40 years. 4. A parent company is consolidated with a wholly owned subsidiary to produce consolidated financial statements. 5. Cost of goods sold is recorded at the same time as the related product is sold. 6. The depreciable cost of equipment is allocated to expense over the useful life of the equipment. 7. A public company reports financial results for each quarter and year-end. 8. A company records a liability for receipt of a payment related to a service to be performed next month. . Accounting assumption or principle the financial statement Economic entity Expense recognition Full disclosure Going concern Measurement Monetary unit Periodicity Revenue recognition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts