Question: Apps Casare RSM Password for Mark M D Question 16 2 pts 26 The U.S.-based Minnesota Mining Company (MMC) has a one-year account receivable from

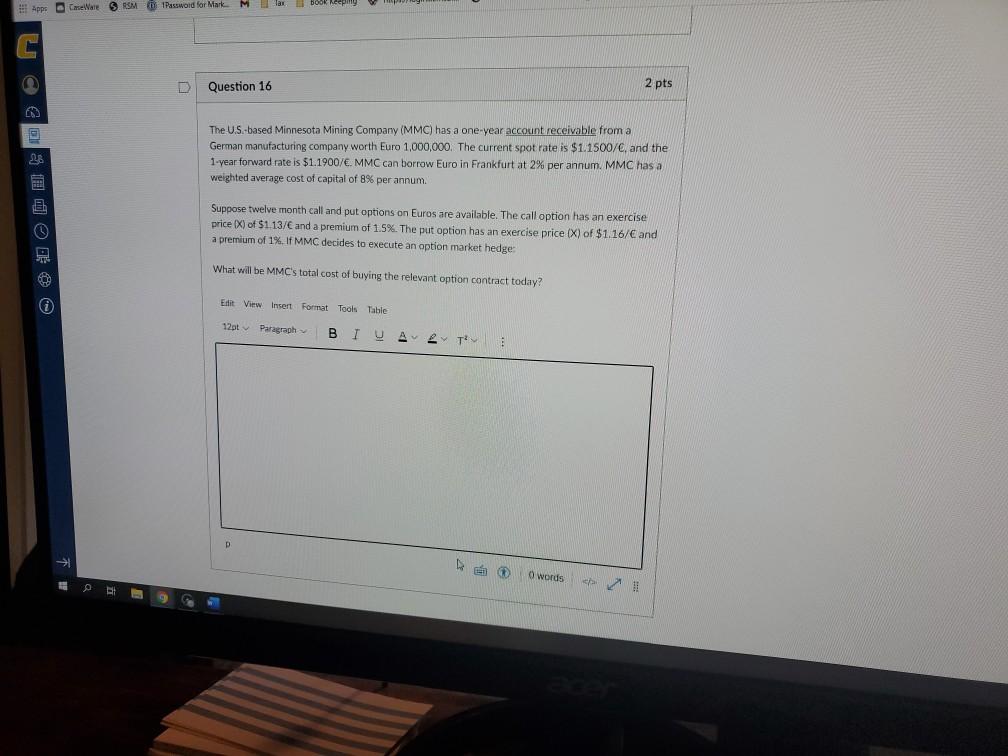

Apps Casare RSM Password for Mark M D Question 16 2 pts 26 The U.S.-based Minnesota Mining Company (MMC) has a one-year account receivable from a German manufacturing company worth Euro 1,000,000. The current spot rate is $1.1500/, and the 1-year forward rate is $1.1900/. MMC can borrow Euro in Frankfurt at 2% per annum. MMC has a weighted average cost of capital of 8% per annum. Suppose twelve month call and put options on Euros are available. The call option has an exercise price X) of $1.13/ and a premium of 1.5%. The put option has an exercise price (X) of $1.16/ and a premium of 1%. If MMC decides to execute an option market hedge What will be MMC's total cost of buying the relevant option contract today? Edit View Insert Format Tools Table 12ptParagraph B I UA 2 tl : en words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts