Question: approx. $125 approx. $199 approx. $375 approx. $258 - NPVNET CASE The Divid. N Wik A pple Stock P R I Gradosti. EXAM W20.0 Take

approx. $125 approx. $199 approx. $375 approx. $258

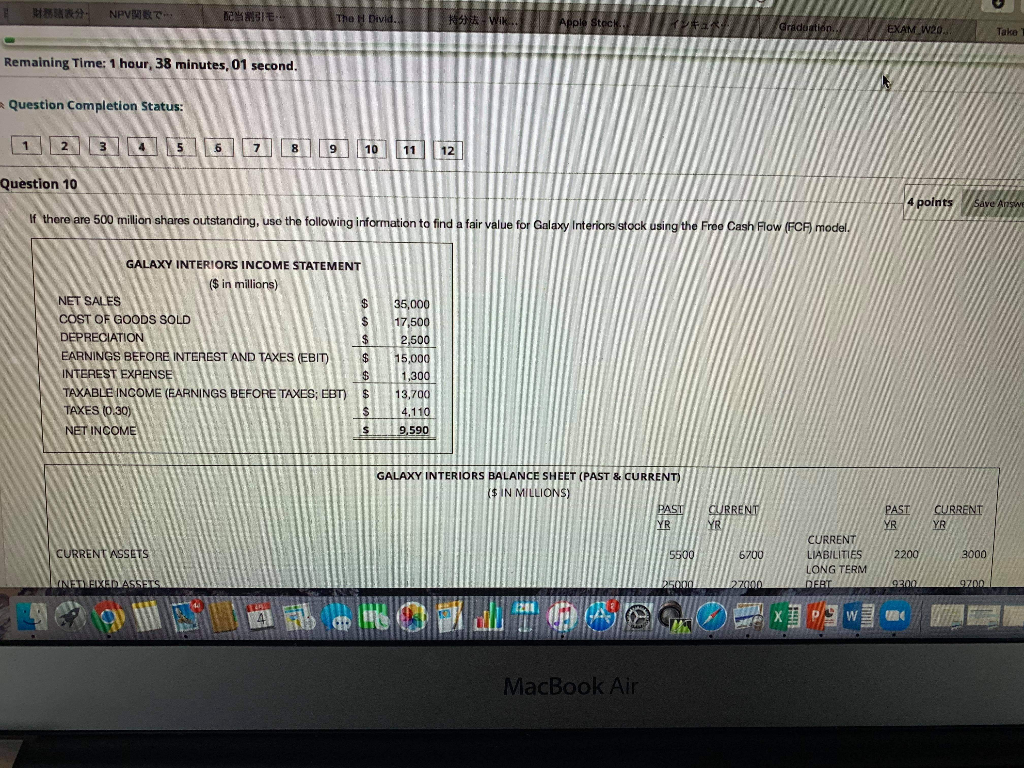

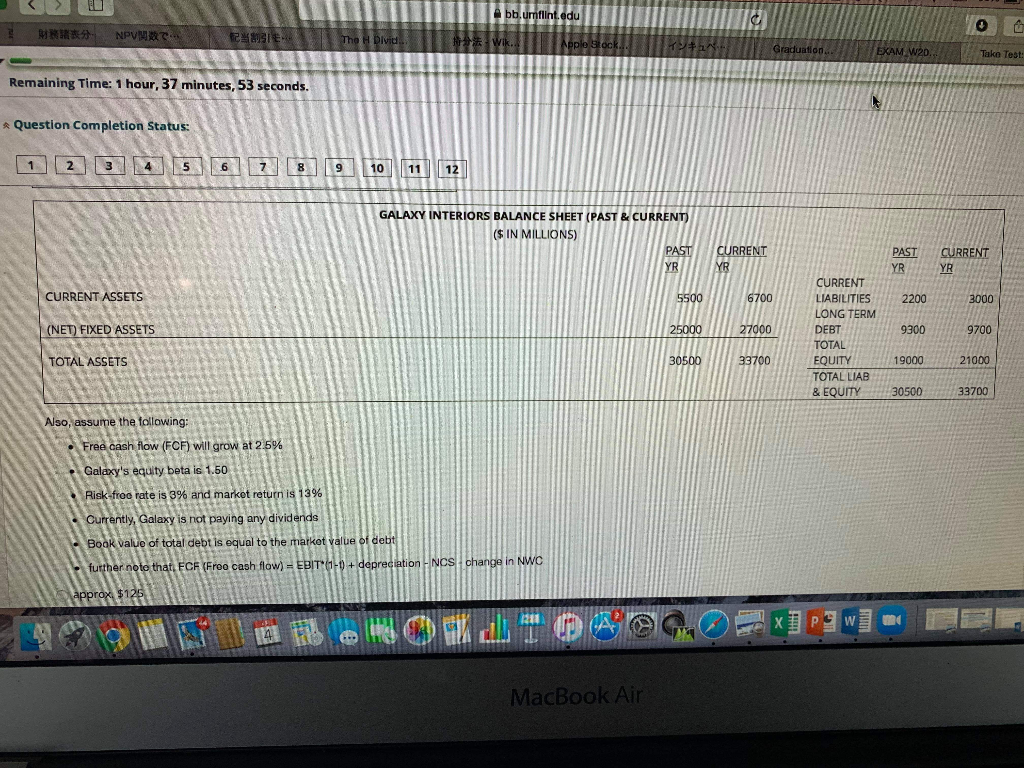

- NPVNET CASE The Divid. N Wik A pple Stock P R I Gradosti. EXAM W20.0 Take Remaining Time: 1 hour, 38 minutes, 01 second. Question Completion Status: 2) 37300B) 19 Question 10 4 points Save Answ If there are 500 million shares outstanding, use the following information to find a fair value for Galaxy Interiors/stock using the Free Cash Flow (FC) model GALAXY INTERIORS INCOME STATEMENT ($ in millions) NET SALES COST OF GOODS SOLD DEPRECIATION EARNINGS BEFORE INTEREST AND TAXES (EBIT INTEREST EXPENSE TAXABLE INCOME (EARNINGS BEFORE TAXES; EBT)$ TAXES (0.30) NET INCOME 35,000 17,500 2,500 15,000 1,300 13,700 4.110 9,590 TILL GALAXY INTERIORS BALANCE SHEET (PAST & CURRENT) IN MILLIONS) PAST CURRENT INB YR PAST YR W CURRENT YR CURRENT ASSETS 5500 6700 Hlin0001127000 CURRENT LIABILITIES LONG TERM ERIT 2200 9200 3000 9700 H MINSTEIXED ASSETS BIOE WORL=68@CD=610 w - wem MacBook Air TM Abb.urflint.edu ** NPVMAT I MISTE E The Divid Wik. Apple Stock Graduation.. EXAM W20. Tako Test: Remaining Time: 1 hour, 37 minutes, 53 seconds. Question Completion Status: 1 2015 6 2 3 10 11 GALAXY INTERIORS BALANCE SHEET (PAST & CURRENT) ($ IN MILLIONS) PAST CURRENT YRITYR 5500 6700 PAST YR CURRENT YR CURRENT ASSETS 2200 3000 (NET) FIXED ASSETS I 25000 27000 9300 9700 CURRENT LIABILITIES LONG TERM DEBT TOTAL EQUITY TOTAL LIAB & EQUITY TOTAL ASSETS 30500 H 33700 19000 21000 30500 33700 Also, assume the following: Free cash flow (FCF) will grow at 2.5% Galaxy's equity beta is 1.50 Risk-free rate is 3% and market return is 13% Currently, Galaxy is not paying any dividends Boor value of total debt is equal to the market value of debt further noto that. FCF (Froo cash flow) - EBIT 0-0 + depreciation - NCS change in NWC approx $125 399Feild karm@G EX] POW] - DE MacBook Air - NPVNET CASE The Divid. N Wik A pple Stock P R I Gradosti. EXAM W20.0 Take Remaining Time: 1 hour, 38 minutes, 01 second. Question Completion Status: 2) 37300B) 19 Question 10 4 points Save Answ If there are 500 million shares outstanding, use the following information to find a fair value for Galaxy Interiors/stock using the Free Cash Flow (FC) model GALAXY INTERIORS INCOME STATEMENT ($ in millions) NET SALES COST OF GOODS SOLD DEPRECIATION EARNINGS BEFORE INTEREST AND TAXES (EBIT INTEREST EXPENSE TAXABLE INCOME (EARNINGS BEFORE TAXES; EBT)$ TAXES (0.30) NET INCOME 35,000 17,500 2,500 15,000 1,300 13,700 4.110 9,590 TILL GALAXY INTERIORS BALANCE SHEET (PAST & CURRENT) IN MILLIONS) PAST CURRENT INB YR PAST YR W CURRENT YR CURRENT ASSETS 5500 6700 Hlin0001127000 CURRENT LIABILITIES LONG TERM ERIT 2200 9200 3000 9700 H MINSTEIXED ASSETS BIOE WORL=68@CD=610 w - wem MacBook Air TM Abb.urflint.edu ** NPVMAT I MISTE E The Divid Wik. Apple Stock Graduation.. EXAM W20. Tako Test: Remaining Time: 1 hour, 37 minutes, 53 seconds. Question Completion Status: 1 2015 6 2 3 10 11 GALAXY INTERIORS BALANCE SHEET (PAST & CURRENT) ($ IN MILLIONS) PAST CURRENT YRITYR 5500 6700 PAST YR CURRENT YR CURRENT ASSETS 2200 3000 (NET) FIXED ASSETS I 25000 27000 9300 9700 CURRENT LIABILITIES LONG TERM DEBT TOTAL EQUITY TOTAL LIAB & EQUITY TOTAL ASSETS 30500 H 33700 19000 21000 30500 33700 Also, assume the following: Free cash flow (FCF) will grow at 2.5% Galaxy's equity beta is 1.50 Risk-free rate is 3% and market return is 13% Currently, Galaxy is not paying any dividends Boor value of total debt is equal to the market value of debt further noto that. FCF (Froo cash flow) - EBIT 0-0 + depreciation - NCS change in NWC approx $125 399Feild karm@G EX] POW] - DE MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts